President

ERP_Cover_Proofs with green barcode.indd - The American ...

ERP_Cover_Proofs with green barcode.indd - The American ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

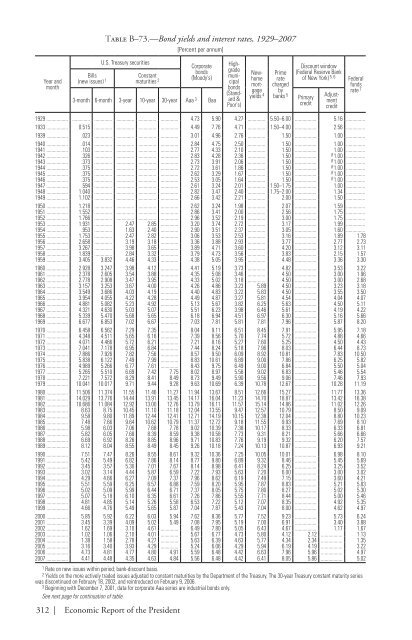

Year andmonthBills(new issues) 1Table B–73.—Bond yields and interest rates, 1929–2007U.S. Treasury securitiesConstantmaturities 2312 | Economic Report of the <strong>President</strong>[Percent per annum]Corporatebonds(Moody's)3-month 6-month 3-year 10-year 30-year Aaa 3 BaaHighgrademunicipalbonds(Standard&Poor's)Newhomemortgageyields 4Primeratechargedbybanks 5Discount window(Federal Reserve Bankof New York) 5, 61929 4.73 5.90 4.27 5.50–6.00 5.16 1933 0.515 4.49 7.76 4.71 1.50–4.00 2.56 1939 .023 3.01 4.96 2.76 1.50 1.00 1940 .014 2.84 4.75 2.50 1.50 1.00 1941 .103 2.77 4.33 2.10 1.50 1.00 1942 .326 2.83 4.28 2.36 1.50 8 1.00 1943 .373 2.73 3.91 2.06 1.50 8 1.00 1944 .375 2.72 3.61 1.86 1.50 8 1.00 1945 .375 2.62 3.29 1.67 1.50 8 1.00 1946 .375 2.53 3.05 1.64 1.50 8 1.00 1947 .594 2.61 3.24 2.01 1.50–1.75 1.00 1948 1.040 2.82 3.47 2.40 1.75–2.00 1.34 1949 1.102 2.66 3.42 2.21 2.00 1.50 1950 1.218 2.62 3.24 1.98 2.07 1.59 1951 1.552 2.86 3.41 2.00 2.56 1.75 1952 1.766 2.96 3.52 2.19 3.00 1.75 1953 1.931 2.47 2.85 3.20 3.74 2.72 3.17 1.99 1954 .953 1.63 2.40 2.90 3.51 2.37 3.05 1.60 1955 1.753 2.47 2.82 3.06 3.53 2.53 3.16 1.89 1.781956 2.658 3.19 3.18 3.36 3.88 2.93 3.77 2.77 2.731957 3.267 3.98 3.65 3.89 4.71 3.60 4.20 3.12 3.111958 1.839 2.84 3.32 3.79 4.73 3.56 3.83 2.15 1.571959 3.405 3.832 4.46 4.33 4.38 5.05 3.95 4.48 3.36 3.301960 2.928 3.247 3.98 4.12 4.41 5.19 3.73 4.82 3.53 3.221961 2.378 2.605 3.54 3.88 4.35 5.08 3.46 4.50 3.00 1.961962 2.778 2.908 3.47 3.95 4.33 5.02 3.18 4.50 3.00 2.681963 3.157 3.253 3.67 4.00 4.26 4.86 3.23 5.89 4.50 3.23 3.181964 3.549 3.686 4.03 4.19 4.40 4.83 3.22 5.83 4.50 3.55 3.501965 3.954 4.055 4.22 4.28 4.49 4.87 3.27 5.81 4.54 4.04 4.071966 4.881 5.082 5.23 4.92 5.13 5.67 3.82 6.25 5.63 4.50 5.111967 4.321 4.630 5.03 5.07 5.51 6.23 3.98 6.46 5.61 4.19 4.221968 5.339 5.470 5.68 5.65 6.18 6.94 4.51 6.97 6.30 5.16 5.661969 6.677 6.853 7.02 6.67 7.03 7.81 5.81 7.81 7.96 5.87 8.201970 6.458 6.562 7.29 7.35 8.04 9.11 6.51 8.45 7.91 5.95 7.181971 4.348 4.511 5.65 6.16 7.39 8.56 5.70 7.74 5.72 4.88 4.661972 4.071 4.466 5.72 6.21 7.21 8.16 5.27 7.60 5.25 4.50 4.431973 7.041 7.178 6.95 6.84 7.44 8.24 5.18 7.96 8.03 6.44 8.731974 7.886 7.926 7.82 7.56 8.57 9.50 6.09 8.92 10.81 7.83 10.501975 5.838 6.122 7.49 7.99 8.83 10.61 6.89 9.00 7.86 6.25 5.821976 4.989 5.266 