March - Putnam Investments

March - Putnam Investments

March - Putnam Investments

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

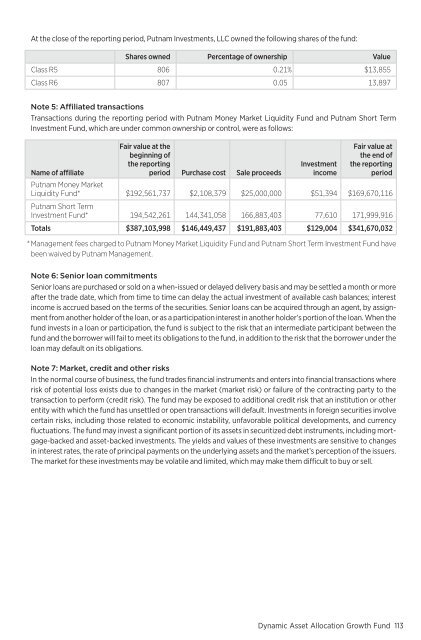

At the close of the reporting period, <strong>Putnam</strong> <strong>Investments</strong>, LLC owned the following shares of the fund:Shares owned Percentage of ownership ValueClass R5 806 0.21 % $13,855Class R6 807 0.05 13,897Note 5: Affiliated transactionsTransactions during the reporting period with <strong>Putnam</strong> Money Market Liquidity Fund and <strong>Putnam</strong> Short TermInvestment Fund, which are under common ownership or control, were as follows:Name of affiliateFair value at thebeginning ofthe reportingperiod Purchase cost Sale proceedsInvestmentincomeFair value atthe end ofthe reportingperiod<strong>Putnam</strong> Money MarketLiquidity Fund * $192,561,737 $2,108,379 $25,000,000 $51,394 $169,670,116<strong>Putnam</strong> Short TermInvestment Fund * 194,542,261 144,341,058 166,883,403 77,610 171,999,916Totals $387,103,998 $146,449,437 $191,883,403 $129,004 $341,670,032* Management fees charged to <strong>Putnam</strong> Money Market Liquidity Fund and <strong>Putnam</strong> Short Term Investment Fund havebeen waived by <strong>Putnam</strong> Management.Note 6: Senior loan commitmentsSenior loans are purchased or sold on a when-issued or delayed delivery basis and may be settled a month or moreafter the trade date, which from time to time can delay the actual investment of available cash balances; interestincome is accrued based on the terms of the securities. Senior loans can be acquired through an agent, by assignmentfrom another holder of the loan, or as a participation interest in another holder’s portion of the loan. When thefund invests in a loan or participation, the fund is subject to the risk that an intermediate participant between thefund and the borrower will fail to meet its obligations to the fund, in addition to the risk that the borrower under theloan may default on its obligations.Note 7: Market, credit and other risksIn the normal course of business, the fund trades financial instruments and enters into financial transactions whererisk of potential loss exists due to changes in the market (market risk) or failure of the contracting party to thetransaction to perform (credit risk). The fund may be exposed to additional credit risk that an institution or otherentity with which the fund has unsettled or open transactions will default. <strong>Investments</strong> in foreign securities involvecertain risks, including those related to economic instability, unfavorable political developments, and currencyfluctuations. The fund may invest a significant portion of its assets in securitized debt instruments, including mortgage-backedand asset-backed investments. The yields and values of these investments are sensitive to changesin interest rates, the rate of principal payments on the underlying assets and the market’s perception of the issuers.The market for these investments may be volatile and limited, which may make them difficult to buy or sell.Dynamic Asset Allocation Growth Fund 113