Individual tax return instructions supplement 2012 - Australian ...

Individual tax return instructions supplement 2012 - Australian ...

Individual tax return instructions supplement 2012 - Australian ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

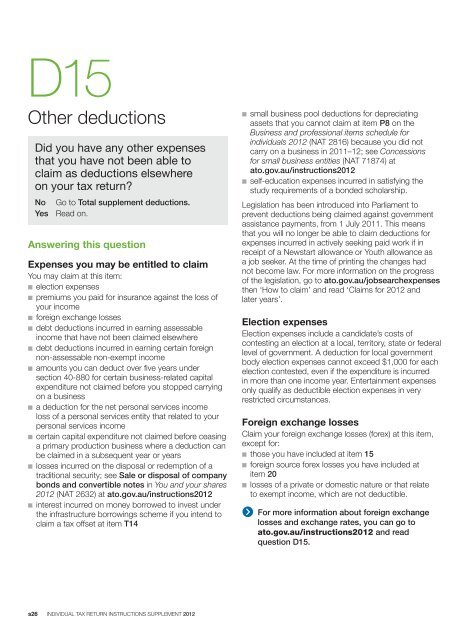

D15Other deductionsDid you have any other expensesthat you have not been able toclaim as deductions elsewhereon your <strong>tax</strong> <strong>return</strong>?NoYesGo to Total <strong>supplement</strong> deductions.Read on.Answering this questionExpenses you may be entitled to claimYou may claim at this item:n election expensesn premiums you paid for insurance against the loss ofyour incomen foreign exchange lossesn debt deductions incurred in earning assessableincome that have not been claimed elsewheren debt deductions incurred in earning certain foreignnon-assessable non-exempt incomen amounts you can deduct over five years undersection 40-880 for certain business-related capitalexpenditure not claimed before you stopped carryingon a businessn a deduction for the net personal services incomeloss of a personal services entity that related to yourpersonal services incomen certain capital expenditure not claimed before ceasinga primary production business where a deduction canbe claimed in a subsequent year or yearsn losses incurred on the disposal or redemption of atraditional security; see Sale or disposal of companybonds and convertible notes in You and your shares<strong>2012</strong> (NAT 2632) at ato.gov.au/<strong>instructions</strong><strong>2012</strong>n interest incurred on money borrowed to invest underthe infrastructure borrowings scheme if you intend toclaim a <strong>tax</strong> offset at item T14n small business pool deductions for depreciatingassets that you cannot claim at item P8 on theBusiness and professional items schedule forindividuals <strong>2012</strong> (NAT 2816) because you did notcarry on a business in 2011–12; see Concessionsfor small business entities (NAT 71874) atato.gov.au/<strong>instructions</strong><strong>2012</strong>n self-education expenses incurred in satisfying thestudy requirements of a bonded scholarship.Legislation has been introduced into Parliament toprevent deductions being claimed against governmentassistance payments, from 1 July 2011. This meansthat you will no longer be able to claim deductions forexpenses incurred in actively seeking paid work if inreceipt of a Newstart allowance or Youth allowance asa job seeker. At the time of printing the changes hadnot become law. For more information on the progressof the legislation, go to ato.gov.au/jobsearchexpensesthen ‘How to claim’ and read ‘Claims for <strong>2012</strong> andlater years’.Election expensesElection expenses include a candidate’s costs ofcontesting an election at a local, territory, state or federallevel of government. A deduction for local governmentbody election expenses cannot exceed $1,000 for eachelection contested, even if the expenditure is incurredin more than one income year. Entertainment expensesonly qualify as deductible election expenses in veryrestricted circumstances.Foreign exchange lossesClaim your foreign exchange losses (forex) at this item,except for:n those you have included at item 15n foreign source forex losses you have included atitem 20n losses of a private or domestic nature or that relateto exempt income, which are not deductible.For more information about foreign exchangelosses and exchange rates, you can go toato.gov.au/<strong>instructions</strong><strong>2012</strong> and readquestion D15.s26 INDIVIDUAL TAX RETURN INSTRUCTIONS SUPPLEMENT <strong>2012</strong>