March - Putnam Investments

March - Putnam Investments

March - Putnam Investments

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

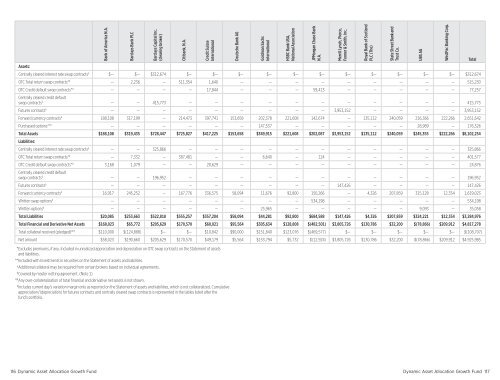

Bank of America N.A.Barclays Bank PLCBarclays Capital Inc.(clearing broker)Citibank, N.A.Credit SuisseInternationalDeutsche Bank AGAssets:Centrally cleared interest rate swap contracts § $— $— $312,674 $— $— $— $— $— $— $— $— $— $— $— $312,674OTC Total return swap contracts* # — 2,236 — 511,354 1,640 — — — — — — — — — 515,230OTC Credit default swap contracts* # — — — — 17,844 — — — 59,413 — — — — — 77,257Centrally cleared credit defaultswap contracts § — — 415,773 — — — — — — — — — — — 415,773Futures contracts § — — — — — — — — — 3,953,152 — — — — 3,953,152Forward currency contracts # 188,108 317,199 — 214,473 397,741 153,658 202,378 221,608 142,674 — 135,112 240,059 216,366 222,266 2,651,642Purchased options** # — — — — — — 147,537 — — — — — 28,989 — 176,526Total Assets $188,108 $319,435 $728,447 $725,827 $417,225 $153,658 $349,915 $221,608 $202,087 $3,953,152 $135,112 $240,059 $245,355 $222,266 $8,102,254Liabilities:Centrally cleared interest rate swap contracts § — — 325,866 — — — — — — — — — — — 325,866OTC Total return swap contracts* # — 7,332 — 387,481 — — 6,640 — 124 — — — — — 401,577OTC Credit default swap contracts* # 3,168 1,079 — — 20,629 — — — — — — — — — 24,876Centrally cleared credit defaultswap contracts § — — 196,952 — — — — — — — — — — — 196,952Futures contracts § — — — — — — — — — 147,426 — — — — 147,426Forward currency contracts # 16,917 245,252 — 167,776 336,575 58,094 11,676 92,800 150,266 — 4,326 207,859 315,128 12,354 1,619,023Written swap options # — — — — — — — — 534,198 — — — — — 534,198Written options # — — — — — — 25,965 — — — — — 9,093 — 35,058Total Liabilities $20,085 $253,663 $522,818 $555,257 $357,204 $58,094 $44,281 $92,800 $684,588 $147,426 $4,326 $207,859 $324,221 $12,354 $3,284,976Total Financial and Derivative Net Assets $168,023 $65,772 $205,629 $170,570 $60,021 $95,564 $305,634 $128,808 $(482,501) $3,805,726 $130,786 $32,200 $(78,866) $209,912 $4,817,278Total collateral received (pledged) ## † $110,000 $(124,888) $— $— $10,842 $90,000 $151,840 $123,076 $(469,577) $— $— $— $— $— $(108,707)Net amount $58,023 $190,660 $205,629 $170,570 $49,179 $5,564 $153,794 $5,732 $(12,924) $3,805,726 $130,786 $32,200 $(78,866) $209,912 $4,925,985Goldman SachsInternationalHSBC Bank USA,National AssociationJPMorgan Chase BankN.A.Merrill Lynch, Pierce,Fenner & Smith, Inc.Royal Bank of ScotlandPLC (The)State Street Bank andTrust Co.UBS AGWestPac Banking Corp.Total*Excludes premiums, if any. Included in unrealized appreciation and depreciation on OTC swap contracts on the Statement of assetsand liabilities.**Included with <strong>Investments</strong> in securities on the Statement of assets and liabilities.†Additional collateral may be required from certain brokers based on individual agreements.#Covered by master netting agreement. (Note 1)##Any over-collateralization of total financial and derivative net assets is not shown.§Includes current day’s variation margin only as reported on the Statement of assets and liabilities, which is not collateralized. Cumulativeappreciation/(depreciation) for futures contracts and centrally cleared swap contracts is represented in the tables listed after thefund’s portfolio.116 Dynamic Asset Allocation Growth Fund Dynamic Asset Allocation Growth Fund 117