2.8 MEUR - Gorenje - Gorenje Group

2.8 MEUR - Gorenje - Gorenje Group

2.8 MEUR - Gorenje - Gorenje Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

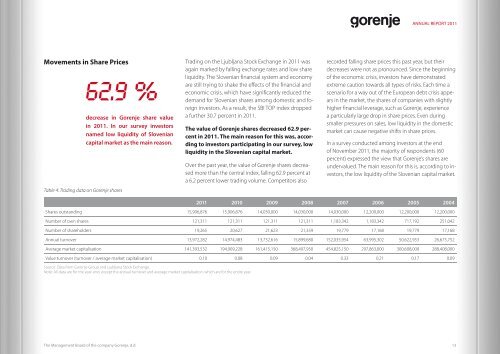

Movements in Share Prices<br />

62.9 %<br />

Table 4: Trading data on <strong>Gorenje</strong> shares<br />

decrease in <strong>Gorenje</strong> share value<br />

in 2011. In our survey investors<br />

named low liquidity of Slovenian<br />

capital market as the main reason.<br />

The Management Board of the company <strong>Gorenje</strong>, d.d.<br />

Trading on the Ljubljana Stock Exchange in 2011 was<br />

again marked by falling exchange rates and low share<br />

liquidity. The Slovenian financial system and economy<br />

are still trying to shake the effects of the financial and<br />

economic crisis, which have significantly reduced the<br />

demand for Slovenian shares among domestic and foreign<br />

investors. As a result, the SBI TOP index dropped<br />

a further 30.7 percent in 2011.<br />

The value of <strong>Gorenje</strong> shares decreased 62.9 percent<br />

in 2011. The main reason for this was, according<br />

to investors participating in our survey, low<br />

liquidity in the Slovenian capital market.<br />

Over the past year, the value of <strong>Gorenje</strong> shares decreased<br />

more than the central index, falling 62.9 percent at<br />

a 6.2 percent lower trading volume. Competitors also<br />

ANNUAL REPORT 2011<br />

recorded falling share prices this past year, but their<br />

decreases were not as pronounced. Since the beginning<br />

of the economic crisis, investors have demonstrated<br />

extreme caution towards all types of risks. Each time a<br />

scenario for a way out of the European debt crisis appears<br />

in the market, the shares of companies with slightly<br />

higher financial leverage, such as <strong>Gorenje</strong>, experience<br />

a particularly large drop in share prices. Even during<br />

smaller pressures on sales, low liquidity in the domestic<br />

market can cause negative shifts in share prices.<br />

In a survey conducted among investors at the end<br />

of November 2011, the majority of respondents (60<br />

percent) expressed the view that <strong>Gorenje</strong>’s shares are<br />

undervalued. The main reason for this is, according to investors,<br />

the low liquidity of the Slovenian capital market.<br />

2011 2010 2009 2008 2007 2006 2005 2004<br />

Shares outstanding 15,906,876 15,906,876 14,030,000 14,030,000 14,030,000 12,200,000 12,200,000 12,200,000<br />

Number of own shares 121,311 121,311 121,311 121,311 1,183,342 1,183,342 717,192 251,042<br />

Number of shareholders 19,265 20,627 21,623 21,359 19,779 17,168 19,779 17,168<br />

Annual turnover 13,972,282 14,974,483 13,732,616 15,899,680 152,035,954 63,995,302 50,622,953 26,675,752<br />

Average market capitalisation 141,393,532 194,909,228 161,415,150 368,497,950 454,825,150 297,863,000 300,608,000 288,408,000<br />

Value turnover (turnover / average market capitalisation) 0.10 0.08 0.09 0.04 0.33 0.21 0.17 0.09<br />

Source: Data from <strong>Gorenje</strong> <strong>Group</strong> and Ljubljana Stock Exchange.<br />

Note: All data are for the year-end, except the annual turnover and average market capitalisation, which are for the entire year.<br />

13