APPENDIX 2.10-A Format of Tender Notice for ... - Cg.nic.in

APPENDIX 2.10-A Format of Tender Notice for ... - Cg.nic.in

APPENDIX 2.10-A Format of Tender Notice for ... - Cg.nic.in

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

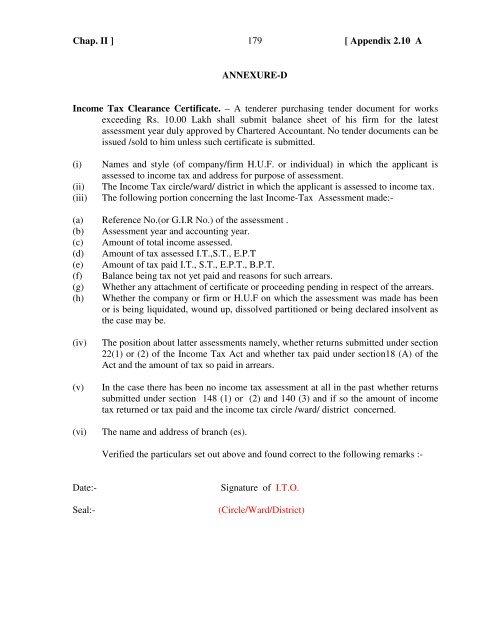

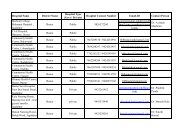

Chap. II ]179[ Appendix <strong>2.10</strong> AANNEXURE-DIncome Tax Clearance Certificate. – A tenderer purchas<strong>in</strong>g tender document <strong>for</strong> worksexceed<strong>in</strong>g Rs. 10.00 Lakh shall submit balance sheet <strong>of</strong> his firm <strong>for</strong> the latestassessment year duly approved by Chartered Accountant. No tender documents can beissued /sold to him unless such certificate is submitted.(i)(ii)(iii)Names and style (<strong>of</strong> company/firm H.U.F. or <strong>in</strong>dividual) <strong>in</strong> which the applicant isassessed to <strong>in</strong>come tax and address <strong>for</strong> purpose <strong>of</strong> assessment.The Income Tax circle/ward/ district <strong>in</strong> which the applicant is assessed to <strong>in</strong>come tax.The follow<strong>in</strong>g portion concern<strong>in</strong>g the last Income-Tax Assessment made:-(a) Reference No.(or G.I.R No.) <strong>of</strong> the assessment .(b) Assessment year and account<strong>in</strong>g year.(c) Amount <strong>of</strong> total <strong>in</strong>come assessed.(d) Amount <strong>of</strong> tax assessed I.T.,S.T., E.P.T(e) Amount <strong>of</strong> tax paid I.T., S.T., E.P.T., B.P.T.(f) Balance be<strong>in</strong>g tax not yet paid and reasons <strong>for</strong> such arrears.(g) Whether any attachment <strong>of</strong> certificate or proceed<strong>in</strong>g pend<strong>in</strong>g <strong>in</strong> respect <strong>of</strong> the arrears.(h) Whether the company or firm or H.U.F on which the assessment was made has beenor is be<strong>in</strong>g liquidated, wound up, dissolved partitioned or be<strong>in</strong>g declared <strong>in</strong>solvent asthe case may be.(iv)(v)(vi)The position about latter assessments namely, whether returns submitted under section22(1) or (2) <strong>of</strong> the Income Tax Act and whether tax paid under section18 (A) <strong>of</strong> theAct and the amount <strong>of</strong> tax so paid <strong>in</strong> arrears.In the case there has been no <strong>in</strong>come tax assessment at all <strong>in</strong> the past whether returnssubmitted under section 148 (1) or (2) and 140 (3) and if so the amount <strong>of</strong> <strong>in</strong>cometax returned or tax paid and the <strong>in</strong>come tax circle /ward/ district concerned.The name and address <strong>of</strong> branch (es).Verified the particulars set out above and found correct to the follow<strong>in</strong>g remarks :-Date:-Seal:-Signature <strong>of</strong> I.T.O.(Circle/Ward/District)