- Page 1 and 2:

EconomicReportof thePresidentTransm

- Page 4 and 5:

C O N T E N T SPageECONOMIC REPORT

- Page 7 and 8:

ECONOMIC REPORT OF THE PRESIDENTTo

- Page 9:

$2 billion to a new international c

- Page 13: LETTER OF TRANSMITTALCouncil of Eco

- Page 16 and 17: chapter 3. the causes and consequen

- Page 18 and 19: appendixesA. Report to the Presiden

- Page 20 and 21: 2-5. Mortgage Lending Today........

- Page 22 and 23: Chapter 1: The Year in Reviewand th

- Page 24 and 25: Chapter 3: The Causes and Consequen

- Page 26 and 27: • Tax reductions in 2001 and 2003

- Page 28 and 29: • More effective statistical use

- Page 30 and 31: • Real GDP posted solid 2.5 perce

- Page 32 and 33: elative to non-energy prices, while

- Page 34 and 35: nonconforming mortgages in 2007. In

- Page 36 and 37: In addition to incomes and mortgage

- Page 38 and 39: Business InventoriesInventory inves

- Page 40 and 41: Indeed, the growth in foreign econo

- Page 42 and 43: During the 12 months of 2007, the u

- Page 44 and 45: output measures announced in the an

- Page 46 and 47: and government purchases. In contra

- Page 48 and 49: Table 1-1.—Administration Economi

- Page 50 and 51: Box 1-3 — continuedParticipation

- Page 52 and 53: finalized), below its 1963-2006 ave

- Page 55 and 56: C H A P T E R 2Credit and Housing M

- Page 57 and 58: lends a debtor money today, which t

- Page 59 and 60: Box 2-1 — continuedPrime loan: Lo

- Page 61 and 62: Box 2-2 — continuedNRSROs. Critic

- Page 63: Box 2-3 — continuedMortgage defau

- Page 67 and 68: Corporate bond yields also rose rel

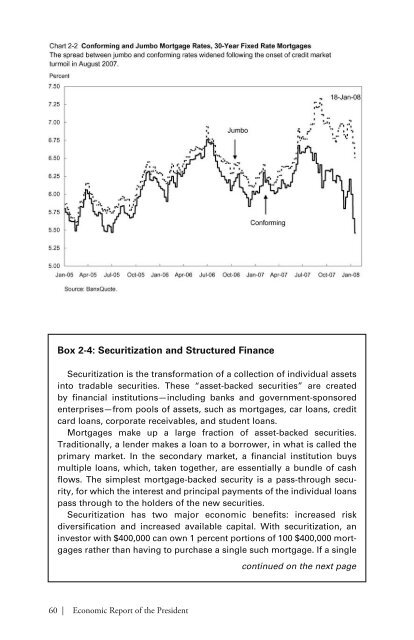

- Page 69 and 70: conduits in that SIVs have less acc

- Page 71 and 72: International ImplicationsA notable

- Page 73 and 74: come together to create a coordinat

- Page 75 and 76: home is forgiven, that portion is t

- Page 77 and 78: alternatives offered in the convent

- Page 79 and 80: to such a change in wealth, which a

- Page 81: lending. FHA Modernization will enc

- Page 84 and 85: Economists often call attention to

- Page 86 and 87: Box 3-1: Trade in ServicesDiscussio

- Page 88 and 89: Box 3-2: The Current Account Defici

- Page 90 and 91: Growth in Domestic ProductionA seco

- Page 92 and 93: Exports and Foreign Direct Investme

- Page 94 and 95: in CFIUS’s role in protecting nat

- Page 96 and 97: these goods than if they were produ

- Page 98 and 99: y import competition are electrical

- Page 101 and 102: C H A P T E R 4The Importance of He

- Page 103 and 104: Box 4-1: Health Effects on Job Prod

- Page 105 and 106: health care spending growth. Rising

- Page 107 and 108: While the study focused on spending

- Page 109 and 110: Box 4-2 — continuedand without pr

- Page 111 and 112: effective price of zero. Even if a

- Page 113 and 114: deduction for health insurance to a

- Page 115 and 116:

