2.8 MEUR - Gorenje - Gorenje Group

2.8 MEUR - Gorenje - Gorenje Group

2.8 MEUR - Gorenje - Gorenje Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ANNUAL REPORT 2011<br />

The fair value of trade receivables and loans was provided by impairment of trade receivables and loans in the<br />

amount of TEUR 3,350 (2010: TEUR 6,293). Impairment loss on investments in the amount of TEUR 1,242 (2010:<br />

TEUR 523) relates to available-for-sale financial assets that were revalued to market value, and to impairment of<br />

the associate company <strong>Gorenje</strong> Projekt, d.o.o.<br />

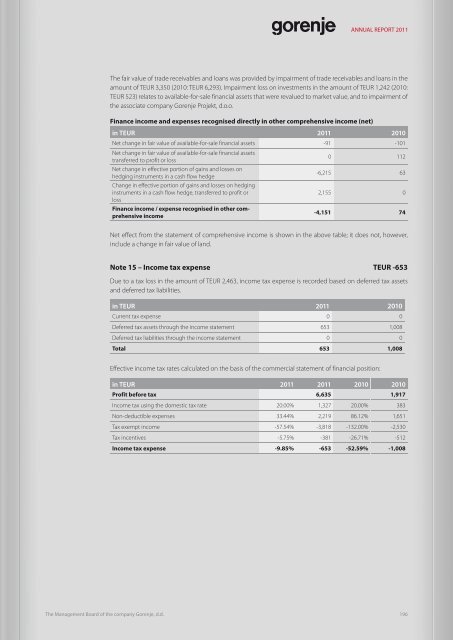

Finance income and expenses recognised directly in other comprehensive income (net)<br />

in TEUR 2011 2010<br />

Net change in fair value of available-for-sale financial assets -91 -101<br />

Net change in fair value of available-for-sale financial assets<br />

transferred to profit or loss<br />

0 112<br />

Net change in effective portion of gains and losses on<br />

hedging instruments in a cash flow hedge<br />

Change in effective portion of gains and losses on hedging<br />

-6,215 63<br />

instruments in a cash flow hedge, transferred to profit or<br />

loss<br />

2,155 0<br />

Finance income / expense recognised in other comprehensive<br />

income<br />

-4,151 74<br />

Net effect from the statement of comprehensive income is shown in the above table; it does not, however,<br />

include a change in fair value of land.<br />

Note 15 – Income tax expense TEUR -653<br />

Due to a tax loss in the amount of TEUR 2,463, income tax expense is recorded based on deferred tax assets<br />

and deferred tax liabilities.<br />

in TEUR 2011 2010<br />

Current tax expense 0 0<br />

Deferred tax assets through the income statement 653 1,008<br />

Deferred tax liabilities through the income statement 0 0<br />

Total 653 1,008<br />

Effective income tax rates calculated on the basis of the commercial statement of financial position:<br />

in TEUR 2011 2011 2010 2010<br />

Profit before tax 6,635 1,917<br />

Income tax using the domestic tax rate 20.00% 1,327 20.00% 383<br />

Non-deductible expenses 33.44% 2,219 86.12% 1,651<br />

Tax exempt income -57.54% -3,818 -132.00% -2,530<br />

Tax incentives<br />

The Management Board of the company <strong>Gorenje</strong>, d.d.<br />

-5.75% -381 -26.71% -512<br />

Income tax expense -9.85% -653 -52.59% -1,008<br />

The Management Board of the company <strong>Gorenje</strong>, d.d. 196