ANNUAL REPORT INTRUM JUSTITIA A N N U A L R EP O R T 2 0 ...

ANNUAL REPORT INTRUM JUSTITIA A N N U A L R EP O R T 2 0 ...

ANNUAL REPORT INTRUM JUSTITIA A N N U A L R EP O R T 2 0 ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

36<br />

Board of Directors’ report<br />

Regional revenues for the year, excluding purchased<br />

debt revaluations, amounted to SEK<br />

1,402.5 M (1,692.1). Revenues in local currencies<br />

fell by –7.9 percent. Operating earnings<br />

excluding revaluations amounted to SEK<br />

208.5 M (142.0), equivalent to a margin of<br />

14.9 percent (8.4). Operating earnings in local<br />

currencies improved by 18.2 percent.<br />

An adjustment to the accounting principles<br />

in this region negatively affected revenues<br />

in the amount of SEK 64.4 M; however the<br />

change had no impact on operating earnings.<br />

Credit management services 78%<br />

Financial services 22%<br />

SERVICE LINES<br />

Share of consolidated revenues, %<br />

SERVICE LINES<br />

Intrum Justitia’s offering is divided into two<br />

services lines:<br />

• Credit Management. Credit information,<br />

payment services and debt collection.<br />

• Financial Services. Financing, payment<br />

guarantee and purchase of receivables. Acquisition<br />

of portfolios of consumer receivables<br />

at less than their nominal value, after<br />

which Intrum Justitia collects the receivables<br />

on its own behalf. The service line also includes<br />

guarantees for charge card receivables.<br />

CREDIT MANAGEMENT<br />

The service line’s revenues for the year amounted<br />

to SEK 3,274.3 M (3,548.3). Revenues in<br />

local currencies fell by –0.5 percent. Operating<br />

earnings amounted to SEK 471.9 M (398.3),<br />

equivalent to a margin of 14.4 percent (11.2).<br />

Operating earnings in foreign currencies improved<br />

by 26.0 percent.<br />

PURCHASED DEBT<br />

The service line’s revenues for the year amounted<br />

to SEK 860.5 M (924.1). Revenues in local<br />

currencies were largely unchanged despite a<br />

negative effect relating to changes to the financial<br />

statements in the Netherlands; see below.<br />

Operating earnings increased to SEK 382.6 M<br />

(361.9).<br />

Disbursements for investments in purchased<br />

debt amounted to SEK 1,049.6 M (870.6) including<br />

SEK 178.4 M in connection with the<br />

acquisition of Nice Invest Nordic AB. The<br />

return on purchased debt was 16.3 percent<br />

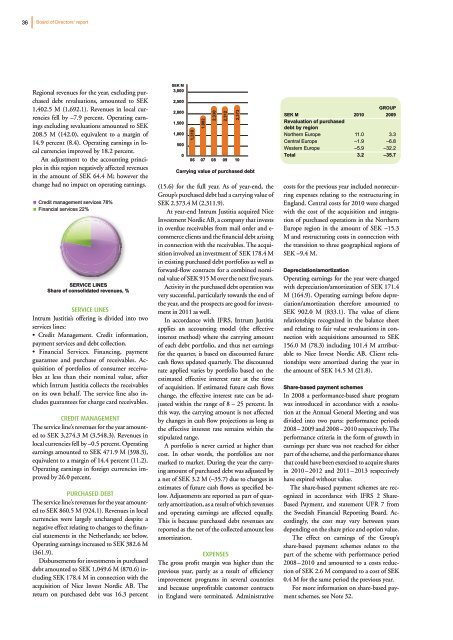

SEK M<br />

3,000<br />

2,500<br />

2,000<br />

1,500<br />

1,000<br />

500<br />

0<br />

1,318<br />

1,882<br />

2,330<br />

06 07 08 09 10<br />

Carrying value of purchased debt<br />

(15.6) for the full year. As of year-end, the<br />

Group’s purchased debt had a carrying value of<br />

SEK 2.373.4 M (2,311.9).<br />

At year-end Intrum Justitia acquired Nice<br />

Investment Nordic AB, a company that invests<br />

in overdue receivables from mail order and ecommerce<br />

clients and the financial debt arising<br />

in connection with the receivables. The acquisition<br />

involved an investment of SEK 178.4 M<br />

in existing purchased debt portfolios as well as<br />

forward-flow contracts for a combined nominal<br />

value of SEK 915 M over the next five years.<br />

Activity in the purchased debt operation was<br />

very successful, particularly towards the end of<br />

the year, and the prospects are good for investment<br />

in 2011 as well.<br />

In accordance with IFRS, Intrum Justitia<br />

applies an accounting model (the effective<br />

interest method) where the carrying amount<br />

of each debt portfolio, and thus net earnings<br />

for the quarter, is based on discounted future<br />

cash flows updated quarterly. The discounted<br />

