March - Putnam Investments

March - Putnam Investments

March - Putnam Investments

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

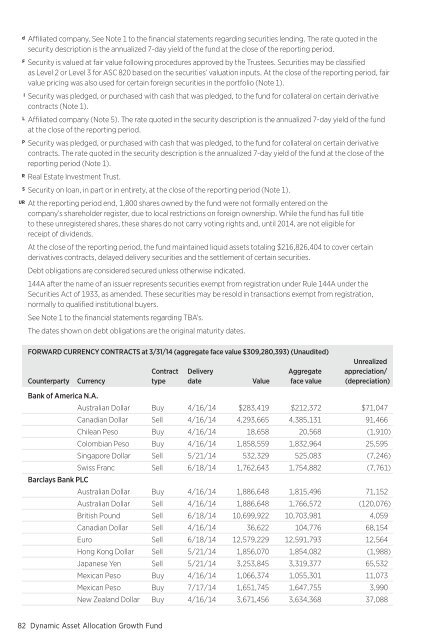

d Affiliated company. See Note 1 to the financial statements regarding securities lending. The rate quoted in thesecurity description is the annualized 7-day yield of the fund at the close of the reporting period.F Security is valued at fair value following procedures approved by the Trustees. Securities may be classifiedas Level 2 or Level 3 for ASC 820 based on the securities’ valuation inputs. At the close of the reporting period, fairvalue pricing was also used for certain foreign securities in the portfolio (Note 1).i Security was pledged, or purchased with cash that was pledged, to the fund for collateral on certain derivativecontracts (Note 1).L Affiliated company (Note 5). The rate quoted in the security description is the annualized 7-day yield of the fundat the close of the reporting period.P Security was pledged, or purchased with cash that was pledged, to the fund for collateral on certain derivativecontracts. The rate quoted in the security description is the annualized 7-day yield of the fund at the close of thereporting period (Note 1).R Real Estate Investment Trust.S Security on loan, in part or in entirety, at the close of the reporting period (Note 1).UR At the reporting period end, 1,800 shares owned by the fund were not formally entered on thecompany’s shareholder register, due to local restrictions on foreign ownership. While the fund has full titleto these unregistered shares, these shares do not carry voting rights and, until 2014, are not eligible forreceipt of dividends.At the close of the reporting period, the fund maintained liquid assets totaling $216,826,404 to cover certainderivatives contracts, delayed delivery securities and the settlement of certain securities.Debt obligations are considered secured unless otherwise indicated.144A after the name of an issuer represents securities exempt from registration under Rule 144A under theSecurities Act of 1933, as amended. These securities may be resold in transactions exempt from registration,normally to qualified institutional buyers.See Note 1 to the financial statements regarding TBA’s.The dates shown on debt obligations are the original maturity dates.FORWARD CURRENCY CONTRACTS at 3/31/14 (aggregate face value $309,280,393 ) (Unaudited)CounterpartyCurrencyContracttypeDeliverydateValueAggregateface valueUnrealizedappreciation/(depreciation)Bank of America N.A.Australian Dollar Buy 4/16/14 $283,419 $212,372 $71,047Canadian Dollar Sell 4/16/14 4,293,665 4,385,131 91,466Chilean Peso Buy 4/16/14 18,658 20,568 (1,910)Colombian Peso Buy 4/16/14 1,858,559 1,832,964 25,595Singapore Dollar Sell 5/21/14 532,329 525,083 (7,246)Swiss Franc Sell 6/18/14 1,762,643 1,754,882 (7,761)Barclays Bank PLCAustralian Dollar Buy 4/16/14 1,886,648 1,815,496 71,152Australian Dollar Sell 4/16/14 1,886,648 1,766,572 (120,076)British Pound Sell 6/18/14 10,699,922 10,703,981 4,059Canadian Dollar Sell 4/16/14 36,622 104,776 68,154Euro Sell 6/18/14 12,579,229 12,591,793 12,564Hong Kong Dollar Sell 5/21/14 1,856,070 1,854,082 (1,988)Japanese Yen Sell 5/21/14 3,253,845 3,319,377 65,532Mexican Peso Buy 4/16/14 1,066,374 1,055,301 11,073Mexican Peso Buy 7/17/14 1,651,745 1,647,755 3,990New Zealand Dollar Buy 4/16/14 3,671,456 3,634,368 37,08882 Dynamic Asset Allocation Growth Fund