Individual tax return instructions supplement 2012 - Australian ...

Individual tax return instructions supplement 2012 - Australian ...

Individual tax return instructions supplement 2012 - Australian ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

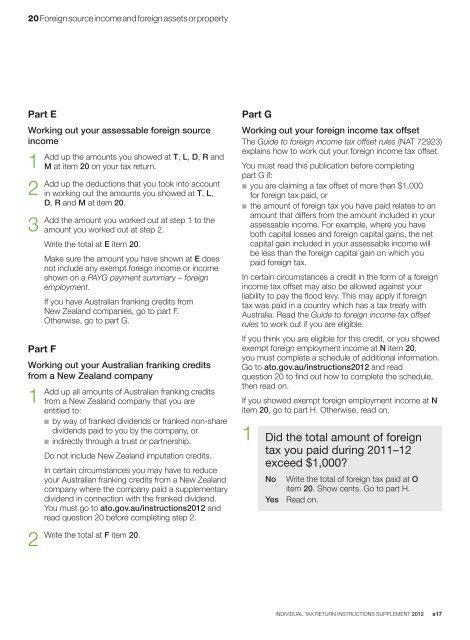

20 Foreign source income and foreign assets or propertyPart EWorking out your assessable foreign sourceincome1Add up the amounts you showed at T, L, D, R andM at item 20 on your <strong>tax</strong> <strong>return</strong>.2Add3AddPart Fup the deductions that you took into accountin working out the amounts you showed at T, L,D, R and M at item 20.the amount you worked out at step 1 to theamount you worked out at step 2.Write the total at E item 20.Make sure the amount you have shown at E doesnot include any exempt foreign income or incomeshown on a PAYG payment summary – foreignemployment.If you have <strong>Australian</strong> franking credits fromNew Zealand companies, go to part F.Otherwise, go to part G.Working out your <strong>Australian</strong> franking creditsfrom a New Zealand company1Add up all amounts of <strong>Australian</strong> franking creditsfrom a New Zealand company that you areentitled to:n by way of franked dividends or franked non-sharedividends paid to you by the company, orn indirectly through a trust or partnership.Do not include New Zealand imputation credits.In certain circumstances you may have to reduceyour <strong>Australian</strong> franking credits from a New Zealandcompany where the company paid a <strong>supplement</strong>arydividend in connection with the franked dividend.You must go to ato.gov.au/<strong>instructions</strong><strong>2012</strong> andread question 20 before completing step 2.2Write the total at F item 20.Part GWorking out your foreign income <strong>tax</strong> offsetThe Guide to foreign income <strong>tax</strong> offset rules (NAT 72923)explains how to work out your foreign income <strong>tax</strong> offset.You must read this publication before completingpart G if:n you are claiming a <strong>tax</strong> offset of more than $1,000for foreign <strong>tax</strong> paid, orn the amount of foreign <strong>tax</strong> you have paid relates to anamount that differs from the amount included in yourassessable income. For example, where you haveboth capital losses and foreign capital gains, the netcapital gain included in your assessable income willbe less than the foreign capital gain on which youpaid foreign <strong>tax</strong>.In certain circumstances a credit in the form of a foreignincome <strong>tax</strong> offset may also be allowed against yourliability to pay the flood levy. This may apply if foreign<strong>tax</strong> was paid in a country which has a <strong>tax</strong> treaty withAustralia. Read the Guide to foreign income <strong>tax</strong> offsetrules to work out if you are eligible.If you think you are eligible for this credit, or you showedexempt foreign employment income at N item 20,you must complete a schedule of additional information.Go to ato.gov.au/<strong>instructions</strong><strong>2012</strong> and readquestion 20 to find out how to complete the schedule,then read on.If you showed exempt foreign employment income at Nitem 20, go to part H. Otherwise, read on.1 Did the total amount of foreign<strong>tax</strong> you paid during 2011–12exceed $1,000?NoYesWrite the total of foreign <strong>tax</strong> paid at Oitem 20. Show cents. Go to part H.Read on.INDIVIDUAL TAX RETURN INSTRUCTIONS SUPPLEMENT <strong>2012</strong> s17