2.8 MEUR - Gorenje - Gorenje Group

2.8 MEUR - Gorenje - Gorenje Group

2.8 MEUR - Gorenje - Gorenje Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

I.<br />

We are the <strong>Gorenje</strong> <strong>Group</strong><br />

Performance Highlights<br />

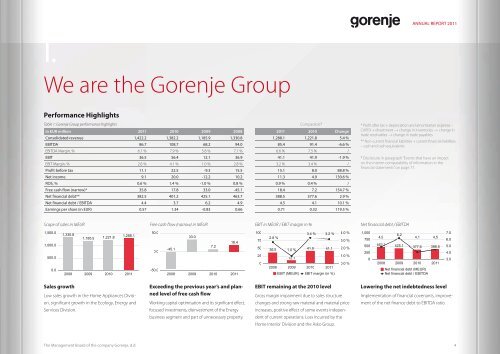

Table 1: <strong>Gorenje</strong> <strong>Group</strong> performance highlights Comparable 1<br />

in EUR million 2011 2010 2009 2008 2011 2010 Change<br />

Consolidated revenue 1,422.2 1,382.2 1,185.9 1,330.8 1,288.1 1,221.8 5.4 %<br />

EBITDA 86.7 108.7 68.2 94.0 85.4 91.4 -6.6 %<br />

EBITDA Margin, % 6.1 % 7.9 % 5.8 % 7.1 % 6.6 % 7.5 % /<br />

EBIT 36.5 56.4 12.1 36.9 41.1 41.9 -1.9 %<br />

EBIT Margin, % 2.6 % 4.1 % 1.0 % <strong>2.8</strong> % 3.2 % 3.4 % /<br />

Profit before tax 11.1 22.5 -9.3 15.5 15.1 8.0 88.8 %<br />

Net income 9.1 20.0 -12.2 10.2 11.3 4.9 130.6 %<br />

ROS, % 0.6 % 1.4 % -1.0 % 0.8 % 0.9 % 0.4 % /<br />

Free cash flow (narrow)* 35.8 17.8 33.0 -45.1 18.4 7.2 154.7 %<br />

Net financial debt** 382.5 401.2 425.1 463.7 388.5 377.6 2.9 %<br />

Net financial debt / EBITDA 4.4 3.7 6.2 4.9 4.5 4.1 10.1 %<br />

Earnings per share (in EUR) 0.57 1.34 -0.83 0.66 0.71 0.32 119.5 %<br />

1,500.0<br />

1,000.0<br />

500.0<br />

0.0<br />

1,330.8<br />

Sales growth<br />

1,185.9<br />

1,221.8<br />

1,288.1<br />

2008 2009 2010 2011<br />

Low sales growth in the Home Appliances Division,<br />

significant growth in the Ecology, Energy and<br />

Services Division.<br />

The Management Board of the company <strong>Gorenje</strong>, d.d.<br />

50.0<br />

0.0<br />

-50.0<br />

-45.1<br />

33.0<br />

7.2<br />

18.4<br />

2008 2009 2010 2011<br />

Exceeding the previous year’s and planned<br />

level of free cash flow<br />

Working capital optimisation and its significant effect,<br />

focused investments, disinvestment of the Energy<br />

business segment and part of unnecessary property.<br />

100<br />

75<br />

50<br />

25<br />

0<br />

<strong>2.8</strong> %<br />

36.9<br />

1.0 %<br />

12.1<br />

3.4 % 3.2 %<br />

41.9 41.1<br />

2008 2009 2010 2011<br />

EBIT (<strong>MEUR</strong>) EBIT margin (in %)<br />

4.0 %<br />

3.0 %<br />

2.0 %<br />

1.0 %<br />

0.0 %<br />

EBIT remaining at the 2010 level<br />

Gross margin impairment due to sales structure<br />

changes and strong raw material and material price<br />

increases, positive effect of some events independent<br />

of current operations. Loss incurred by the<br />

Home Interior Division and the Asko <strong>Group</strong>.<br />

ANNUAL REPORT 2011<br />

* Profit after tax + depreciation and amortisation expense –<br />

CAPEX + divestment –+ change in inventories –+ change in<br />

trade receivables –+ change in trade payables<br />

** Non-current financial liabilities + current financial liabilities<br />

– cash and cash equivalents<br />

1 Disclosure in paragraph “Events that have an impact<br />

on the interim comparability of information in the<br />

financial statements” on page 77.<br />

Scope of sales in <strong>MEUR</strong> Free cash flow (narrow) in <strong>MEUR</strong> EBIT in <strong>MEUR</strong> / EBIT margin in % Net financial debt / EBITDA<br />

1,000<br />

750<br />

500<br />

250<br />

0<br />

4,9<br />

6,2<br />

4,1 4,5<br />

463.7 425.1 377.6 388.5<br />

2008 2009 2010 2011<br />

Net financial debt (<strong>MEUR</strong>)<br />

Net financial debt / EBITDA<br />

7.0<br />

6.0<br />

5.0<br />

4.0<br />

3.0<br />

Lowering the net indebtedness level<br />

Implementation of financial covenants, improvement<br />

of the net finance debt to EBITDA ratio.<br />

4