Individual tax return instructions supplement 2012 - Australian ...

Individual tax return instructions supplement 2012 - Australian ...

Individual tax return instructions supplement 2012 - Australian ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

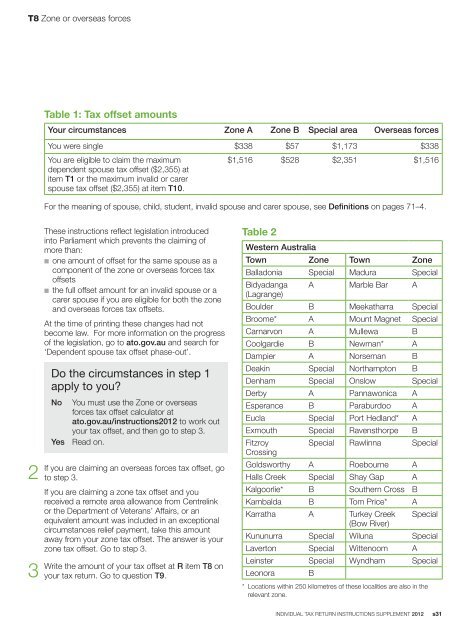

T8 Zone or overseas forcesTable 1: Tax offset amountsYour circumstances Zone A Zone B Special area Overseas forcesYou were single $338 $57 $1,173 $338You are eligible to claim the maximumdependent spouse <strong>tax</strong> offset ($2,355) atitem T1 or the maximum invalid or carerspouse <strong>tax</strong> offset ($2,355) at item T10.$1,516 $528 $2,351 $1,516For the meaning of spouse, child, student, invalid spouse and carer spouse, see Definitions on pages 71–4.2If3WriteThese <strong>instructions</strong> reflect legislation introducedinto Parliament which prevents the claiming ofmore than:n one amount of offset for the same spouse as acomponent of the zone or overseas forces <strong>tax</strong>offsetsn the full offset amount for an invalid spouse or acarer spouse if you are eligible for both the zoneand overseas forces <strong>tax</strong> offsets.At the time of printing these changes had notbecome law. For more information on the progressof the legislation, go to ato.gov.au and search for‘Dependent spouse <strong>tax</strong> offset phase-out’.Do the circumstances in step 1apply to you?NoYesYou must use the Zone or overseasforces <strong>tax</strong> offset calculator atato.gov.au/<strong>instructions</strong><strong>2012</strong> to work outyour <strong>tax</strong> offset, and then go to step 3.Read on.you are claiming an overseas forces <strong>tax</strong> offset, goto step 3.If you are claiming a zone <strong>tax</strong> offset and youreceived a remote area allowance from Centrelinkor the Department of Veterans’ Affairs, or anequivalent amount was included in an exceptionalcircumstances relief payment, take this amountaway from your zone <strong>tax</strong> offset. The answer is yourzone <strong>tax</strong> offset. Go to step 3.the amount of your <strong>tax</strong> offset at R item T8 onyour <strong>tax</strong> <strong>return</strong>. Go to question T9.Table 2Western AustraliaTown Zone Town ZoneBalladonia Special Madura SpecialBidyadanga(Lagrange)A Marble Bar ABoulder B Meekatharra SpecialBroome* A Mount Magnet SpecialCarnarvon A Mullewa BCoolgardie B Newman* ADampier A Norseman BDeakin Special Northampton BDenham Special Onslow SpecialDerby A Pannawonica AEsperance B Paraburdoo AEucla Special Port Hedland* AExmouth Special Ravensthorpe BFitzroyCrossingSpecial Rawlinna SpecialGoldsworthy A Roebourne AHalls Creek Special Shay Gap AKalgoorlie* B Southern Cross BKambalda B Tom Price* AKarratha A Turkey Creek(Bow River)SpecialKununurra Special Wiluna SpecialLaverton Special Wittenoom ALeinster Special Wyndham SpecialLeonoraB* Locations within 250 kilometres of these localities are also in therelevant zone.INDIVIDUAL TAX RETURN INSTRUCTIONS SUPPLEMENT <strong>2012</strong> s31