March - Putnam Investments

March - Putnam Investments

March - Putnam Investments

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

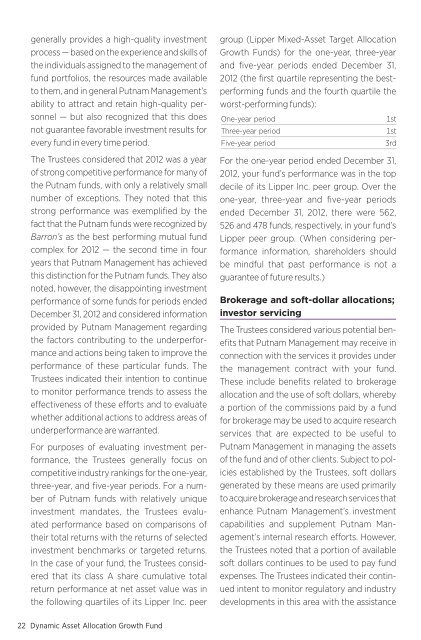

generally provides a high- quality investmentprocess — based on the experience and skills ofthe individuals assigned to the management offund portfolios, the resources made availableto them, and in general <strong>Putnam</strong> Management’sability to attract and retain high- quality personnel— but also recognized that this doesnot guarantee favorable investment results forevery fund in every time period.The Trustees considered that 2012 was a yearof strong competitive performance for many ofthe <strong>Putnam</strong> funds, with only a relatively smallnumber of exceptions. They noted that thisstrong performance was exemplified by thefact that the <strong>Putnam</strong> funds were recognized byBarron’s as the best performing mutual fundcomplex for 2012 — the second time in fouryears that <strong>Putnam</strong> Management has achievedthis distinction for the <strong>Putnam</strong> funds. They alsonoted, however, the disappointing investmentperformance of some funds for periods endedDecember 31, 2012 and considered informationprovided by <strong>Putnam</strong> Management regardingthe factors contributing to the underperformanceand actions being taken to improve theperformance of these particular funds. TheTrustees indicated their intention to continueto monitor performance trends to assess theeffectiveness of these efforts and to evaluatewhether additional actions to address areas ofunderperformance are warranted.For purposes of evaluating investment performance,the Trustees generally focus oncompetitive industry rankings for the one- year,three- year, and five- year periods. For a numberof <strong>Putnam</strong> funds with relatively uniqueinvestment mandates, the Trustees evaluatedperformance based on comparisons oftheir total returns with the returns of selectedinvestment benchmarks or targeted returns.In the case of your fund, the Trustees consideredthat its class A share cumulative totalreturn performance at net asset value was inthe following quartiles of its Lipper Inc. peergroup (Lipper Mixed- Asset Target AllocationGrowth Funds) for the one- year, three- yearand five- year periods ended December 31,2012 (the first quartile representing the bestperformingfunds and the fourth quartile theworst-performing funds):One- year period1stThree- year period1stFive- year period3rdFor the one- year period ended December 31,2012, your fund’s performance was in the topdecile of its Lipper Inc. peer group. Over theone- year, three- year and five- year periodsended December 31, 2012, there were 562,526 and 478 funds, respectively, in your fund’sLipper peer group. (When considering performanceinformation, shareholders shouldbe mindful that past performance is not aguarantee of future results.)Brokerage and soft- dollar allocations;investor servicingThe Trustees considered various potential benefitsthat <strong>Putnam</strong> Management may receive inconnection with the services it provides underthe management contract with your fund.These include benefits related to brokerageallocation and the use of soft dollars, wherebya portion of the commissions paid by a fundfor brokerage may be used to acquire researchservices that are expected to be useful to<strong>Putnam</strong> Management in managing the assetsof the fund and of other clients. Subject to policiesestablished by the Trustees, soft dollarsgenerated by these means are used primarilyto acquire brokerage and research services thatenhance <strong>Putnam</strong> Management’s investmentcapabilities and supplement <strong>Putnam</strong> Management’sinternal research efforts. However,the Trustees noted that a portion of availablesoft dollars continues to be used to pay fundexpenses. The Trustees indicated their continuedintent to monitor regulatory and industrydevelopments in this area with the assistance22 Dynamic Asset Allocation Growth Fund