Individual tax return instructions supplement 2012 - Australian ...

Individual tax return instructions supplement 2012 - Australian ...

Individual tax return instructions supplement 2012 - Australian ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

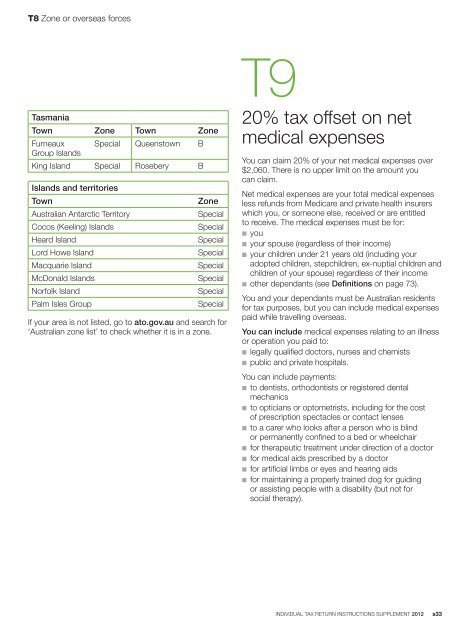

T8 Zone or overseas forcesT9TasmaniaTown Zone Town ZoneFurneauxGroup IslandsSpecial Queenstown BKing Island Special Rosebery BIslands and territoriesTown<strong>Australian</strong> Antarctic TerritoryCocos (Keeling) IslandsHeard IslandLord Howe IslandMacquarie IslandMcDonald IslandsNorfolk IslandPalm Isles GroupZoneSpecialSpecialSpecialSpecialSpecialSpecialSpecialSpecialIf your area is not listed, go to ato.gov.au and search for‘<strong>Australian</strong> zone list’ to check whether it is in a zone.20% <strong>tax</strong> offset on netmedical expensesYou can claim 20% of your net medical expenses over$2,060. There is no upper limit on the amount youcan claim.Net medical expenses are your total medical expensesless refunds from Medicare and private health insurerswhich you, or someone else, received or are entitledto receive. The medical expenses must be for:n youn your spouse (regardless of their income)n your children under 21 years old (including youradopted children, stepchildren, ex-nuptial children andchildren of your spouse) regardless of their incomen other dependants (see Definitions on page 73).You and your dependants must be <strong>Australian</strong> residentsfor <strong>tax</strong> purposes, but you can include medical expensespaid while travelling overseas.You can include medical expenses relating to an illnessor operation you paid to:n legally qualified doctors, nurses and chemistsn public and private hospitals.You can include payments:n to dentists, orthodontists or registered dentalmechanicsn to opticians or optometrists, including for the costof prescription spectacles or contact lensesn to a carer who looks after a person who is blindor permanently confined to a bed or wheelchairn for therapeutic treatment under direction of a doctorn for medical aids prescribed by a doctorn for artificial limbs or eyes and hearing aidsn for maintaining a properly trained dog for guidingor assisting people with a disability (but not forsocial therapy).INDIVIDUAL TAX RETURN INSTRUCTIONS SUPPLEMENT <strong>2012</strong> s33