Individual tax return instructions supplement 2012 - Australian ...

Individual tax return instructions supplement 2012 - Australian ...

Individual tax return instructions supplement 2012 - Australian ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

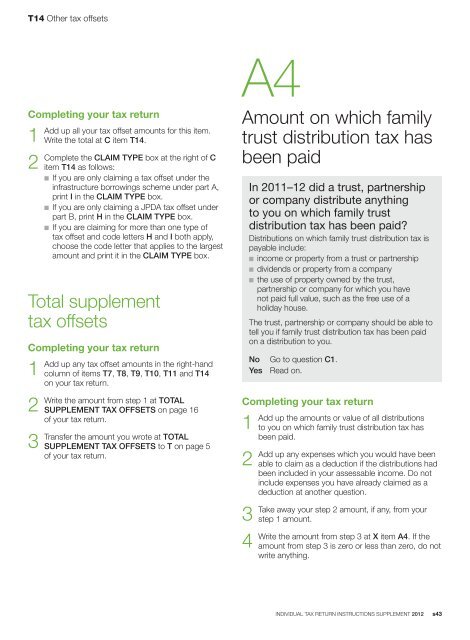

T14 Other <strong>tax</strong> offsetsA4Completing your <strong>tax</strong> <strong>return</strong>1Add2Completeup all your <strong>tax</strong> offset amounts for this item.Write the total at C item T14.the CLAIM TYPE box at the right of Citem T14 as follows:n If you are only claiming a <strong>tax</strong> offset under theinfrastructure borrowings scheme under part A,print I in the CLAIM TYPE box.n If you are only claiming a JPDA <strong>tax</strong> offset underpart B, print H in the CLAIM TYPE box.n If you are claiming for more than one type of<strong>tax</strong> offset and code letters H and I both apply,choose the code letter that applies to the largestamount and print it in the CLAIM TYPE box.Total <strong>supplement</strong><strong>tax</strong> offsetsCompleting your <strong>tax</strong> <strong>return</strong>1Add2Write3Transferup any <strong>tax</strong> offset amounts in the right-handcolumn of items T7, T8, T9, T10, T11 and T14on your <strong>tax</strong> <strong>return</strong>.the amount from step 1 at TOTALSUPPLEMENT TAX OFFSETS on page 16of your <strong>tax</strong> <strong>return</strong>.the amount you wrote at TOTALSUPPLEMENT TAX OFFSETS to T on page 5of your <strong>tax</strong> <strong>return</strong>.Amount on which familytrust distribution <strong>tax</strong> hasbeen paidIn 2011–12 did a trust, partnershipor company distribute anythingto you on which family trustdistribution <strong>tax</strong> has been paid?Distributions on which family trust distribution <strong>tax</strong> ispayable include:n income or property from a trust or partnershipn dividends or property from a companyn the use of property owned by the trust,partnership or company for which you havenot paid full value, such as the free use of aholiday house.The trust, partnership or company should be able totell you if family trust distribution <strong>tax</strong> has been paidon a distribution to you.No Go to question C1.Yes Read on.Completing your <strong>tax</strong> <strong>return</strong>1Add2Add3Take4Writeup the amounts or value of all distributionsto you on which family trust distribution <strong>tax</strong> hasbeen paid.up any expenses which you would have beenable to claim as a deduction if the distributions hadbeen included in your assessable income. Do notinclude expenses you have already claimed as adeduction at another question.away your step 2 amount, if any, from yourstep 1 amount.the amount from step 3 at X item A4. If theamount from step 3 is zero or less than zero, do notwrite anything.INDIVIDUAL TAX RETURN INSTRUCTIONS SUPPLEMENT <strong>2012</strong> s43