European Infrastructure Finance Yearbook - Investing In Bonds ...

European Infrastructure Finance Yearbook - Investing In Bonds ...

European Infrastructure Finance Yearbook - Investing In Bonds ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

and its subsidiaries. The majority of the new<br />

gencos are still UES subsidiaries but are likely to<br />

be privatized in the short term.<br />

Some observers refer to UES’ new investment<br />

program as ‘GOELRO-2’ (the first GOELRO was<br />

the original Soviet plan in 1920 for national<br />

economic recovery and development). GOELRO-<br />

2 envisages heavy investment in new generation<br />

capacity, which should result in an additional 34<br />

gigawatts (GW)--the equivalent of 16% of the<br />

current national generation capacity--by 2011.<br />

The investment plan relies heavily on external<br />

equity and debt financing, and consequently<br />

most gencos are tapping the equity and debt<br />

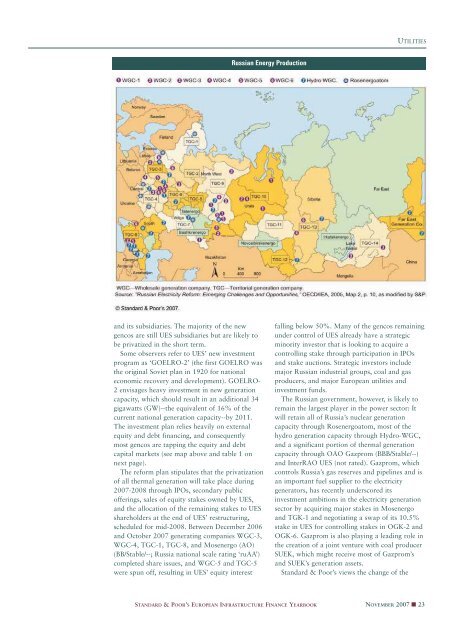

capital markets (see map above and table 1 on<br />

next page).<br />

The reform plan stipulates that the privatization<br />

of all thermal generation will take place during<br />

2007-2008 through IPOs, secondary public<br />

offerings, sales of equity stakes owned by UES,<br />

and the allocation of the remaining stakes to UES<br />

shareholders at the end of UES’ restructuring,<br />

scheduled for mid-2008. Between December 2006<br />

and October 2007 generating companies WGC-3,<br />

WGC-4, TGC-1, TGC-8, and Mosenergo (AO)<br />

(BB/Stable/--; Russia national scale rating ‘ruAA’)<br />

completed share issues, and WGC-5 and TGC-5<br />

were spun off, resulting in UES’ equity interest<br />

Russian Energy Production<br />

STANDARD & POOR’S EUROPEAN INFRASTRUCTURE FINANCE YEARBOOK<br />

UTILITIES<br />

falling below 50%. Many of the gencos remaining<br />

under control of UES already have a strategic<br />

minority investor that is looking to acquire a<br />

controlling stake through participation in IPOs<br />

and stake auctions. Strategic investors include<br />

major Russian industrial groups, coal and gas<br />

producers, and major <strong>European</strong> utilities and<br />

investment funds.<br />

The Russian government, however, is likely to<br />

remain the largest player in the power sector: It<br />

will retain all of Russia’s nuclear generation<br />

capacity through Rosenergoatom, most of the<br />

hydro generation capacity through Hydro-WGC,<br />

and a significant portion of thermal generation<br />

capacity through OAO Gazprom (BBB/Stable/--)<br />

and <strong>In</strong>terRAO UES (not rated). Gazprom, which<br />

controls Russia’s gas reserves and pipelines and is<br />

an important fuel supplier to the electricity<br />

generators, has recently underscored its<br />

investment ambitions in the electricity generation<br />

sector by acquiring major stakes in Mosenergo<br />

and TGK-1 and negotiating a swap of its 10.5%<br />

stake in UES for controlling stakes in OGK-2 and<br />

OGK-6. Gazprom is also playing a leading role in<br />

the creation of a joint venture with coal producer<br />

SUEK, which might receive most of Gazprom’s<br />

and SUEK’s generation assets.<br />

Standard & Poor’s views the change of the<br />

NOVEMBER 2007 ■ 23