ANNUAL REPORT INTRUM JUSTITIA A N N U A L R EP O R T 2 0 ...

ANNUAL REPORT INTRUM JUSTITIA A N N U A L R EP O R T 2 0 ...

ANNUAL REPORT INTRUM JUSTITIA A N N U A L R EP O R T 2 0 ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

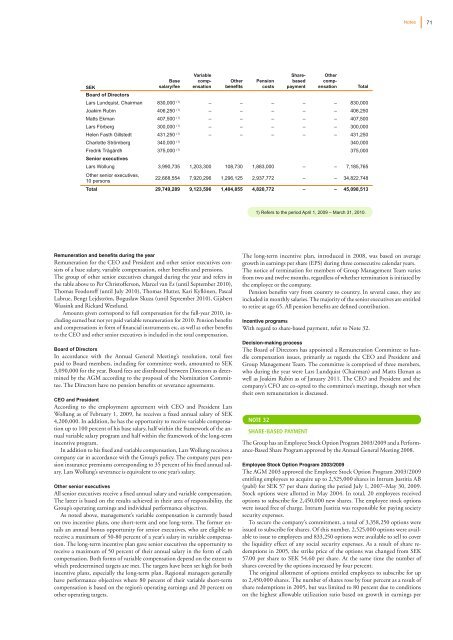

SEK<br />

Base<br />

salary/fee<br />

Variable<br />

comp-<br />

ensation<br />

Other<br />

benefits<br />

Pension<br />

costs<br />

Sharebased<br />

payment<br />

Other<br />

compensation<br />

Board of Directors<br />

Lars Lundquist, Chairman 830,000 (1) – – – – – 830,000<br />

Joakim Rubin 406,250 (1) – – – – – 406,250<br />

Matts Ekman 407,500 (1) – – – – – 407,500<br />

Lars Förberg 300,000 (1) – – – – – 300,000<br />

Helen Fasth Gillstedt 431,250 (1) – – – – – 431,250<br />

Charlotte Strömberg 340,000 (1) 340,000<br />

Fredrik Trägårdh 375,000 (1) Senior executives<br />

375,000<br />

Lars Wollung 3,990,735 1,203,300 108,730 1,883,000 – – 7,185,765<br />

Other senior executives,<br />

10 persons<br />

22,668,554 7,920,296 1,296,125 2,937,772 – – 34,822,748<br />

Total 29,749,289 9,123,596 1,404,855 4,820,772 – – 45,098,513<br />

Remuneration and benefits during the year<br />

Remuneration for the CEO and President and other senior executives consists<br />

of a base salary, variable compensation, other benefits and pensions.<br />

The group of other senior executives changed during the year and refers in<br />

the table above to Per Christofferson, Marcel van Es (until September 2010),<br />

Thomas Feodoroff (until July 2010), Thomas Hutter, Kari Kyllönen, Pascal<br />

Labrue, Bengt Lejdström, Bogusław Skuza (until September 2010), Gijsbert<br />

Wassink and Rickard Westlund.<br />

Amounts given correspond to full compensation for the full-year 2010, including<br />

earned but not yet paid variable renumeration for 2010. Pension benefits<br />

and compensations in form of financial instruments etc, as well as other benefits<br />

to the CEO and other senior executives is included in the total compensation.<br />

Board of Directors<br />

In accordance with the Annual General Meeting’s resolution, total fees<br />

paid to Board members, including for committee work, amounted to SEK<br />

3,090,000 for the year. Board fees are distributed between Directors as determined<br />

by the AGM according to the proposal of the Nomination Committee.<br />

The Directors have no pension benefits or severance agreements.<br />

CEO and President<br />

According to the employment agreement with CEO and President Lars<br />

Wollung as of February 1, 2009, he receives a fixed annual salary of SEK<br />

4,200,000. In addition, he has the opportunity to receive variable compensation<br />

up to 100 percent of his base salary, half within the framework of the annual<br />

variable salary program and half within the framework of the long-term<br />

incentive program.<br />

In addition to his fixed and variable compensation, Lars Wollung receives a<br />

company car in accordance with the Group’s policy. The company pays pension<br />

insurance premiums corresponding to 35 percent of his fixed annual salary.<br />

Lars Wollung’s severance is equivalent to one year’s salary.<br />

Other senior executives<br />

All senior executives receive a fixed annual salary and variable compensation.<br />

