March - Putnam Investments

March - Putnam Investments

March - Putnam Investments

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

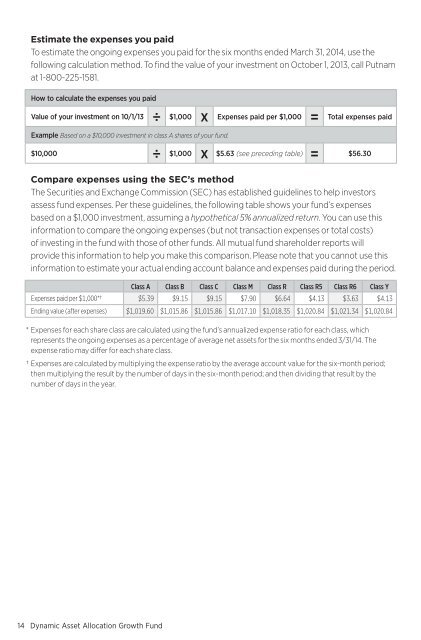

Estimate the expenses you paidTo estimate the ongoing expenses you paid for the six months ended <strong>March</strong> 31, 2014, use thefollowing calculation method. To find the value of your investment on October 1, 2013, call <strong>Putnam</strong>at 1-800-225-1581.How to calculate the expenses you paidValue of your investment on 10/1/13÷ $1,000 x Expenses paid per $1,000 =Total expenses paidExample Based on a $10,000 investment in class A shares of your fund.$10,000÷ $1,000 x $5.63 (see preceding table) =$56.30Compare expenses using the SEC’s methodThe Securities and Exchange Commission (SEC) has established guidelines to help investorsassess fund expenses. Per these guidelines, the following table shows your fund’s expensesbased on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use thisinformation to compare the ongoing expenses (but not transaction expenses or total costs)of investing in the fund with those of other funds. All mutual fund shareholder reports willprovide this information to help you make this comparison. Please note that you cannot use thisinformation to estimate your actual ending account balance and expenses paid during the period.Class A Class B Class C Class M Class R Class R5 Class R6 Class YExpenses paid per $1,000*† $5.39 $9.15 $9.15 $7.90 $6.64 $4.13 $3.63 $4.13Ending value (after expenses) $1,019.60 $1,015.86 $1,015.86 $1,017.10 $1,018.35 $1,020.84 $1,021.34 $1,020.84* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, whichrepresents the ongoing expenses as a percentage of average net assets for the six months ended 3/31/14. Theexpense ratio may differ for each share class.† Expenses are calculated by multiplying the expense ratio by the average account value for the six-month period;then multiplying the result by the number of days in the six-month period; and then dividing that result by thenumber of days in the year.14 Dynamic Asset Allocation Growth Fund