March - Putnam Investments

March - Putnam Investments

March - Putnam Investments

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

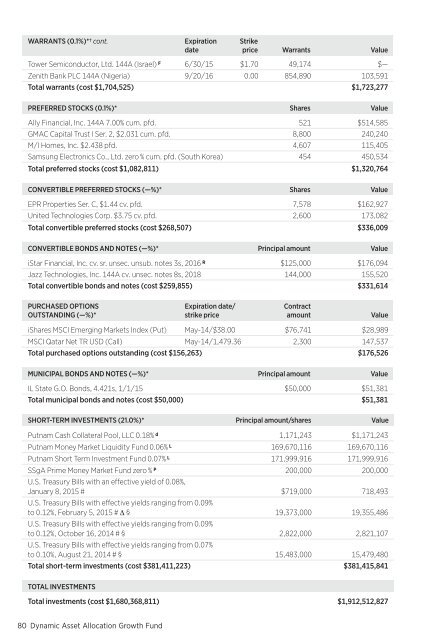

WARRANTS (0.1%)*† cont.ExpirationdateStrikeprice Warrants ValueTower Semiconductor, Ltd. 144A (Israel) F 6/30/15 $1.70 49,174 $—Zenith Bank PLC 144A (Nigeria) 9/20/16 0.00 854,890 103,591Total warrants (cost $1,704,525) $1,723,277PREFERRED STOCKS (0.1%)* Shares ValueAlly Financial, Inc. 144A 7.00% cum. pfd. 521 $514,585GMAC Capital Trust I Ser. 2, $2.031 cum. pfd. 8,800 240,240M/I Homes, Inc. $2.438 pfd. 4,607 115,405Samsung Electronics Co., Ltd. zero % cum. pfd. (South Korea) 454 450,534Total preferred stocks (cost $1,082,811) $1,320,764CONVERTIBLE PREFERRED STOCKS (—%)* Shares ValueEPR Properties Ser. C, $1.44 cv. pfd. 7,578 $162,927United Technologies Corp. $3.75 cv. pfd. 2,600 173,082Total convertible preferred stocks (cost $268,507) $336,009CONVERTIBLE BONDS AND NOTES (—%)* Principal amount ValueiStar Financial, Inc. cv. sr. unsec. unsub. notes 3s, 2016 R $125,000 $176,094Jazz Technologies, Inc. 144A cv. unsec. notes 8s, 2018 144,000 155,520Total convertible bonds and notes (cost $259,855) $331,614PURCHASED OPTIONSOUTSTANDING (—%)*Expiration date/strike priceContractamountValueiShares MSCI Emerging Markets Index (Put) May-14/$38.00 $76,741 $28,989MSCI Qatar Net TR USD (Call) May-14/1,479.36 2,300 147,537Total purchased options outstanding (cost $156,263) $176,526MUNICIPAL BONDS AND NOTES (—%)* Principal amount ValueIL State G.O. Bonds, 4.421s, 1/1/15 $50,000 $51,381Total municipal bonds and notes (cost $50,000) $51,381SHORT-TERM INVESTMENTS (21.0%)* Principal amount/shares Value<strong>Putnam</strong> Cash Collateral Pool, LLC 0.18% d 1,171,243 $1,171,243<strong>Putnam</strong> Money Market Liquidity Fund 0.06% L 169,670,116 169,670,116<strong>Putnam</strong> Short Term Investment Fund 0.07% L 171,999,916 171,999,916SSgA Prime Money Market Fund zero % P 200,000 200,000U.S. Treasury Bills with an effective yield of 0.08%,January 8, 2015 # $719,000 718,493U.S. Treasury Bills with effective yields ranging from 0.09%to 0.12%, February 5, 2015 # Δ § 19,373,000 19,355,486U.S. Treasury Bills with effective yields ranging from 0.09%to 0.12%, October 16, 2014 # § 2,822,000 2,821,107U.S. Treasury Bills with effective yields ranging from 0.07%to 0.10%, August 21, 2014 # § 15,483,000 15,479,480Total short-term investments (cost $381,411,223) $381,415,841TOTAL INVESTMENTSTotal investments (cost $1,680,368,811) $1,912,512,82780 Dynamic Asset Allocation Growth Fund