2.8 MEUR - Gorenje - Gorenje Group

2.8 MEUR - Gorenje - Gorenje Group

2.8 MEUR - Gorenje - Gorenje Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

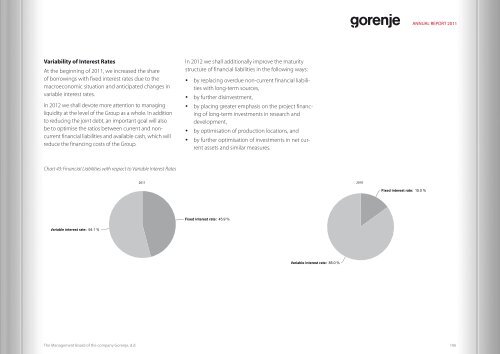

Variability of Interest Rates<br />

At the beginning of 2011, we increased the share<br />

of borrowings with fixed interest rates due to the<br />

macroeconomic situation and anticipated changes in<br />

variable interest rates.<br />

In 2012 we shall devote more attention to managing<br />

liquidity at the level of the <strong>Group</strong> as a whole. In addition<br />

to reducing the joint debt, an important goal will also<br />

be to optimise the ratios between current and noncurrent<br />

financial liabilities and available cash, which will<br />

reduce the financing costs of the <strong>Group</strong>.<br />

Chart 43: Financial Liabilities with respect to Variable Interest Rates<br />

Variable interest rate: 54.1 %<br />

The Management Board of the company <strong>Gorenje</strong>, d.d.<br />

2011<br />

In 2012 we shall additionally improve the maturity<br />

structure of financial liabilities in the following ways:<br />

� by replacing overdue non-current financial liabilities<br />

with long-term sources,<br />

� by further disinvestment,<br />

� by placing greater emphasis on the project financing<br />

of long-term investments in research and<br />

development,<br />

� by optimisation of production locations, and<br />

� by further optimisation of investments in net current<br />

assets and similar measures.<br />

Fixed interest rate: 45.9 %<br />

Variable interest rate: 85.0 %<br />

2010<br />

Fixed interest rate: 15.0 %<br />

ANNUAL REPORT 2011<br />

106