March - Putnam Investments

March - Putnam Investments

March - Putnam Investments

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

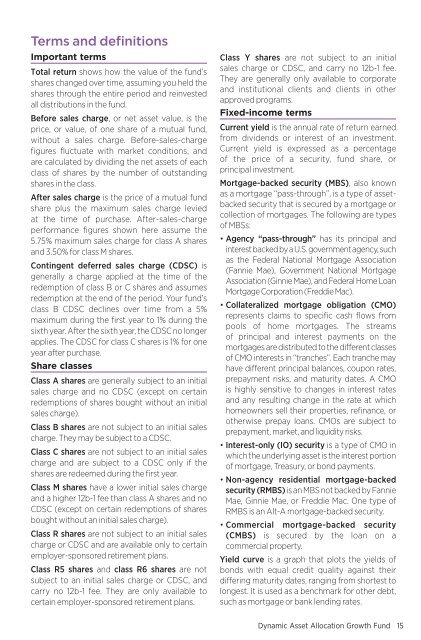

Terms and definitionsImportant termsTotal return shows how the value of the fund’sshares changed over time, assuming you held theshares through the entire period and reinvestedall distributions in the fund.Before sales charge, or net asset value, is theprice, or value, of one share of a mutual fund,without a sales charge. Before-sales-chargefigures fluctuate with market conditions, andare calculated by dividing the net assets of eachclass of shares by the number of outstandingshares in the class.After sales charge is the price of a mutual fundshare plus the maximum sales charge leviedat the time of purchase. After-sales-chargeperformance figures shown here assume the5.75% maximum sales charge for class A sharesand 3.50% for class M shares.Contingent deferred sales charge (CDSC) isgenerally a charge applied at the time of theredemption of class B or C shares and assumesredemption at the end of the period. Your fund’sclass B CDSC declines over time from a 5%maximum during the first year to 1% during thesixth year. After the sixth year, the CDSC no longerapplies. The CDSC for class C shares is 1% for oneyear after purchase.Share classesClass A shares are generally subject to an initialsales charge and no CDSC (except on certainredemptions of shares bought without an initialsales charge).Class B shares are not subject to an initial salescharge. They may be subject to a CDSC.Class C shares are not subject to an initial salescharge and are subject to a CDSC only if theshares are redeemed during the first year.Class M shares have a lower initial sales chargeand a higher 12b-1 fee than class A shares and noCDSC (except on certain redemptions of sharesbought without an initial sales charge).Class R shares are not subject to an initial salescharge or CDSC and are available only to certainemployer-sponsored retirement plans.Class R5 shares and class R6 shares are notsubject to an initial sales charge or CDSC, andcarry no 12b-1 fee. They are only available tocertain employer-sponsored retirement plans.Class Y shares are not subject to an initialsales charge or CDSC, and carry no 12b-1 fee.They are generally only available to corporateand institutional clients and clients in otherapproved programs.Fixed-income termsCurrent yield is the annual rate of return earnedfrom dividends or interest of an investment.Current yield is expressed as a percentageof the price of a security, fund share, orprincipal investment.Mortgage-backed security (MBS), also knownas a mortgage “pass-through”, is a type of assetbackedsecurity that is secured by a mortgage orcollection of mortgages. The following are typesof MBSs:• Agency “pass-through” has its principal andinterest backed by a U.S. government agency, suchas the Federal National Mortgage Association(Fannie Mae), Government National MortgageAssociation (Ginnie Mae), and Federal Home LoanMortgage Corporation (Freddie Mac).• Collateralized mortgage obligation (CMO)represents claims to specific cash flows frompools of home mortgages. The streamsof principal and interest payments on themortgages are distributed to the different classesof CMO interests in “tranches”. Each tranche mayhave different principal balances, coupon rates,prepayment risks, and maturity dates. A CMOis highly sensitive to changes in interest ratesand any resulting change in the rate at whichhomeowners sell their properties, refinance, orotherwise prepay loans. CMOs are subject toprepayment, market, and liquidity risks.• Interest-only (IO) security is a type of CMO inwhich the underlying asset is the interest portionof mortgage, Treasury, or bond payments.• Non-agency residential mortgage-backedsecurity (RMBS) is an MBS not backed by FannieMae, Ginnie Mae, or Freddie Mac. One type ofRMBS is an Alt-A mortgage-backed security.• Commercial mortgage-backed security(CMBS) is secured by the loan on acommercial property.Yield curve is a graph that plots the yields ofbonds with equal credit quality against theirdiffering maturity dates, ranging from shortest tolongest. It is used as a benchmark for other debt,such as mortgage or bank lending rates.Dynamic Asset Allocation Growth Fund 15