March - Putnam Investments

March - Putnam Investments

March - Putnam Investments

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

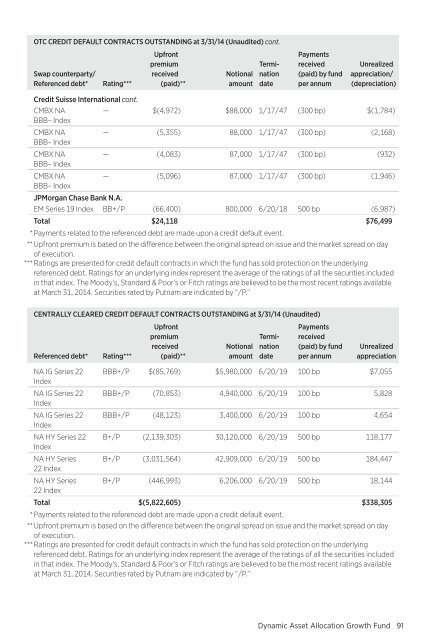

OTC CREDIT DEFAULT CONTRACTS OUTSTANDING at 3/31/14 (Unaudited) cont.Swap counterparty/Referenced debt*Rating***Upfrontpremiumreceived(paid)**NotionalamountTerminationdatePaymentsreceived(paid) by fundper annumUnrealizedappreciation/(depreciation)Credit Suisse International cont.CMBX NA — $(4,972 ) $88,000 1/17/47 (300 bp) $(1,784 )BBB– IndexCMBX NA — (5,355) 88,000 1/17/47 (300 bp) (2,168)BBB– IndexCMBX NA — (4,083) 87,000 1/17/47 (300 bp) (932)BBB– IndexCMBX NA — (5,096) 87,000 1/17/47 (300 bp) (1,946)BBB– IndexJPMorgan Chase Bank N.A.EM Series 19 Index BB+/P (66,400) 800,000 6/20/18 500 bp (6,987)Total $24,118 $76,499* Payments related to the referenced debt are made upon a credit default event.** Upfront premium is based on the difference between the original spread on issue and the market spread on dayof execution.*** Ratings are presented for credit default contracts in which the fund has sold protection on the underlyingreferenced debt. Ratings for an underlying index represent the average of the ratings of all the securities includedin that index. The Moody’s, Standard & Poor’s or Fitch ratings are believed to be the most recent ratings availableat <strong>March</strong> 31, 2014. Securities rated by <strong>Putnam</strong> are indicated by “/P.”CENTRALLY CLEARED CREDIT DEFAULT CONTRACTS OUTSTANDING at 3/31/14 (Unaudited)Referenced debt*Rating***Upfrontpremiumreceived(paid)**NotionalamountTerminationdatePaymentsreceived(paid) by fundper annumUnrealizedappreciationNA IG Series 22 BBB+/P $(85,769 ) $5,980,000 6/20/19 100 bp $7,055IndexNA IG Series 22 BBB+/P (70,853) 4,940,000 6/20/19 100 bp 5,828IndexNA IG Series 22 BBB+/P (48,123) 3,400,000 6/20/19 100 bp 4,654IndexNA HY Series 22 B+/P (2,139,303) 30,120,000 6/20/19 500 bp 118,177IndexNA HY Series B+/P (3,031,564) 42,909,000 6/20/19 500 bp 184,44722 IndexNA HY Series B+/P (446,993) 6,206,000 6/20/19 500 bp 18,14422 IndexTotal $(5,822,605 ) $338,305* Payments related to the referenced debt are made upon a credit default event.** Upfront premium is based on the difference between the original spread on issue and the market spread on dayof execution.*** Ratings are presented for credit default contracts in which the fund has sold protection on the underlyingreferenced debt. Ratings for an underlying index represent the average of the ratings of all the securities includedin that index. The Moody’s, Standard & Poor’s or Fitch ratings are believed to be the most recent ratings availableat <strong>March</strong> 31, 2014. Securities rated by <strong>Putnam</strong> are indicated by “/P.”Dynamic Asset Allocation Growth Fund 91