Individual tax return instructions supplement 2012 - Australian ...

Individual tax return instructions supplement 2012 - Australian ...

Individual tax return instructions supplement 2012 - Australian ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

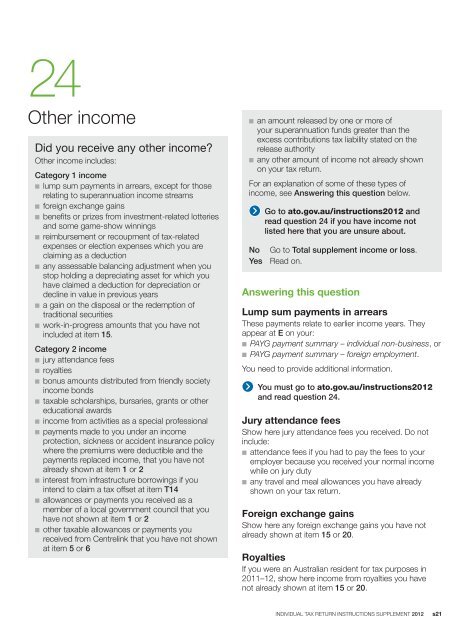

24Other incomeDid you receive any other income?Other income includes:Category 1 incomen lump sum payments in arrears, except for thoserelating to superannuation income streamsn foreign exchange gainsn benefits or prizes from investment-related lotteriesand some game-show winningsn reimbursement or recoupment of <strong>tax</strong>-relatedexpenses or election expenses which you areclaiming as a deductionn any assessable balancing adjustment when youstop holding a depreciating asset for which youhave claimed a deduction for depreciation ordecline in value in previous yearsn a gain on the disposal or the redemption oftraditional securitiesn work-in-progress amounts that you have notincluded at item 15.Category 2 incomen jury attendance feesn royaltiesn bonus amounts distributed from friendly societyincome bondsn <strong>tax</strong>able scholarships, bursaries, grants or othereducational awardsn income from activities as a special professionaln payments made to you under an incomeprotection, sickness or accident insurance policywhere the premiums were deductible and thepayments replaced income, that you have notalready shown at item 1 or 2n interest from infrastructure borrowings if youintend to claim a <strong>tax</strong> offset at item T14n allowances or payments you received as amember of a local government council that youhave not shown at item 1 or 2n other <strong>tax</strong>able allowances or payments youreceived from Centrelink that you have not shownat item 5 or 6n an amount released by one or more ofyour superannuation funds greater than theexcess contributions <strong>tax</strong> liability stated on therelease authorityn any other amount of income not already shownon your <strong>tax</strong> <strong>return</strong>.For an explanation of some of these types ofincome, see Answering this question below.NoYesGo to ato.gov.au/<strong>instructions</strong><strong>2012</strong> andread question 24 if you have income notlisted here that you are unsure about.Go to Total <strong>supplement</strong> income or loss.Read on.Answering this questionLump sum payments in arrearsThese payments relate to earlier income years. Theyappear at E on your:n PAYG payment summary – individual non-business, orn PAYG payment summary – foreign employment.You need to provide additional information.You must go to ato.gov.au/<strong>instructions</strong><strong>2012</strong>and read question 24.Jury attendance feesShow here jury attendance fees you received. Do notinclude:n attendance fees if you had to pay the fees to youremployer because you received your normal incomewhile on jury dutyn any travel and meal allowances you have alreadyshown on your <strong>tax</strong> <strong>return</strong>.Foreign exchange gainsShow here any foreign exchange gains you have notalready shown at item 15 or 20.RoyaltiesIf you were an <strong>Australian</strong> resident for <strong>tax</strong> purposes in2011–12, show here income from royalties you havenot already shown at item 15 or 20.INDIVIDUAL TAX RETURN INSTRUCTIONS SUPPLEMENT <strong>2012</strong> s21