Individual tax return instructions supplement 2012 - Australian ...

Individual tax return instructions supplement 2012 - Australian ...

Individual tax return instructions supplement 2012 - Australian ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

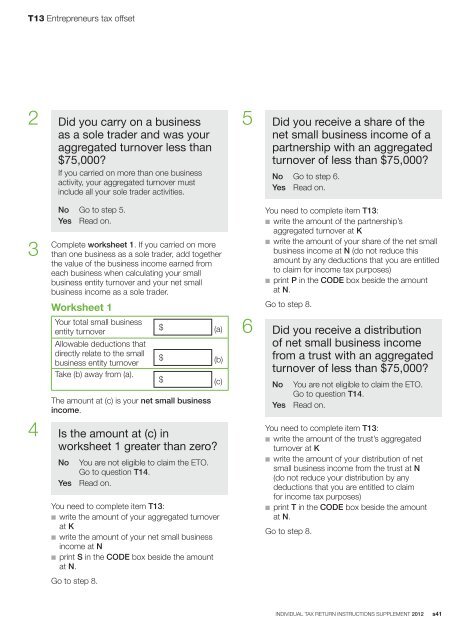

T13 Entrepreneurs <strong>tax</strong> offset2 Did you carry on a businessas a sole trader and was youraggregated turnover less than$75,000?If you carried on more than one businessactivity, your aggregated turnover mustinclude all your sole trader activities.3CompleteNo Go to step 5.Yes Read on.worksheet 1. If you carried on morethan one business as a sole trader, add togetherthe value of the business income earned fromeach business when calculating your smallbusiness entity turnover and your net smallbusiness income as a sole trader.Worksheet 1Your total small businessentity turnoverAllowable deductions thatdirectly relate to the smallbusiness entity turnoverTake (b) away from (a).$ (a)$ (b)$ (c)The amount at (c) is your net small businessincome.4 Is the amount at (c) inworksheet 1 greater than zero?NoYesYou are not eligible to claim the ETO.Go to question T14.Read on.You need to complete item T13:n write the amount of your aggregated turnoverat Kn write the amount of your net small businessincome at Nn print S in the CODE box beside the amountat N.Go to step 8.5 Did you receive a share of thenet small business income of apartnership with an aggregatedturnover of less than $75,000?No Go to step 6.Yes Read on.You need to complete item T13:n write the amount of the partnership’saggregated turnover at Kn write the amount of your share of the net smallbusiness income at N (do not reduce thisamount by any deductions that you are entitledto claim for income <strong>tax</strong> purposes)n print P in the CODE box beside the amountat N.Go to step 8.6 Did you receive a distributionof net small business incomefrom a trust with an aggregatedturnover of less than $75,000?NoYesYou are not eligible to claim the ETO.Go to question T14.Read on.You need to complete item T13:n write the amount of the trust’s aggregatedturnover at Kn write the amount of your distribution of netsmall business income from the trust at N(do not reduce your distribution by anydeductions that you are entitled to claimfor income <strong>tax</strong> purposes)n print T in the CODE box beside the amountat N.Go to step 8.INDIVIDUAL TAX RETURN INSTRUCTIONS SUPPLEMENT <strong>2012</strong> s41