Individual tax return instructions supplement 2012 - Australian ...

Individual tax return instructions supplement 2012 - Australian ...

Individual tax return instructions supplement 2012 - Australian ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

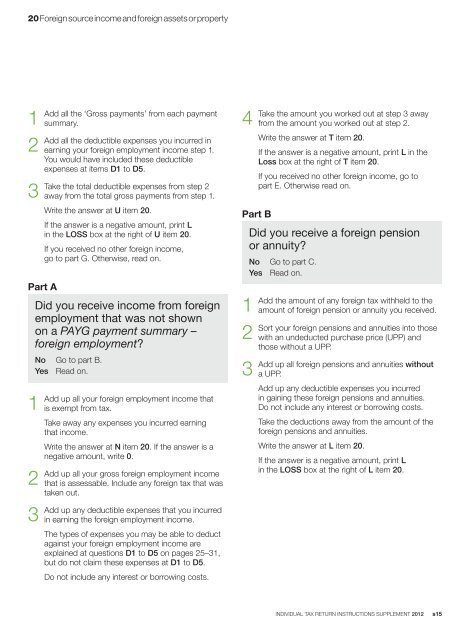

20 Foreign source income and foreign assets or property1Add2Add3TakePart Aall the ‘Gross payments’ from each paymentsummary.all the deductible expenses you incurred inearning your foreign employment income step 1.You would have included these deductibleexpenses at items D1 to D5.the total deductible expenses from step 2away from the total gross payments from step 1.Write the answer at U item 20.If the answer is a negative amount, print Lin the LOSS box at the right of U item 20.If you received no other foreign income,go to part G. Otherwise, read on.Did you receive income from foreignemployment that was not shownon a PAYG payment summary –foreign employment?No Go to part B.Yes Read on.1Add2Add3Addup all your foreign employment income thatis exempt from <strong>tax</strong>.Take away any expenses you incurred earningthat income.Write the answer at N item 20. If the answer is anegative amount, write 0.up all your gross foreign employment incomethat is assessable. Include any foreign <strong>tax</strong> that wastaken out.up any deductible expenses that you incurredin earning the foreign employment income.The types of expenses you may be able to deductagainst your foreign employment income areexplained at questions D1 to D5 on pages 25–31,but do not claim these expenses at D1 to D5.Do not include any interest or borrowing costs.4TakePart Bthe amount you worked out at step 3 awayfrom the amount you worked out at step 2.Write the answer at T item 20.If the answer is a negative amount, print L in theLoss box at the right of T item 20.If you received no other foreign income, go topart E. Otherwise read on.Did you receive a foreign pensionor annuity?No Go to part C.Yes Read on.1Add2Sort3Addthe amount of any foreign <strong>tax</strong> withheld to theamount of foreign pension or annuity you received.your foreign pensions and annuities into thosewith an undeducted purchase price (UPP) andthose without a UPP.up all foreign pensions and annuities withouta UPP.Add up any deductible expenses you incurredin gaining these foreign pensions and annuities.Do not include any interest or borrowing costs.Take the deductions away from the amount of theforeign pensions and annuities.Write the answer at L item 20.If the answer is a negative amount, print Lin the LOSS box at the right of L item 20.INDIVIDUAL TAX RETURN INSTRUCTIONS SUPPLEMENT <strong>2012</strong> s15