European Infrastructure Finance Yearbook - Investing In Bonds ...

European Infrastructure Finance Yearbook - Investing In Bonds ...

European Infrastructure Finance Yearbook - Investing In Bonds ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

COMMENTARY<br />

Publication Date:<br />

Oct. 31, 2007<br />

Primary Credit Analysts:<br />

Lidia Polakovic,<br />

London,<br />

(44) 20-7176-3985<br />

Michael Wilkins,<br />

London,<br />

(44) 20-7176-3528<br />

Secondary Credit Analysts:<br />

Arthur F Simonson,<br />

New York,<br />

(1) 212-438-2094<br />

Ian Greer,<br />

Melbourne,<br />

(61) 3-9631-2032<br />

Peter Rigby,<br />

New York,<br />

(1) 212-438-2085<br />

Other Secondary Credit<br />

Analysts:<br />

Jonathan Manley,<br />

London,<br />

(44) 20-7176-3952<br />

Peter Kernan,<br />

London,<br />

(44) 20-7176-3618<br />

Paul B Calder, CFA,<br />

Toronto,<br />

(1) 416-507-2523<br />

HOW INFRASTRUCTURE ASSETS HAVE WEATHERED A<br />

DECADE OF STORMS<br />

Over the past decade, Standard & Poor’s<br />

Ratings Services has witnessed<br />

phenomenal growth in demand for<br />

infrastructure assets. A highly sought after asset<br />

class in the financial markets, infrastructure<br />

benefits from its reputation for stability and<br />

flexibility to respond to changing investor needs.<br />

The sector is evolving, with assets becoming more<br />

varied and the financial structures that support<br />

their financings increasingly sophisticated, making<br />

risk analysis more complex than ever.<br />

This year marks Standard & Poor’s<br />

<strong><strong>In</strong>frastructure</strong> <strong>Finance</strong> Ratings group’s 10th<br />

anniversary. It therefore seems appropriate to<br />

review the highs and lows of the past decade, and<br />

to consider how infrastructure has matured as an<br />

asset class.<br />

<strong>In</strong> 1997, infrastructure finance faced a difficult<br />

environment. The Asian crisis was unfolding,<br />

threatening many project and infrastructure<br />

credits rated by Standard & Poor’s across the<br />

region. <strong>In</strong> many cases the crisis derailed projects<br />

at all stages of the pipeline--from many in<br />

development infancy to a handful ready to close<br />

on their financings. Market shocks have followed.<br />

Notably, the California power crisis, Enron Corp.<br />

bankruptcy, Brazilian energy crisis, and events of<br />

Sept. 11, 2001, caused widespread disruption in<br />

the project, utility, and transportation sectors.<br />

Through it all, though, infrastructure assets<br />

have shown resilience, and the market continues<br />

to grow. This should surprise few. As the global<br />

economy has boomed, the need for supporting<br />

infrastructure has exploded, which has also<br />

resulted in a significant rise in the number of<br />

Standard & Poor’s ratings in the sector. Project<br />

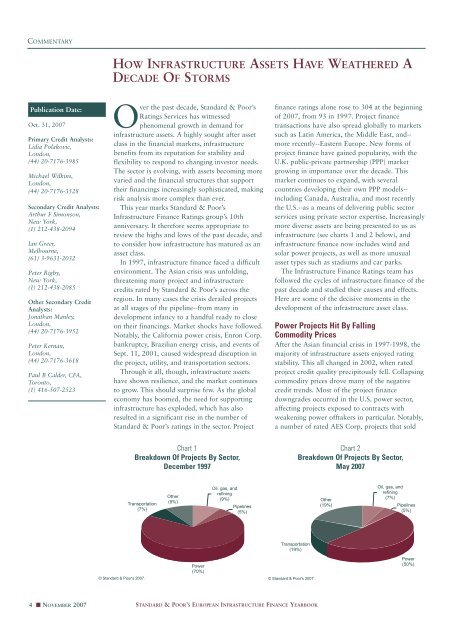

Chart 1<br />

Breakdown Of Projects By Sector,<br />

December 1997<br />

4 ■ NOVEMBER 2007 STANDARD & POOR’S EUROPEAN INFRASTRUCTURE FINANCE YEARBOOK<br />

finance ratings alone rose to 304 at the beginning<br />

of 2007, from 93 in 1997. Project finance<br />

transactions have also spread globally to markets<br />

such as Latin America, the Middle East, and-more<br />

recently--Eastern Europe. New forms of<br />

project finance have gained popularity, with the<br />

U.K. public-private partnership (PPP) market<br />

growing in importance over the decade. This<br />

market continues to expand, with several<br />

countries developing their own PPP models-including<br />

Canada, Australia, and most recently<br />

the U.S.--as a means of delivering public sector<br />

services using private sector expertise. <strong>In</strong>creasingly<br />

more diverse assets are being presented to us as<br />

infrastructure (see charts 1 and 2 below), and<br />

infrastructure finance now includes wind and<br />

solar power projects, as well as more unusual<br />

asset types such as stadiums and car parks.<br />

The <strong><strong>In</strong>frastructure</strong> <strong>Finance</strong> Ratings team has<br />

followed the cycles of infrastructure finance of the<br />

past decade and studied their causes and effects.<br />

Here are some of the decisive moments in the<br />

development of the infrastructure asset class.<br />

Power Projects Hit By Falling<br />

Commodity Prices<br />

After the Asian financial crisis in 1997-1998, the<br />

majority of infrastructure assets enjoyed rating<br />

stability. This all changed in 2002, when rated<br />

project credit quality precipitously fell. Collapsing<br />

commodity prices drove many of the negative<br />

credit trends. Most of the project finance<br />

downgrades occurred in the U.S. power sector,<br />

affecting projects exposed to contracts with<br />

weakening power offtakers in particular. Notably,<br />

a number of rated AES Corp. projects that sold<br />

Chart 2<br />

Breakdown Of Projects By Sector,<br />

May 2007