2.8 MEUR - Gorenje - Gorenje Group

2.8 MEUR - Gorenje - Gorenje Group

2.8 MEUR - Gorenje - Gorenje Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

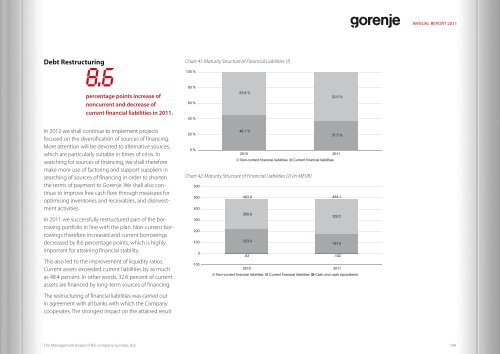

Debt Restructuring<br />

8.6<br />

percentage points increase of<br />

noncurrent and decrease of<br />

current financial liabilities in 2011.<br />

In 2012 we shall continue to implement projects<br />

focused on the diversification of sources of financing.<br />

More attention will be devoted to alternative sources,<br />

which are particularly suitable in times of crisis. In<br />

searching for sources of financing, we shall therefore<br />

make more use of factoring and support suppliers in<br />

searching of sources of financing in order to shorten<br />

the terms of payment to <strong>Gorenje</strong>. We shall also continue<br />

to improve free cash flow through measures for<br />

optimising inventories and receivables, and disinvestment<br />

activities.<br />

In 2011 we successfully restructured part of the borrowing<br />

portfolio in line with the plan. Non-current borrowings<br />

therefore increased and current borrowings<br />

decreased by 8.6 percentage points, which is highly<br />

important for attaining financial stability.<br />

This also led to the improvement of liquidity ratios.<br />

Current assets exceeded current liabilities by as much<br />

as 48.4 percent. In other words, 32.6 percent of current<br />

assets are financed by long-term sources of financing.<br />

The restructuring of financial liabilities was carried out<br />

in agreement with all banks with which the Company<br />

cooperates. The strongest impact on the attained result<br />

The Management Board of the company <strong>Gorenje</strong>, d.d.<br />

Chart 41: Maturity Structure of Financial Liabilities (1)<br />

100 %<br />

80 %<br />

60 %<br />

40 %<br />

20 %<br />

0 %<br />

53.9 %<br />

46.1 %<br />

62.5 %<br />

2010 2011<br />

Non-current financial liabilities Current financial liabilities<br />

Chart 42: Maturity Structure of Financial Liabilities (2) (in <strong>MEUR</strong>)<br />

600<br />

500<br />

400<br />

300<br />

200<br />

100<br />

0<br />

-100<br />

37.5 %<br />

483.9 484.1<br />

260.9<br />

223.0<br />

302.5<br />

181.6<br />

-83 -102<br />

2010 2011<br />

Non-current financial liabilities Current financial liabilities Cash and cash equivalents<br />

ANNUAL REPORT 2011<br />

104