Individual tax return instructions supplement 2012 - Australian ...

Individual tax return instructions supplement 2012 - Australian ...

Individual tax return instructions supplement 2012 - Australian ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

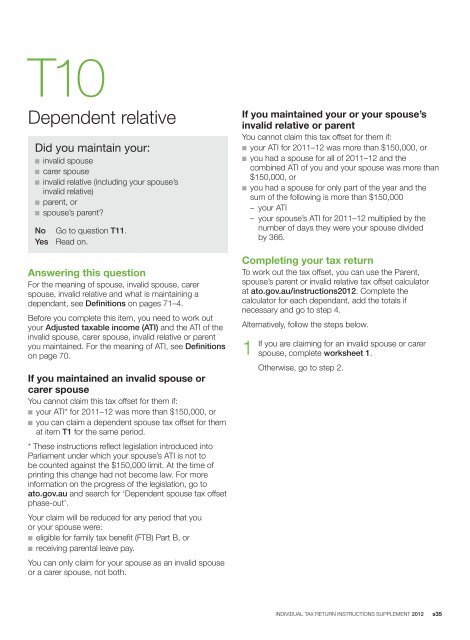

T10Dependent relativeDid you maintain your:n invalid spousen carer spousen invalid relative (including your spouse’sinvalid relative)n parent, orn spouse’s parent?No Go to question T11.Yes Read on.Answering this questionFor the meaning of spouse, invalid spouse, carerspouse, invalid relative and what is maintaining adependant, see Definitions on pages 71–4.Before you complete this item, you need to work outyour Adjusted <strong>tax</strong>able income (ATI) and the ATI of theinvalid spouse, carer spouse, invalid relative or parentyou maintained. For the meaning of ATI, see Definitionson page 70.If you maintained an invalid spouse orcarer spouseYou cannot claim this <strong>tax</strong> offset for them if:n your ATI* for 2011–12 was more than $150,000, orn you can claim a dependent spouse <strong>tax</strong> offset for themat item T1 for the same period.* These <strong>instructions</strong> reflect legislation introduced intoParliament under which your spouse’s ATI is not tobe counted against the $150,000 limit. At the time ofprinting this change had not become law. For moreinformation on the progress of the legislation, go toato.gov.au and search for ‘Dependent spouse <strong>tax</strong> offsetphase-out’.Your claim will be reduced for any period that youor your spouse were:n eligible for family <strong>tax</strong> benefit (FTB) Part B, orn receiving parental leave pay.You can only claim for your spouse as an invalid spouseor a carer spouse, not both.If you maintained your or your spouse’sinvalid relative or parentYou cannot claim this <strong>tax</strong> offset for them if:n your ATI for 2011–12 was more than $150,000, orn you had a spouse for all of 2011–12 and thecombined ATI of you and your spouse was more than$150,000, orn you had a spouse for only part of the year and thesum of the following is more than $150,000– your ATI– your spouse’s ATI for 2011–12 multiplied by thenumber of days they were your spouse dividedby 366.Completing your <strong>tax</strong> <strong>return</strong>To work out the <strong>tax</strong> offset, you can use the Parent,spouse’s parent or invalid relative <strong>tax</strong> offset calculatorat ato.gov.au/<strong>instructions</strong><strong>2012</strong>. Complete thecalculator for each dependant, add the totals ifnecessary and go to step 4.Alternatively, follow the steps below.1Ifyou are claiming for an invalid spouse or carerspouse, complete worksheet 1.Otherwise, go to step 2.INDIVIDUAL TAX RETURN INSTRUCTIONS SUPPLEMENT <strong>2012</strong> s35