2.8 MEUR - Gorenje - Gorenje Group

2.8 MEUR - Gorenje - Gorenje Group

2.8 MEUR - Gorenje - Gorenje Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

was due to long-term borrowings in the form of notes<br />

granted from German Deutsche Bank in the amount of<br />

EUR 100 mio, and the utilisation of borrowings in the<br />

amount of EUR 41.7 granted to the Company in 2010 by<br />

IFC, together with a syndicate of banks.<br />

The liquid assets available at the end of 2011 amounted<br />

to EUR 206.3 mio. Slightly more than half of this<br />

amount is represented by unutilised borrowings, and<br />

the remainder by cash and cash equivalents. Available<br />

liquid assets decreased in the past year, primarily on<br />

account of the conversion of short-term borrowings<br />

into long-term borrowings. In our opinion, we have<br />

thus minimised the short-term liquidity risk of the<br />

<strong>Gorenje</strong> <strong>Group</strong>.<br />

The Management Board of the company <strong>Gorenje</strong>, d.d.<br />

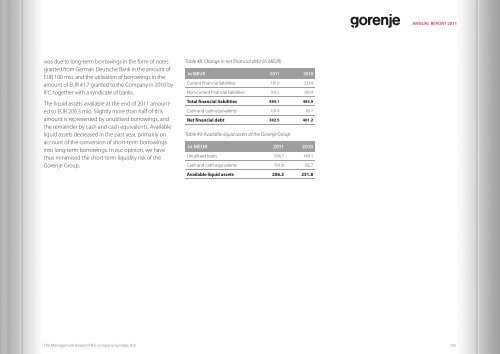

Table 48: Change in net financial debt (in <strong>MEUR</strong>)<br />

in <strong>MEUR</strong> 2011 2010<br />

Current financial liabilities 181.6 223.0<br />

Non-current financial liabilities 302.5 260.9<br />

Total financial liabilities 484.1 483.9<br />

Cash and cash equivalents 101.6 82.7<br />

Net financial debt 382.5 401.2<br />

Table 49: Available liquid assets of the <strong>Gorenje</strong> <strong>Group</strong><br />

in <strong>MEUR</strong> 2011 2010<br />

Unutilised loans 104.7 149.1<br />

Cash and cash equivalents 101.6 82.7<br />

Available liquid assets 206.3 231.8<br />

ANNUAL REPORT 2011<br />

105