Individual tax return instructions supplement 2012 - Australian ...

Individual tax return instructions supplement 2012 - Australian ...

Individual tax return instructions supplement 2012 - Australian ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

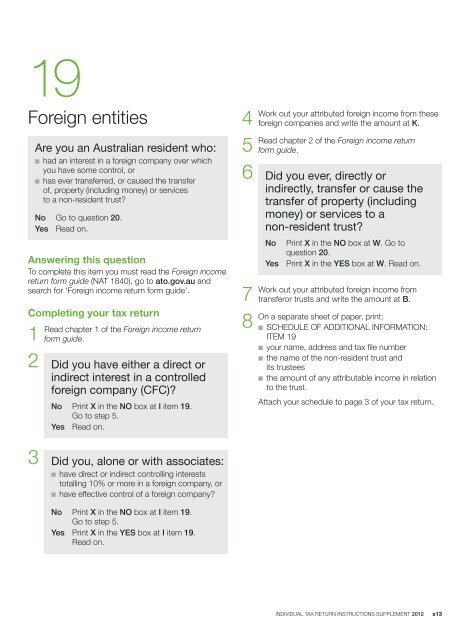

19Foreign entitiesAre you an <strong>Australian</strong> resident who:n had an interest in a foreign company over whichyou have some control, orn has ever transferred, or caused the transferof, property (including money) or servicesto a non‐resident trust?No Go to question 20.Yes Read on.Answering this questionTo complete this item you must read the Foreign income<strong>return</strong> form guide (NAT 1840), go to ato.gov.au andsearch for ‘Foreign income <strong>return</strong> form guide’.Completing your <strong>tax</strong> <strong>return</strong>1Readchapter 1 of the Foreign income <strong>return</strong>form guide.2 Did you have either a direct orindirect interest in a controlledforeign company (CFC)?No Print X in the NO box at I item 19.Go to step 5.Yes Read on.4Work5Readout your attributed foreign income from theseforeign companies and write the amount at K.chapter 2 of the Foreign income <strong>return</strong>form guide.6 Did you ever, directly orindirectly, transfer or cause thetransfer of property (includingmoney) or services to anon‐resident trust?7Work8OnNoYesPrint X in the NO box at W. Go toquestion 20.Print X in the YES box at W. Read on.out your attributed foreign income fromtransferor trusts and write the amount at B.a separate sheet of paper, print:n SCHEDULE OF ADDITIONAL INFORMATION:ITEM 19n your name, address and <strong>tax</strong> file numbern the name of the non-resident trust andits trusteesn the amount of any attributable income in relationto the trust.Attach your schedule to page 3 of your <strong>tax</strong> <strong>return</strong>.3 Did you, alone or with associates:n have direct or indirect controlling intereststotalling 10% or more in a foreign company, orn have effective control of a foreign company?No Print X in the NO box at I item 19.Go to step 5.Yes Print X in the YES box at I item 19.Read on.INDIVIDUAL TAX RETURN INSTRUCTIONS SUPPLEMENT <strong>2012</strong> s13