March - Putnam Investments

March - Putnam Investments

March - Putnam Investments

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

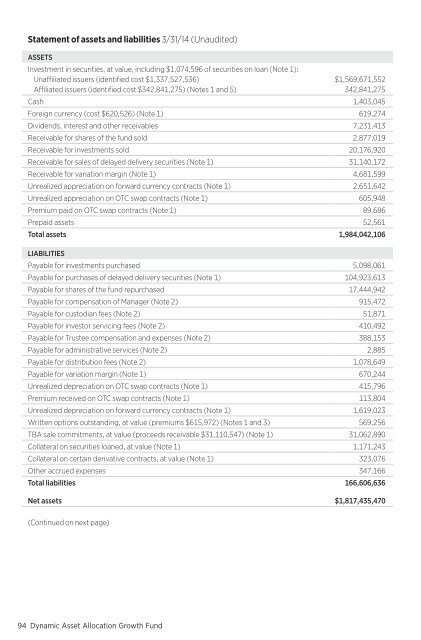

Statement of assets and liabilities 3/31/14 (Unaudited)ASSETSInvestment in securities, at value, including $1,074,596 of securities on loan (Note 1):Unaffiliated issuers (identified cost $1,337,527,536) $1,569,671,552Affiliated issuers (identified cost $342,841,275) (Notes 1 and 5) 342,841,275Cash 1,403,045Foreign currency (cost $620,526) (Note 1) 619,274Dividends, interest and other receivables 7,231,413Receivable for shares of the fund sold 2,877,019Receivable for investments sold 20,176,920Receivable for sales of delayed delivery securities (Note 1) 31,140,172Receivable for variation margin (Note 1) 4,681,599Unrealized appreciation on forward currency contracts (Note 1) 2,651,642Unrealized appreciation on OTC swap contracts (Note 1) 605,948Premium paid on OTC swap contracts (Note 1) 89,686Prepaid assets 52,561Total assets 1,984,042,106LIABILITIESPayable for investments purchased 5,098,061Payable for purchases of delayed delivery securities (Note 1) 104,923,613Payable for shares of the fund repurchased 17,444,942Payable for compensation of Manager (Note 2) 915,472Payable for custodian fees (Note 2) 51,871Payable for investor servicing fees (Note 2) 410,492Payable for Trustee compensation and expenses (Note 2) 388,153Payable for administrative services (Note 2) 2,885Payable for distribution fees (Note 2) 1,078,649Payable for variation margin (Note 1) 670,244Unrealized depreciation on OTC swap contracts (Note 1) 415,796Premium received on OTC swap contracts (Note 1) 113,804Unrealized depreciation on forward currency contracts (Note 1) 1,619,023Written options outstanding, at value (premiums $615,972) (Notes 1 and 3) 569,256TBA sale commitments, at value (proceeds receivable $31,110,547) (Note 1) 31,062,890Collateral on securities loaned, at value (Note 1) 1,171,243Collateral on certain derivative contracts, at value (Note 1) 323,076Other accrued expenses 347,166Total liabilities 166,606,636Net assets $1,817,435,470(Continued on next page)94 Dynamic Asset Allocation Growth Fund