March - Putnam Investments

March - Putnam Investments

March - Putnam Investments

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

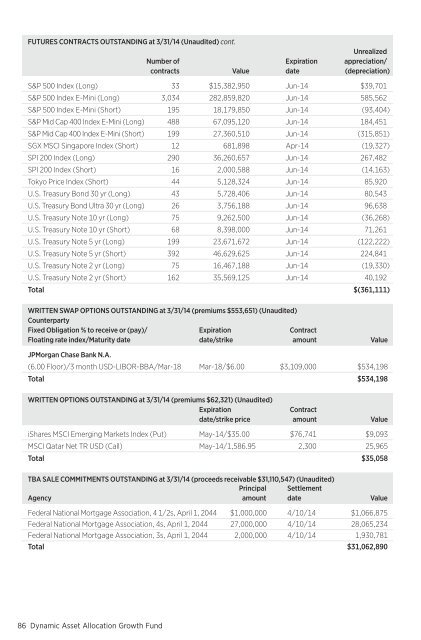

FUTURES CONTRACTS OUTSTANDING at 3/31/14 (Unaudited) cont.Number ofcontractsValueExpirationdateUnrealizedappreciation/(depreciation)S&P 500 Index (Long) 33 $15,382,950 Jun-14 $39,701S&P 500 Index E-Mini (Long) 3,034 282,859,820 Jun-14 585,562S&P 500 Index E-Mini (Short) 195 18,179,850 Jun-14 (93,404)S&P Mid Cap 400 Index E-Mini (Long) 488 67,095,120 Jun-14 184,451S&P Mid Cap 400 Index E-Mini (Short) 199 27,360,510 Jun-14 (315,851)SGX MSCI Singapore Index (Short) 12 681,898 Apr-14 (19,327)SPI 200 Index (Long) 290 36,260,657 Jun-14 267,482SPI 200 Index (Short) 16 2,000,588 Jun-14 (14,163)Tokyo Price Index (Short) 44 5,128,324 Jun-14 85,920U.S. Treasury Bond 30 yr (Long) 43 5,728,406 Jun-14 80,543U.S. Treasury Bond Ultra 30 yr (Long) 26 3,756,188 Jun-14 96,638U.S. Treasury Note 10 yr (Long) 75 9,262,500 Jun-14 (36,268)U.S. Treasury Note 10 yr (Short) 68 8,398,000 Jun-14 71,261U.S. Treasury Note 5 yr (Long) 199 23,671,672 Jun-14 (122,222)U.S. Treasury Note 5 yr (Short) 392 46,629,625 Jun-14 224,841U.S. Treasury Note 2 yr (Long) 75 16,467,188 Jun-14 (19,330)U.S. Treasury Note 2 yr (Short) 162 35,569,125 Jun-14 40,192Total $(361,111 )WRITTEN SWAP OPTIONS OUTSTANDING at 3/31/14 (premiums $553,651) (Unaudited)CounterpartyFixed Obligation % to receive or (pay)/Floating rate index/Maturity dateExpirationdate/strikeContractamountValueJPMorgan Chase Bank N.A.(6.00 Floor)/3 month USD-LIBOR-BBA/Mar-18 Mar-18/$6.00 $3,109,000 $534,198Total $534,198WRITTEN OPTIONS OUTSTANDING at 3/31/14 (premiums $62,321 ) (Unaudited)Expirationdate/strike priceContractamountiShares MSCI Emerging Markets Index (Put) May-14/$35.00 $76,741 $9,093MSCI Qatar Net TR USD (Call) May-14/1,586.95 2,300 25,965Total $35,058TBA SALE COMMITMENTS OUTSTANDING at 3/31/14 (proceeds receivable $31,110,547 ) (Unaudited)AgencyPrincipalamountSettlementdateFederal National Mortgage Association, 4 1/2s, April 1, 2044 $1,000,000 4/10/14 $1,066,875Federal National Mortgage Association, 4s, April 1, 2044 27,000,000 4/10/14 28,065,234Federal National Mortgage Association, 3s, April 1, 2044 2,000,000 4/10/14 1,930,781Total $31,062,890ValueValue86 Dynamic Asset Allocation Growth Fund