March - Putnam Investments

March - Putnam Investments

March - Putnam Investments

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

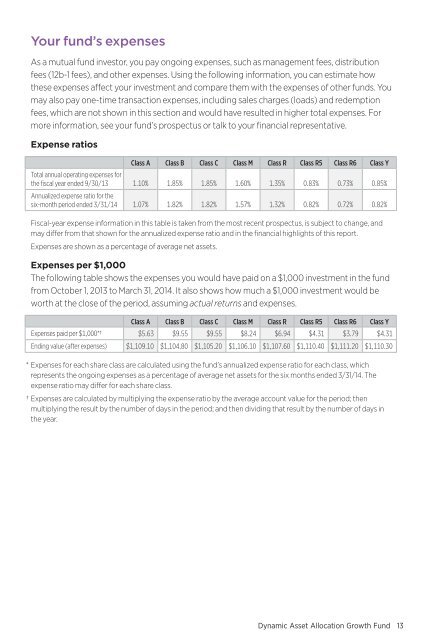

Your fund’s expensesAs a mutual fund investor, you pay ongoing expenses, such as management fees, distributionfees (12b-1 fees), and other expenses. Using the following information, you can estimate howthese expenses affect your investment and compare them with the expenses of other funds. Youmay also pay one-time transaction expenses, including sales charges (loads) and redemptionfees, which are not shown in this section and would have resulted in higher total expenses. Formore information, see your fund’s prospectus or talk to your financial representative.Expense ratiosClass A Class B Class C Class M Class R Class R5 Class R6 Class YTotal annual operating expenses forthe fiscal year ended 9/30/13 1.10% 1.85% 1.85% 1.60% 1.35% 0.83% 0.73% 0.85%Annualized expense ratio for thesix-month period ended 3/31/14 1.07% 1.82% 1.82% 1.57% 1.32% 0.82% 0.72% 0.82%Fiscal-year expense information in this table is taken from the most recent prospectus, is subject to change, andmay differ from that shown for the annualized expense ratio and in the financial highlights of this report.Expenses are shown as a percentage of average net assets.Expenses per $1,000The following table shows the expenses you would have paid on a $1,000 investment in the fundfrom October 1, 2013 to <strong>March</strong> 31, 2014. It also shows how much a $1,000 investment would beworth at the close of the period, assuming actual returns and expenses.Class A Class B Class C Class M Class R Class R5 Class R6 Class YExpenses paid per $1,000*† $5.63 $9.55 $9.55 $8.24 $6.94 $4.31 $3.79 $4.31Ending value (after expenses) $1,109.10 $1,104.80 $1,105.20 $1,106.10 $1,107.60 $1,110.40 $1,111.20 $1,110.30* Expenses for each share class are calculated using the fund’s annualized expense ratio for each class, whichrepresents the ongoing expenses as a percentage of average net assets for the six months ended 3/31/14. Theexpense ratio may differ for each share class.† Expenses are calculated by multiplying the expense ratio by the average account value for the period; thenmultiplying the result by the number of days in the period; and then dividing that result by the number of days inthe year.Dynamic Asset Allocation Growth Fund 13