rate applied varies by portfolio based on the<br />

estimated effective interest rate at the time<br />

of acquisition. If estimated future cash flows<br />

change, the effective interest rate can be adjusted<br />

within the range of 8 – 25 percent. In<br />

this way, the carrying amount is not affected<br />

by changes in cash flow projections as long as<br />

the effective interest rate remains within the<br />

stipulated range.<br />

A portfolio is never carried at higher than<br />

cost. In other words, the portfolios are not<br />

marked to market. During the year the carrying<br />

amount of purchased debt was adjusted by<br />

a net of SEK 3.2 M (–35.7) due to changes in<br />

estimates of future cash flows as specified below.<br />

Adjustments are reported as part of quarterly<br />

amortization, as a result of which revenues<br />

and operating earnings are affected equally.<br />

This is because purchased debt revenues are<br />

reported as the net of the collected amount less<br />

amortization.<br />

EXPENSES<br />

The gross profit margin was higher than the<br />

previous year, partly as a result of efficiency<br />

improvement programs in several countries<br />

and because unprofitable customer contracts<br />

in England were terminated. Administrative<br />

2,312<br />

2,373<br />

SEK M<br />

Revaluation of purchased<br />

debt by region<br />

2010<br />

GROUP<br />

2009<br />

Northern Europe 11.0 3.3<br />

Central Europe –1.9 –6.8<br />

Western Europe –5.9 –32.2<br />

Total 3.2 –35.7<br />

costs for the previous year included nonrecurring<br />

expenses relating to the restructuring in<br />

England. Central costs for 2010 were charged<br />

with the cost of the acquisition and integration<br />

of purchased operations in the Northern<br />

Europe region in the amount of SEK –15.3<br />

M and restructuring costs in connection with<br />

the transition to three geographical regions of<br />

SEK –9.4 M.<br />

Depreciation/amortization<br />

Operating earnings for the year were charged<br />

with depreciation/amortization of SEK 171.4<br />

M (164.9). Operating earnings before depreciation/amortization<br />

therefore amounted to<br />

SEK 902.0 M (833.1). The value of client<br />

relationships recognized in the balance sheet<br />

and relating to fair value revaluations in connection<br />

with acquisitions amounted to SEK<br />

156.0 M (78.3) including 101.4 M attributable<br />

to Nice Invest Nordic AB. Client relationships<br />

were amortized during the year in<br />

the amount of SEK 14.5 M (21.8).<br />

Share-based payment schemes<br />

In 2008 a performance-based share program<br />

was introduced in accordance with a resolution<br />

at the Annual General Meeting and was<br />

divided into two parts: performance periods<br />

2008 – 2009 and 2008 – 2010 respectively. The<br />

performance criteria in the form of growth in<br />

earnings per share was not reached for either<br />

part of the scheme, and the performance shares<br />

that could have been exercised to acquire shares<br />

in 2010 – 2012 and 2011 – 2013 respectively<br />

have expired without value.<br />

The share-based payment schemes are recognized<br />

in accordance with IFRS 2 Share-<br />

Based Payment, and statement UFR 7 from<br />

the Swedish Financial Reporting Board. Accordingly,<br />

the cost may vary between years<br />

depending on the share price and option value.<br />

The effect on earnings of the Group’s<br />

share-based payment schemes relates to the<br />

part of the scheme with performance period<br />

2008 – 2010 and amounted to a costs reduction<br />

of SEK 2.6 M compared to a cost of SEK<br />

0.4 M for the same period the previous year.<br />

For more information on share-based payment<br />

schemes, see Note 32.