2.8 MEUR - Gorenje - Gorenje Group

2.8 MEUR - Gorenje - Gorenje Group

2.8 MEUR - Gorenje - Gorenje Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Financial Position and Liquidity<br />

18.7 <strong>MEUR</strong><br />

reduction of net financial debt.<br />

Financial liabilities increased by EUR 161 thousand<br />

(0.03 percent) in 2011. At the same time, the funds on<br />

the account increased by EUR 18.9 mio, thus reducing<br />

the net financial debt by EUR 18.7 mio (4.7 percent).<br />

We managed to achieve this result by implementing<br />

measures for improving the management of liabilities<br />

and inventories, and through disinvestments.<br />

In the structure of sources of financing, the share of<br />

trade liabilities decreased by EUR 4<strong>2.8</strong> mio in 2011. This<br />

was due to the optimisation of the purchasing process<br />

in the goods and material stocks segment and the<br />

sale of the Istrabenz <strong>Gorenje</strong> company. On the other<br />

side, the share of equity increased to 31.8 percent and<br />

financial liabilities increased by two percentage points<br />

to 38.7 percent.<br />

The value of the net financial debt / EBITDA ratio worsened<br />

in the past year, despite the decrease in net financial<br />

debt, due to lower EBITDA. The main reason for lower<br />

EBITDA is primarily in the one-off effect of the acquisition<br />

of the Asko <strong>Group</strong> in 2010 and the negative operation of<br />

the Home Interior Division. In 2010, Asko had a significant<br />

positive effect on the <strong>Group</strong>’s profitability due to its<br />

negative goodwill.<br />

The Management Board of the company <strong>Gorenje</strong>, d.d.<br />

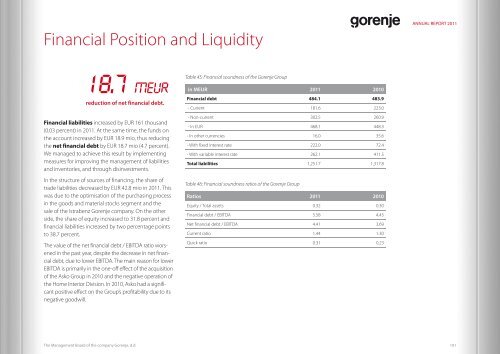

Table 45: Financial soundness of the <strong>Gorenje</strong> <strong>Group</strong><br />

in <strong>MEUR</strong> 2011 2010<br />

Financial debt 484.1 483.9<br />

- Current 181.6 223.0<br />

- Non-current 302.5 260.9<br />

- In EUR 468.1 448.3<br />

- In other currencies 16.0 35.6<br />

- With fixed interest rate 222.0 72.4<br />

- With variable interest rate 262.1 411.5<br />

Total liabilities 1,251.7 1,317.8<br />

Table 46: Financial soundness ratios of the <strong>Gorenje</strong> <strong>Group</strong><br />

Ratios 2011 2010<br />

Equity / Total assets 0.32 0.30<br />

Financial debt / EBITDA 5.58 4.45<br />

Net financial debt / EBITDA 4.41 3.69<br />

Current ratio 1.44 1.30<br />

Quick ratio 0.31 0.23<br />

ANNUAL REPORT 2011<br />

101