Individual tax return instructions supplement 2012 - Australian ...

Individual tax return instructions supplement 2012 - Australian ...

Individual tax return instructions supplement 2012 - Australian ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

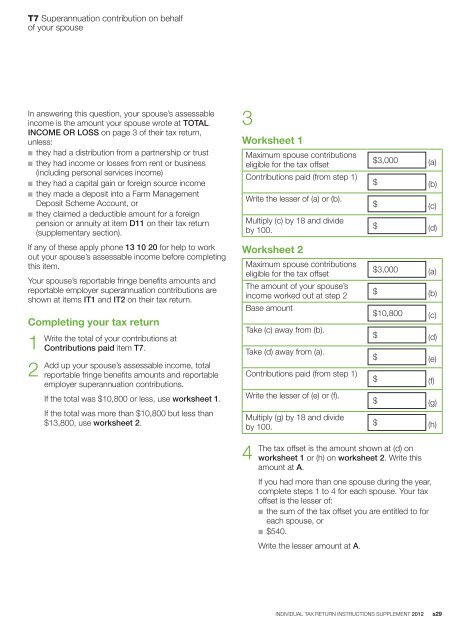

T7 Superannuation contribution on behalfof your spouseIn answering this question, your spouse’s assessableincome is the amount your spouse wrote at TOTALINCOME OR LOSS on page 3 of their <strong>tax</strong> <strong>return</strong>,unless:n they had a distribution from a partnership or trustn they had income or losses from rent or business(including personal services income)n they had a capital gain or foreign source incomen they made a deposit into a Farm ManagementDeposit Scheme Account, orn they claimed a deductible amount for a foreignpension or annuity at item D11 on their <strong>tax</strong> <strong>return</strong>(<strong>supplement</strong>ary section).If any of these apply phone 13 10 20 for help to workout your spouse’s assessable income before completingthis item.Your spouse’s reportable fringe benefits amounts andreportable employer superannuation contributions areshown at items IT1 and IT2 on their <strong>tax</strong> <strong>return</strong>.Completing your <strong>tax</strong> <strong>return</strong>1Write2Addthe total of your contributions atContributions paid item T7.up your spouse’s assessable income, totalreportable fringe benefits amounts and reportableemployer superannuation contributions.If the total was $10,800 or less, use worksheet 1.If the total was more than $10,800 but less than$13,800, use worksheet 2.3Worksheet 1Maximum spouse contributionseligible for the <strong>tax</strong> offsetContributions paid (from step 1)Write the lesser of (a) or (b).Multiply (c) by 18 and divideby 100.Worksheet 2Maximum spouse contributionseligible for the <strong>tax</strong> offsetThe amount of your spouse’sincome worked out at step 2Base amountTake (c) away from (b).Take (d) away from (a).Contributions paid (from step 1)Write the lesser of (e) or (f).Multiply (g) by 18 and divideby 100.$3,000 (a)$ (b)$ (c)$ (d)$3,000 (a)$ (b)$10,800 (c)$ (d)$ (e)$ (f)$ (g)$ (h)4The<strong>tax</strong> offset is the amount shown at (d) onworksheet 1 or (h) on worksheet 2. Write thisamount at A.If you had more than one spouse during the year,complete steps 1 to 4 for each spouse. Your <strong>tax</strong>offset is the lesser of:n the sum of the <strong>tax</strong> offset you are entitled to foreach spouse, orn $540.Write the lesser amount at A.INDIVIDUAL TAX RETURN INSTRUCTIONS SUPPLEMENT <strong>2012</strong> s29