6.77 7.61 8.43 9.75 6.49 9.00 6.84 5.50 5.041977 5.265 5.510 6.69 7.42 7.75 8.02 8.97 5.56 9.02 6.83 5.46 5.541978 7.221 7.572 8.29 8.41 8.49 8.73 9.49 5.90 9.56 9.06 7.46 7.931979 10.041 10.017 9.71 9.44 9.28 9.63 10.69 6.39 10.78 12.67 10.28 11.191980 11.506 11.374 11.55 11.46 11.27 11.94 13.67 8.51 12.66 15.27 11.77 13.361981 14.029 13.776 14.44 13.91 13.45 14.17 16.04 11.23 14.70 18.87 13.42 16.381982 10.686 11.084 12.92 13.00 12.76 13.79 16.11 11.57 15.14 14.86 11.02 12.261983 8.63 8.75 10.45 11.10 11.18 12.04 13.55 9.47 12.57 10.79 8.50 9.091984 9.58 9.80 11.89 12.44 12.41 12.71 14.19 10.15 12.38 12.04 8.80 10.231985 7.48 7.66 9.64 10.62 10.79 11.37 12.72 9.18 11.55 9.93 7.69 8.101986 5.98 6.03 7.06 7.68 7.78 9.02 10.39 7.38 10.17 8.33 6.33 6.811987 5.82 6.05 7.68 8.39 8.59 9.38 10.58 7.73 9.31 8.21 5.66 6.661988 6.69 6.92 8.26 8.85 8.96 9.71 10.83 7.76 9.19 9.32 6.20 7.571989 8.12 8.04 8.55 8.49 8.45 9.26 10.18 7.24 10.13 10.87 6.93 9.211990 7.51 7.47 8.26 8.55 8.61 9.32 10.36 7.25 10.05 10.01 6.98 8.101991 5.42 5.49 6.82 7.86 8.14 8.77 9.80 6.89 9.32 8.46 5.45 5.691992 3.45 3.57 5.30 7.01 7.67 8.14 8.98 6.41 8.24 6.25 3.25 3.521993 3.02 3.14 4.44 5.87 6.59 7.22 7.93 5.63 7.20 6.00 3.00 3.021994 4.29 4.66 6.27 7.09 7.37 7.96 8.62 6.19 7.49 7.15 3.60 4.211995 5.51 5.59 6.25 6.57 6.88 7.59 8.20 5.95 7.87 8.83 5.21 5.831996 5.02 5.09 5.99 6.44 6.71 7.37 8.05 5.75 7.80 8.27 5.02 5.301997 5.07 5.18 6.10 6.35 6.61 7.26 7.86 5.55 7.71 8.44 5.00 5.461998 4.81 4.85 5.14 5.26 5.58 6.53 7.22 5.12 7.07 8.35 4.92 5.351999 4.66 4.76 5.49 5.65 5.87 7.04 7.87 5.43 7.04 8.00 4.62 4.972000 5.85 5.92 6.22 6.03 5.94 7.62 8.36 5.77 7.52 9.23 5.73 6.242001 3.45 3.39 4.09 5.02 5.49 7.08 7.95 5.19 7.00 6.91 3.40 3.882002 1.62 1.69 3.10 4.61 6.49 7.80 5.05 6.43 4.67 1.17 1.672003 1.02 1.06 2.10 4.01 5.67 6.77 4.73 5.80 4.12 2.12 1.132004 1.38 1.58 2.78 4.27 5.63 6.39 4.63 5.77 4.34 2.34 1.352005 3.16 3.40 3.93 4.29 5.24 6.06 4.29 5.94 6.19 4.19 3.222006 4.73 4.81 4.77 4.80 4.91 5.59 6.48 4.42 6.63 7.96 5.96 4.972007 4.41 4.48 4.35 4.63 4.84 5.56 6.48 4.42 6.41 8.05 5.86 5.021 Rate on new issues within period; bank-discount basis.2 Yields on the more actively traded issues adjusted to constant maturities by the Department of the Treasury. The 30-year Treasury constant maturity serieswas discontinued on February 18, 2002, and reintroduced on February 9, 2006.3 Beginning with December 7, 2001, data for corporate Aaa series are industrial bonds only.See next page for continuation of table.PrimarycreditAdjustmentcreditFederalfundsrate 7