Individual tax return instructions supplement 2012 - Australian ...

Individual tax return instructions supplement 2012 - Australian ...

Individual tax return instructions supplement 2012 - Australian ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

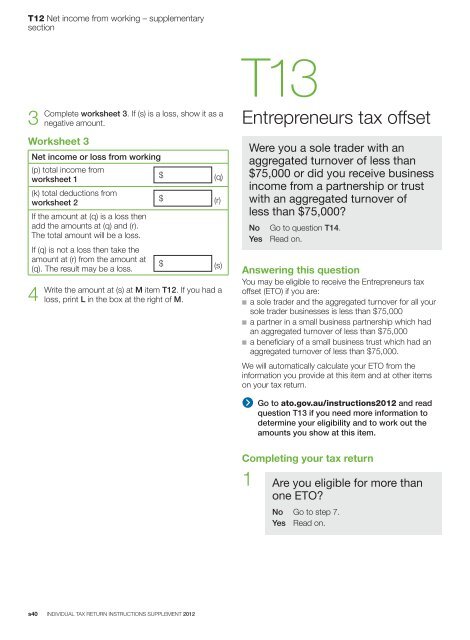

T12 Net income from working – <strong>supplement</strong>arysectionT133Completeworksheet 3. If (s) is a loss, show it as anegative amount.Worksheet 3Net income or loss from working(p) total income from$worksheet 1(q)(k) total deductions fromworksheet 2If the amount at (q) is a loss thenadd the amounts at (q) and (r).The total amount will be a loss.If (q) is not a loss then take theamount at (r) from the amount at(q). The result may be a loss.4Write$ (r)$ (s)the amount at (s) at M item T12. If you had aloss, print L in the box at the right of M.Entrepreneurs <strong>tax</strong> offsetWere you a sole trader with anaggregated turnover of less than$75,000 or did you receive businessincome from a partnership or trustwith an aggregated turnover ofless than $75,000?No Go to question T14.Yes Read on.Answering this questionYou may be eligible to receive the Entrepreneurs <strong>tax</strong>offset (ETO) if you are:n a sole trader and the aggregated turnover for all yoursole trader businesses is less than $75,000n a partner in a small business partnership which hadan aggregated turnover of less than $75,000n a beneficiary of a small business trust which had anaggregated turnover of less than $75,000.We will automatically calculate your ETO from theinformation you provide at this item and at other itemson your <strong>tax</strong> <strong>return</strong>.Go to ato.gov.au/<strong>instructions</strong><strong>2012</strong> and readquestion T13 if you need more information todetermine your eligibility and to work out theamounts you show at this item.Completing your <strong>tax</strong> <strong>return</strong>1 Are you eligible for more thanone ETO?No Go to step 7.Yes Read on.s40 INDIVIDUAL TAX RETURN INSTRUCTIONS SUPPLEMENT <strong>2012</strong>