To reduce the extent to which high-

- Page 117 and 118:

Administration supports broad adopt

- Page 119 and 120:

C H A P T E R 5Tax PolicySocieties

- Page 121 and 122:

in 2000. Tax revenues increased str

- Page 123 and 124:

Alternative Minimum TaxPrior to 196

- Page 125 and 126:

The Impact of Recent Tax Reductions

- Page 127 and 128:

35 percent marginal tax rate on the

- Page 129 and 130:

C corporations fall under the corpo

- Page 131 and 132:

Significance of Tax Cuts to Individ

- Page 133 and 134:

Box 5-1: Marriage Penalty BasicsIt

- Page 135 and 136:

The Structure of Business TaxesDesp

- Page 137 and 138:

investments are made. A more modest

- Page 139 and 140:

able to defer $35 of tax liability

- Page 141 and 142:

C H A P T E R 6The Nation’s Infra

- Page 143 and 144:

A monopolistic bridge owner may cho

- Page 145 and 146:

etween places to accommodating grow

- Page 147 and 148:

the same time. At hours when many d

- Page 149 and 150:

BridgesOn August 1, 2007, the I-35W

- Page 151 and 152:

where shippers have an alternative

- Page 153 and 154:

Freight shipments into and out of t

- Page 155 and 156:

Box 6-2: Delays at New York City Ai

- Page 157 and 158:

uilt, the marginal cost of transmis

- Page 159 and 160:

access was in mobile wireless conne

- Page 161 and 162:

Infrastructure PolicyThough the U.S

- Page 163 and 164:

could shorten the wait by adding an

- Page 165 and 166:

In 2005, the Federal Aviation Admin

- Page 167 and 168:

C H A P T E R 7Searching for Altern

- Page 169 and 170:

The first U.S. oil well was drilled

- Page 171 and 172:

Most of the oil consumed in the Uni

- Page 173 and 174:

Also, depending on the fuel and tec

- Page 175 and 176:

Table 7-1. —Estimated Average Lev

- Page 177 and 178:

Nevada. The facility is expected to

- Page 179 and 180:

Wind PowerWind power supplies about

- Page 181 and 182:

amounts of electricity, it could be

- Page 183 and 184:

years, as corn-based ethanol produc

- Page 185 and 186:

the power, range, and convenient fu

- Page 187 and 188:

other petroleum products is project

- Page 189 and 190:

To help meet the growing demand for

- Page 191 and 192:

C H A P T E R 8Improving Economic S

- Page 193 and 194:

The second largest Federal statisti

- Page 195 and 196:

As shown in Chart 8-3, spending on

- Page 197 and 198:

Monetary and fiscal policymakers al

- Page 199 and 200:

service-sector output much more fre

- Page 201 and 202:

Box 8-1: How to Reverse a Decline i

- Page 203 and 204:

Information Protection and Statisti

- Page 205 and 206:

forward instead of the growth rate

- Page 207:

Appendix AREPORT TO THE PRESIDENT O

- Page 210 and 211:

Council Members and Their Dates of

- Page 213 and 214:

Report to the President on theActiv

- Page 215 and 216:

The Council also prepared in-depth

- Page 217 and 218:

The Staff of the Council of Economi

- Page 219:

Jane Tufts, Bruce Kaplan, and Anna

- Page 223 and 224:

C O N T E N T SNational Income or E

- Page 225 and 226:

Prices—ContinuedPageB-63. Changes

- Page 227 and 228:

General NotesDetail in these tables

- Page 229 and 230:

Table B-1.—Gross domestic product

- Page 231 and 232:

Table B-2.—Real gross domestic pr

- Page 233 and 234:

Table B-4.—Percent changes in rea

- Page 235 and 236:

Table B-5.—Contributions to perce

- Page 237 and 238:

Table B-6.—Chain-type quantity in

- Page 239 and 240:

Table B-7.—Chain-type price index

- Page 241 and 242:

Table B-9.—Real gross domestic pr

- Page 243 and 244:

Table B-11.—Real gross value adde

- Page 245 and 246:

Table B-12.—Gross domestic produc

- Page 247 and 248:

Table B-13.—Real gross domestic p

- Page 249 and 250:

Table B-15.—Gross value added and

- Page 251 and 252:

Table B-17.—Real personal consump

- Page 253 and 254:

Table B-19.—Real private fixed in

- Page 255 and 256:

Table B-21.—Real government consu

- Page 257 and 258:

QuarterTable B-23.—Real private i

- Page 259 and 260:

Table B-25.—Real exports and impo

- Page 261 and 262:

Table B-27.—Relation of national

- Page 263 and 264:

Table B-28.—National income by ty

- Page 265 and 266:

Table B-29.—Sources of personal i

- Page 267 and 268:

Table B-31.—Total and per capita

- Page 269 and 270:

Table B-32.—Gross saving and inve

- Page 271 and 272:

Population, Employment, Wages, and

- Page 273 and 274:

Table B-35.—Civilian population a

- Page 275 and 276:

Table B-37.—Civilian employment b

- Page 277 and 278:

Table B-39.—Civilian labor force

- Page 279 and 280:

Table B-41.—Civilian employment/p

- Page 281 and 282:

Table B-43.—Civilian unemployment

- Page 283 and 284:

Table B-45.—Unemployment insuranc

- Page 285 and 286:

Table B-46.—Employees on nonagric

- Page 287 and 288:

Table B-48.—Employment cost index

- Page 289 and 290:

Table B-50.—Changes in productivi

- Page 291 and 292:

Table B-52.—Industrial production

- Page 293 and 294:

Table B-54.—Capacity utilization

- Page 295 and 296:

Table B-56.—New private housing u

- Page 297 and 298:

Table B-58.—Manufacturers’ ship

- Page 299 and 300:

PricesTable B-60.—Consumer price

- Page 301 and 302:

Table B-61.—Consumer price indexe

- Page 303 and 304:

Table B-63.—Changes in special co

- Page 305 and 306:

Year or monthTable B-65.—Producer

- Page 307 and 308:

Table B-66.—Producer price indexe

- Page 309 and 310:

Table B-67.—Producer price indexe

- Page 311 and 312:

Year and monthMoney Stock, Credit,

- Page 313 and 314:

Table B-70.—Components of money s

- Page 315 and 316:

Table B-72.—Bank credit at all co

- Page 317 and 318:

Table B-73.—Bond yields and inter

- Page 319 and 320:

Table B-74.—Credit market borrowi

- Page 321 and 322:

Table B-76.—Mortgage debt outstan

- Page 323 and 324:

Government FinanceTable B-78.—Fed

- Page 325 and 326:

Table B-80.—Federal receipts and

- Page 327 and 328:

Table B-82.—Federal and State and

- Page 329 and 330:

Table B-84.—Federal Government cu

- Page 331 and 332:

Table B-86.—State and local gover

- Page 333 and 334:

Table B-88.—Maturity distribution

- Page 335 and 336:

Corporate Profits and FinanceTable

- Page 337 and 338:

Table B-92.—Corporate profits of

- Page 339 and 340:

Table B-94.—Relation of profits a

- Page 341 and 342:

Year or monthTable B-96.—Common s

- Page 343 and 344:

Table B-98.—Farm business balance

- Page 345 and 346:

YearTotalTable B-100.—Farm input

- Page 347 and 348:

Table B-102.—U.S. exports and imp

- Page 349 and 350:

Table B-103.—U.S. international t

- Page 351 and 352:

Table B-105.—U.S. international t

- Page 353 and 354:

Table B-107.—International invest

- Page 355 and 356:

Table B-109.—Civilian unemploymen

- Page 357 and 358:

Table B-111.—International reserv