Individual tax return instructions supplement 2012 - Australian ...

Individual tax return instructions supplement 2012 - Australian ...

Individual tax return instructions supplement 2012 - Australian ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

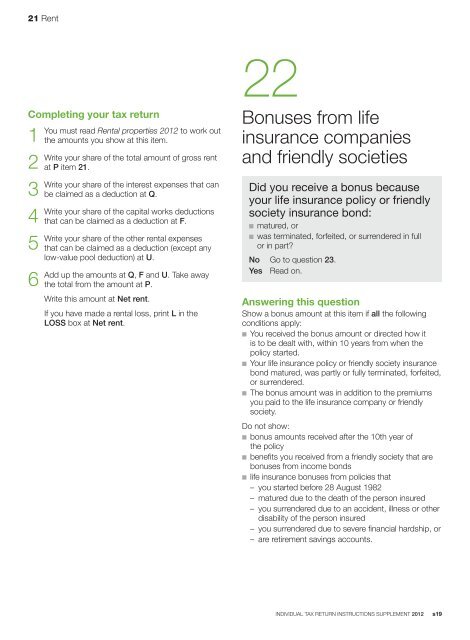

21 RentCompleting your <strong>tax</strong> <strong>return</strong>1You2Write3Write4Write5Write6Addmust read Rental properties <strong>2012</strong> to work outthe amounts you show at this item.your share of the total amount of gross rentat P item 21.your share of the interest expenses that canbe claimed as a deduction at Q.your share of the capital works deductionsthat can be claimed as a deduction at F.your share of the other rental expensesthat can be claimed as a deduction (except anylow‐value pool deduction) at U.up the amounts at Q, F and U. Take awaythe total from the amount at P.Write this amount at Net rent.If you have made a rental loss, print L in theLOSS box at Net rent.22Bonuses from lifeinsurance companiesand friendly societiesDid you receive a bonus becauseyour life insurance policy or friendlysociety insurance bond:n matured, orn was terminated, forfeited, or surrendered in fullor in part?No Go to question 23.Yes Read on.Answering this questionShow a bonus amount at this item if all the followingconditions apply:n You received the bonus amount or directed how itis to be dealt with, within 10 years from when thepolicy started.n Your life insurance policy or friendly society insurancebond matured, was partly or fully terminated, forfeited,or surrendered.n The bonus amount was in addition to the premiumsyou paid to the life insurance company or friendlysociety.Do not show:n bonus amounts received after the 10th year ofthe policyn benefits you received from a friendly society that arebonuses from income bondsn life insurance bonuses from policies that– you started before 28 August 1982– matured due to the death of the person insured– you surrendered due to an accident, illness or otherdisability of the person insured– you surrendered due to severe financial hardship, or– are retirement savings accounts.INDIVIDUAL TAX RETURN INSTRUCTIONS SUPPLEMENT <strong>2012</strong> s19