2.8 MEUR - Gorenje - Gorenje Group

2.8 MEUR - Gorenje - Gorenje Group

2.8 MEUR - Gorenje - Gorenje Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

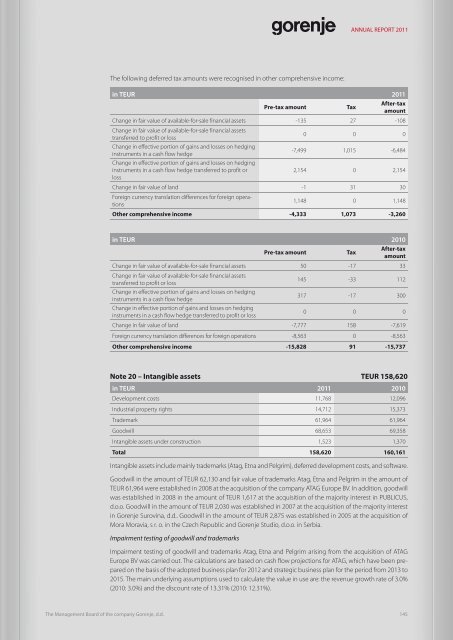

The following deferred tax amounts were recognised in other comprehensive income:<br />

ANNUAL REPORT 2011<br />

in TEUR 2011<br />

Pre-tax amount Tax<br />

After-tax<br />

amount<br />

Change in fair value of available-for-sale financial assets -135 27 -108<br />

Change in fair value of available-for-sale financial assets<br />

transferred to profit or loss<br />

0 0 0<br />

Change in effective portion of gains and losses on hedging<br />

instruments in a cash flow hedge<br />

Change in effective portion of gains and losses on hedging<br />

-7,499 1,015 -6,484<br />

instruments in a cash flow hedge transferred to profit or<br />

loss<br />

2,154 0 2,154<br />

Change in fair value of land -1 31 30<br />

Foreign currency translation differences for foreign operations<br />

1,148 0 1,148<br />

Other comprehensive income -4,333 1,073 -3,260<br />

in TEUR 2010<br />

Pre-tax amount Tax<br />

After-tax<br />

amount<br />

Change in fair value of available-for-sale financial assets 50 -17 33<br />

Change in fair value of available-for-sale financial assets<br />

transferred to profit or loss<br />

145 -33 112<br />

Change in effective portion of gains and losses on hedging<br />

instruments in a cash flow hedge<br />

317 -17 300<br />

Change in effective portion of gains and losses on hedging<br />

instruments in a cash flow hedge transferred to profit or loss<br />

0 0 0<br />

Change in fair value of land -7,777 158 -7,619<br />

Foreign currency translation differences for foreign operations -8,563 0 -8,563<br />

Other comprehensive income -15,828 91 -15,737<br />

Note 20 – Intangible assets TEUR 158,620<br />

in TEUR 2011 2010<br />

Development costs 11,768 12,096<br />

Industrial property rights 14,712 15,373<br />

Trademark 61,964 61,964<br />

Goodwill 68,653 69,358<br />

The Management Board of Intangible the company assets <strong>Gorenje</strong>, under d.d. construction 1,523 1,370<br />

Total 158,620 160,161<br />

Intangible assets include mainly trademarks (Atag, Etna and Pelgrim), deferred development costs, and software.<br />

Goodwill in the amount of TEUR 62,130 and fair value of trademarks Atag, Etna and Pelgrim in the amount of<br />

TEUR 61,964 were established in 2008 at the acquisition of the company ATAG Europe BV. In addition, goodwill<br />

was established in 2008 in the amount of TEUR 1,617 at the acquisition of the majority interest in PUBLICUS,<br />

d.o.o. Goodwill in the amount of TEUR 2,030 was established in 2007 at the acquisition of the majority interest<br />

in <strong>Gorenje</strong> Surovina, d.d.. Goodwill in the amount of TEUR 2,875 was established in 2005 at the acquisition of<br />

Mora Moravia, s r. o. in the Czech Republic and <strong>Gorenje</strong> Studio, d.o.o. in Serbia.<br />

Impairment testing of goodwill and trademarks<br />

Impairment testing of goodwill and trademarks Atag, Etna and Pelgrim arising from the acquisition of ATAG<br />

Europe BV was carried out. The calculations are based on cash flow projections for ATAG, which have been prepared<br />

on the basis of the adopted business plan for 2012 and strategic business plan for the period from 2013 to<br />

2015. The main underlying assumptions used to calculate the value in use are: the revenue growth rate of 3.0%<br />

(2010: 3.0%) and the discount rate of 13.31% (2010: 12.31%).<br />

The Management Board of the company <strong>Gorenje</strong>, d.d. 145