Individual tax return instructions supplement 2012 - Australian ...

Individual tax return instructions supplement 2012 - Australian ...

Individual tax return instructions supplement 2012 - Australian ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

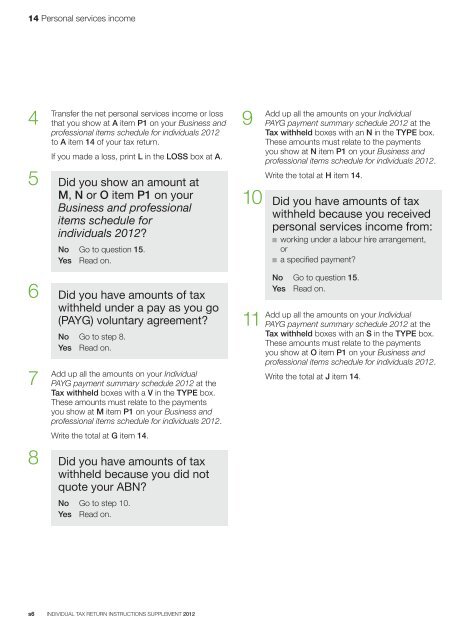

14 Personal services income4Transferthe net personal services income or lossthat you show at A item P1 on your Business andprofessional items schedule for individuals <strong>2012</strong>to A item 14 of your <strong>tax</strong> <strong>return</strong>.If you made a loss, print L in the LOSS box at A.5 Did you show an amount atM, N or O item P1 on yourBusiness and professionalitems schedule forindividuals <strong>2012</strong>?9Addup all the amounts on your <strong>Individual</strong>PAYG payment summary schedule <strong>2012</strong> at theTax withheld boxes with an N in the TYPE box.These amounts must relate to the paymentsyou show at N item P1 on your Business andprofessional items schedule for individuals <strong>2012</strong>.No Go to question 15.Yes Read on.6 Did you have amounts of <strong>tax</strong>withheld under a pay as you go(PAYG) voluntary agreement?7AddNo Go to step 8.Yes Read on.up all the amounts on your <strong>Individual</strong>PAYG payment summary schedule <strong>2012</strong> at theTax withheld boxes with a V in the TYPE box.These amounts must relate to the paymentsyou show at M item P1 on your Business andprofessional items schedule for individuals <strong>2012</strong>.Write the total at H item 14.10 Did you have amounts of <strong>tax</strong>withheld because you receivedpersonal services income from:n working under a labour hire arrangement,orn a specified payment?11No Go to question 15.Yes Read on.Add up all the amounts on your <strong>Individual</strong>PAYG payment summary schedule <strong>2012</strong> at theTax withheld boxes with an S in the TYPE box.These amounts must relate to the paymentsyou show at O item P1 on your Business andprofessional items schedule for individuals <strong>2012</strong>.Write the total at J item 14.Write the total at G item 14.8 Did you have amounts of <strong>tax</strong>withheld because you did notquote your ABN?No Go to step 10.Yes Read on.s6 INDIVIDUAL TAX RETURN INSTRUCTIONS SUPPLEMENT <strong>2012</strong>