European Infrastructure Finance Yearbook - Investing In Bonds ...

European Infrastructure Finance Yearbook - Investing In Bonds ...

European Infrastructure Finance Yearbook - Investing In Bonds ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

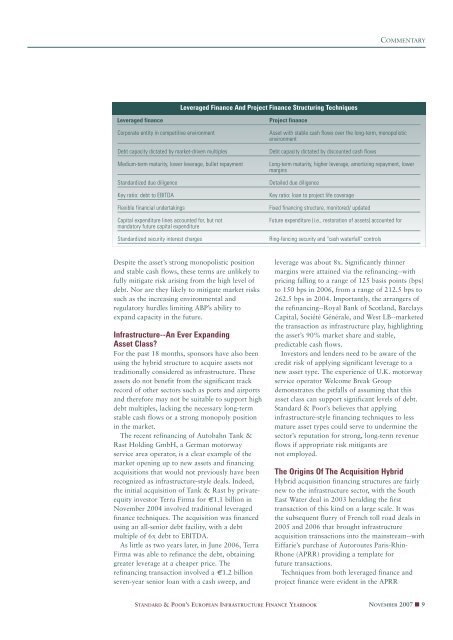

Leveraged <strong>Finance</strong> And Project <strong>Finance</strong> Structuring Techniques<br />

Leveraged finance Project finance<br />

Despite the asset’s strong monopolistic position<br />

and stable cash flows, these terms are unlikely to<br />

fully mitigate risk arising from the high level of<br />

debt. Nor are they likely to mitigate market risks<br />

such as the increasing environmental and<br />

regulatory hurdles limiting ABP’s ability to<br />

expand capacity in the future.<br />

<strong><strong>In</strong>frastructure</strong>--An Ever Expanding<br />

Asset Class?<br />

For the past 18 months, sponsors have also been<br />

using the hybrid structure to acquire assets not<br />

traditionally considered as infrastructure. These<br />

assets do not benefit from the significant track<br />

record of other sectors such as ports and airports<br />

and therefore may not be suitable to support high<br />

debt multiples, lacking the necessary long-term<br />

stable cash flows or a strong monopoly position<br />

in the market.<br />

The recent refinancing of Autobahn Tank &<br />

Rast Holding GmbH, a German motorway<br />

service area operator, is a clear example of the<br />

market opening up to new assets and financing<br />

acquisitions that would not previously have been<br />

recognized as infrastructure-style deals. <strong>In</strong>deed,<br />

the initial acquisition of Tank & Rast by privateequity<br />

investor Terra Firma for €1.1 billion in<br />

November 2004 involved traditional leveraged<br />

finance techniques. The acquisition was financed<br />

using an all-senior debt facility, with a debt<br />

multiple of 6x debt to EBITDA.<br />

As little as two years later, in June 2006, Terra<br />

Firma was able to refinance the debt, obtaining<br />

greater leverage at a cheaper price. The<br />

refinancing transaction involved a €1.2 billion<br />

seven-year senior loan with a cash sweep, and<br />

COMMENTARY<br />

Corporate entity in competitive environment Asset with stable cash flows over the long-term, monopolistic<br />

environment<br />

Debt capacity dictated by market-driven multiples Debt capacity dictated by discounted cash flows<br />

Medium-term maturity, lower leverage, bullet repayment Long-term maturity, higher leverage, amortizing repayment, lower<br />

margins<br />

Standardized due diligence Detailed due diligence<br />

Key ratio: debt to EBITDA Key ratio: loan to project life coverage<br />

Flexible financial undertakings Fixed financing structure, monitored/ updated<br />

Capital expenditure lines accounted for, but not Future expenditure (i.e., restoration of assets) accounted for<br />

mandatory future capital expenditure<br />

Standardized security interest charges Ring-fencing security and "cash waterfall" controls<br />

leverage was about 8x. Significantly thinner<br />

margins were attained via the refinancing--with<br />

pricing falling to a range of 125 basis points (bps)<br />

to 150 bps in 2006, from a range of 212.5 bps to<br />

262.5 bps in 2004. Importantly, the arrangers of<br />

the refinancing--Royal Bank of Scotland, Barclays<br />

Capital, Société Générale, and West LB--marketed<br />

the transaction as infrastructure play, highlighting<br />

the asset’s 90% market share and stable,<br />

predictable cash flows.<br />

<strong>In</strong>vestors and lenders need to be aware of the<br />

credit risk of applying significant leverage to a<br />

new asset type. The experience of U.K. motorway<br />

service operator Welcome Break Group<br />

demonstrates the pitfalls of assuming that this<br />

asset class can support significant levels of debt.<br />

Standard & Poor’s believes that applying<br />

infrastructure-style financing techniques to less<br />

mature asset types could serve to undermine the<br />

sector’s reputation for strong, long-term revenue<br />

flows if appropriate risk mitigants are<br />

not employed.<br />

The Origins Of The Acquisition Hybrid<br />

Hybrid acquisition financing structures are fairly<br />

new to the infrastructure sector, with the South<br />

East Water deal in 2003 heralding the first<br />

transaction of this kind on a large scale. It was<br />

the subsequent flurry of French toll road deals in<br />

2005 and 2006 that brought infrastructure<br />

acquisition transactions into the mainstream--with<br />

Eiffarie’s purchase of Autoroutes Paris-Rhin-<br />

Rhone (APRR) providing a template for<br />

future transactions.<br />

Techniques from both leveraged finance and<br />

project finance were evident in the APRR<br />

STANDARD & POOR’S EUROPEAN INFRASTRUCTURE FINANCE YEARBOOK NOVEMBER 2007 ■ 9