Valuation of Biodiversity Benefits (OECD)

Valuation of Biodiversity Benefits (OECD)

Valuation of Biodiversity Benefits (OECD)

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

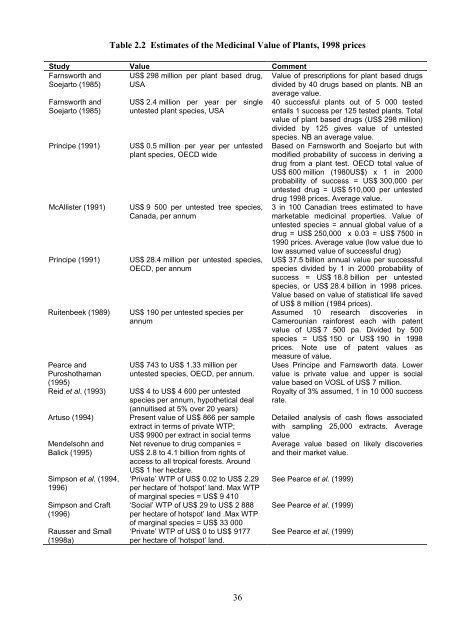

Table 2.2 Estimates <strong>of</strong> the Medicinal Value <strong>of</strong> Plants, 1998 pricesStudy Value CommentFarnsworth and US$ 298 million per plant based drug, Value <strong>of</strong> prescriptions for plant based drugsSoejarto (1985) USAdivided by 40 drugs based on plants. NB anFarnsworth andSoejarto (1985)Principe (1991)McAllister (1991)Principe (1991)Ruitenbeek (1989)Pearce andPuroshothaman(1995)Reid et al. (1993)Artuso (1994)Mendelsohn andBalick (1995)Simpson et al. (1994,1996)Simpson and Craft(1996)Rausser and Small(1998a)US$ 2.4 million per year per singleuntested plant species, USAUS$ 0.5 million per year per untestedplant species, <strong>OECD</strong> wideUS$ 9 500 per untested tree species,Canada, per annumUS$ 28.4 million per untested species,<strong>OECD</strong>, per annumUS$ 190 per untested species perannumUS$ 743 to US$ 1.33 million peruntested species, <strong>OECD</strong>, per annum.US$ 4 to US$ 4 600 per untestedspecies per annum, hypothetical deal(annuitised at 5% over 20 years)Present value <strong>of</strong> US$ 866 per sampleextract in terms <strong>of</strong> private WTP;US$ 9900 per extract in social termsNet revenue to drug companies =US$ 2.8 to 4.1 billion from rights <strong>of</strong>access to all tropical forests. AroundUS$ 1 her hectare.‘Private’ WTP <strong>of</strong> US$ 0.02 to US$ 2.29per hectare <strong>of</strong> ‘hotspot’ land. Max WTP<strong>of</strong> marginal species = US$ 9 410‘Social’ WTP <strong>of</strong> US$ 29 to US$ 2 888per hectare <strong>of</strong> hotspot’ land .Max WTP<strong>of</strong> marginal species = US$ 33 000‘Private’ WTP <strong>of</strong> US$ 0 to US$ 9177per hectare <strong>of</strong> ‘hotspot’ land.average value.40 successful plants out <strong>of</strong> 5 000 testedentails 1 success per 125 tested plants. Totalvalue <strong>of</strong> plant based drugs (US$ 298 million)divided by 125 gives value <strong>of</strong> untestedspecies. NB an average value.Based on Farnsworth and Soejarto but withmodified probability <strong>of</strong> success in deriving adrug from a plant test. <strong>OECD</strong> total value <strong>of</strong>US$ 600 million (1980US$) x 1 in 2000probability <strong>of</strong> success = US$ 300,000 peruntested drug = US$ 510,000 per untesteddrug 1998 prices. Average value.3 in 100 Canadian trees estimated to havemarketable medicinal properties. Value <strong>of</strong>untested species = annual global value <strong>of</strong> adrug = US$ 250,000 x 0.03 = US$ 7500 in1990 prices. Average value (low value due tolow assumed value <strong>of</strong> successful drug)US$ 37.5 billion annual value per successfulspecies divided by 1 in 2000 probability <strong>of</strong>success = US$ 18.8 billion per untestedspecies, or US$ 28.4 billion in 1998 prices.Value based on value <strong>of</strong> statistical life saved<strong>of</strong> US$ 8 million (1984 prices).Assumed 10 research discoveries inCamerounian rainforest each with patentvalue <strong>of</strong> US$ 7 500 pa. Divided by 500species = US$ 150 or US$ 190 in 1998prices. Note use <strong>of</strong> patent values asmeasure <strong>of</strong> value.Uses Principe and Farnsworth data. Lowervalue is private value and upper is socialvalue based on VOSL <strong>of</strong> US$ 7 million.Royalty <strong>of</strong> 3% assumed, 1 in 10 000 successrate.Detailed analysis <strong>of</strong> cash flows associatedwith sampling 25,000 extracts. AveragevalueAverage value based on likely discoveriesand their market value.See Pearce et al. (1999)See Pearce et al. (1999)See Pearce et al. (1999)36