Individual tax return instructions supplement 2012 - Australian ...

Individual tax return instructions supplement 2012 - Australian ...

Individual tax return instructions supplement 2012 - Australian ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

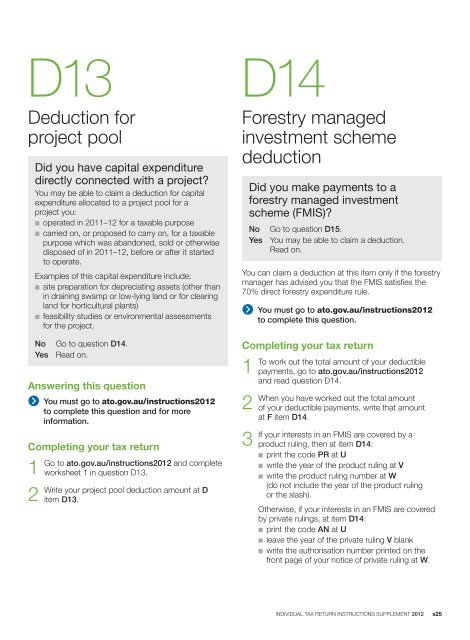

D13Deduction forproject poolDid you have capital expendituredirectly connected with a project?You may be able to claim a deduction for capitalexpenditure allocated to a project pool for aproject you:n operated in 2011–12 for a <strong>tax</strong>able purposen carried on, or proposed to carry on, for a <strong>tax</strong>ablepurpose which was abandoned, sold or otherwisedisposed of in 2011–12, before or after it startedto operate.Examples of this capital expenditure include:n site preparation for depreciating assets (other thanin draining swamp or low-lying land or for clearingland for horticultural plants)n feasibility studies or environmental assessmentsfor the project.No Go to question D14.Yes Read on.Answering this questionYou must go to ato.gov.au/<strong>instructions</strong><strong>2012</strong>to complete this question and for moreinformation.Completing your <strong>tax</strong> <strong>return</strong>1Go2Writeto ato.gov.au/<strong>instructions</strong><strong>2012</strong> and completeworksheet 1 in question D13.your project pool deduction amount at Ditem D13.D14Forestry managedinvestment schemedeductionDid you make payments to aforestry managed investmentscheme (FMIS)?No Go to question D15.Yes You may be able to claim a deduction.Read on.You can claim a deduction at this item only if the forestrymanager has advised you that the FMIS satisfies the70% direct forestry expenditure rule.You must go to ato.gov.au/<strong>instructions</strong><strong>2012</strong>to complete this question.Completing your <strong>tax</strong> <strong>return</strong>1To2When3Ifwork out the total amount of your deductiblepayments, go to ato.gov.au/<strong>instructions</strong><strong>2012</strong>and read question D14.you have worked out the total amountof your deductible payments, write that amountat F item D14.your interests in an FMIS are covered by aproduct ruling, then at item D14:n print the code PR at Un write the year of the product ruling at Vn write the product ruling number at W(do not include the year of the product rulingor the slash).Otherwise, if your interests in an FMIS are coveredby private rulings, at item D14:n print the code AN at Un leave the year of the private ruling V blankn write the authorisation number printed on thefront page of your notice of private ruling at W.INDIVIDUAL TAX RETURN INSTRUCTIONS SUPPLEMENT <strong>2012</strong> s25