Individual tax return instructions supplement 2012 - Australian ...

Individual tax return instructions supplement 2012 - Australian ...

Individual tax return instructions supplement 2012 - Australian ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

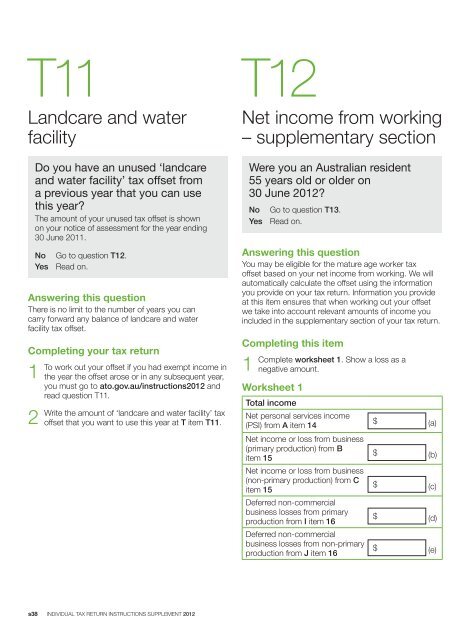

T11Landcare and waterfacilityDo you have an unused ‘landcareand water facility’ <strong>tax</strong> offset froma previous year that you can usethis year?The amount of your unused <strong>tax</strong> offset is shownon your notice of assessment for the year ending30 June 2011.No Go to question T12.Yes Read on.Answering this questionThere is no limit to the number of years you cancarry forward any balance of landcare and waterfacility <strong>tax</strong> offset.Completing your <strong>tax</strong> <strong>return</strong>1To2Writework out your offset if you had exempt income inthe year the offset arose or in any subsequent year,you must go to ato.gov.au/<strong>instructions</strong><strong>2012</strong> andread question T11.the amount of ‘landcare and water facility’ <strong>tax</strong>offset that you want to use this year at T item T11.T12Net income from working– <strong>supplement</strong>ary sectionWere you an <strong>Australian</strong> resident55 years old or older on30 June <strong>2012</strong>?No Go to question T13.Yes Read on.Answering this questionYou may be eligible for the mature age worker <strong>tax</strong>offset based on your net income from working. We willautomatically calculate the offset using the informationyou provide on your <strong>tax</strong> <strong>return</strong>. Information you provideat this item ensures that when working out your offsetwe take into account relevant amounts of income youincluded in the <strong>supplement</strong>ary section of your <strong>tax</strong> <strong>return</strong>.Completing this item1Completeworksheet 1. Show a loss as anegative amount.Worksheet 1Total incomeNet personal services income(PSI) from A item 14Net income or loss from business(primary production) from Bitem 15Net income or loss from business(non-primary production) from Citem 15Deferred non-commercialbusiness losses from primaryproduction from I item 16Deferred non-commercialbusiness losses from non‐primaryproduction from J item 16$ (a)$ (b)$ (c)$ (d)$ (e)s38 INDIVIDUAL TAX RETURN INSTRUCTIONS SUPPLEMENT <strong>2012</strong>