The latter is based on the results achieved in their area of responsibility, the<br />

Group’s operating earnings and individual performance objectives.<br />

As noted above, management’s variable compensation is currently based<br />

on two incentive plans, one short-term and one long-term. The former entails<br />

an annual bonus opportunity for senior executives, who are eligible to<br />

receive a maximum of 50-80 percent of a year’s salary in variable compensation.<br />

The long-term incentive plan gave senior executives the opportunity to<br />

receive a maximum of 50 percent of their annual salary in the form of cash<br />

compensation. Both forms of variable compensation depend on the extent to<br />

which predetermined targets are met. The targets have been set high for both<br />

incentive plans, especially the long-term plan. Regional managers generally<br />

have performance objectives where 80 percent of their variable short-term<br />

compensation is based on the region’s operating earnings and 20 percent on<br />

other operating targets.<br />

Total<br />

1) Refers to the period April 1, 2009 – March 31, 2010.<br />

Notes<br />

The long-term incentive plan, introduced in 2008, was based on average<br />

growth in earnings per share (<strong>EP</strong>S) during three consecutive calendar years.<br />

The notice of termination for members of Group Management Team varies<br />

from two and twelve months, regardless of whether termination is initiated by<br />

the employee or the company.<br />

Pension benefits vary from country to country. In several cases, they are<br />

included in monthly salaries. The majority of the senior executives are entitled<br />

to retire at age 65. All pension benefits are defined contribution.<br />

Incentive programs<br />

With regard to share-based payment, refer to Note 32.<br />

Decision-making process<br />

The Board of Directors has appointed a Remuneration Committee to handle<br />

compensation issues, primarily as regards the CEO and President and<br />

Group Management Team. The committee is comprised of three members,<br />

who during the year were Lars Lundquist (Chairman) and Matts Ekman as<br />

well as Joakim Rubin as of January 2011. The CEO and President and the<br />

company’s CFO are co-opted to the committee’s meetings, though not when<br />

their own remuneration is discussed.<br />

NotE 32<br />

SharE-baSEd paymENt<br />

The Group has an Employee Stock Option Program 2003/2009 and a Performance-Based<br />

Share Program approved by the Annual General Meeting 2008.<br />

Employee Stock Option Program 2003/2009<br />

The AGM 2003 approved the Employee Stock Option Program 2003/2009<br />

entitling employees to acquire up to 2,525,000 shares in Intrum Justitia AB<br />

(publ) for SEK 57 per share during the period July 1, 2007–May 30, 2009.<br />

Stock options were allotted in May 2004. In total, 20 employees received<br />

options to subscribe for 2,450,000 new shares. The employee stock options<br />

were issued free of charge. Intrum Justitia was responsible for paying society<br />

security expenses.<br />

To secure the company’s commitment, a total of 3,358,250 options were<br />

issued to subscribe for shares. Of this number, 2,525,000 options were available<br />

to issue to employees and 833,250 options were available to sell to cover<br />

the liquidity effect of any social security expenses. As a result of share redemptions<br />

in 2005, the strike price of the options was changed from SEK<br />

57.00 per share to SEK 54.60 per share. At the same time the number of<br />

shares covered by the options increased by four percent.<br />

The original allotment of options entitled employees to subscribe for up<br />

to 2,450,000 shares. The number of shares rose by four percent as a result of<br />

share redemptions in 2005, but was limited to 80 percent due to conditions<br />

on the highest allowable utilization ratio based on growth in earnings per<br />

71