Research Journal of Economics & Business Studies - RJEBS - The ...

Research Journal of Economics & Business Studies - RJEBS - The ...

Research Journal of Economics & Business Studies - RJEBS - The ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

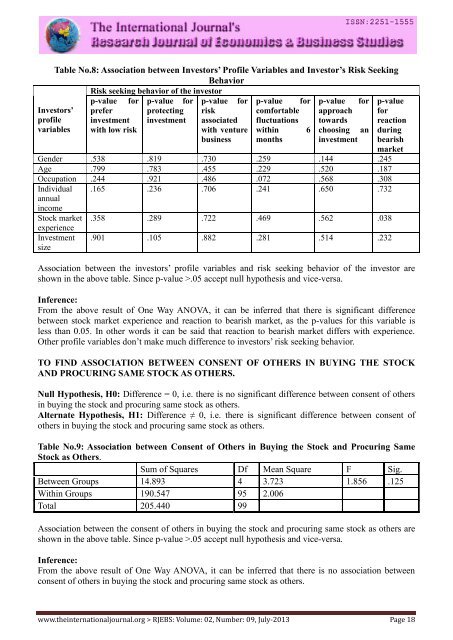

Table No.8: Association between Investors’ Pr<strong>of</strong>ile Variables and Investor’s Risk Seeking<br />

Behavior<br />

Risk seeking behavior <strong>of</strong> the investor<br />

p-value for p-value for p-value for p-value for p-value for<br />

prefer protecting<br />

approach<br />

investment investment<br />

towards<br />

with low risk<br />

choosing an<br />

Investors’<br />

pr<strong>of</strong>ile<br />

variables<br />

risk<br />

associated<br />

with venture<br />

business<br />

comfortable<br />

fluctuations<br />

within 6<br />

months<br />

investment<br />

p-value<br />

for<br />

reaction<br />

during<br />

bearish<br />

market<br />

Gender .538 .819 .730 .259 .144 .245<br />

Age .799 .783 .455 .229 .520 .187<br />

Occupation .244 .921 .486 .072 .568 .308<br />

Individual<br />

annual<br />

income<br />

Stock market<br />

experience<br />

Investment<br />

size<br />

.165 .236 .706 .241 .650 .732<br />

.358 .289 .722 .469 .562 .038<br />

.901 .105 .882 .281 .514 .232<br />

Association between the investors’ pr<strong>of</strong>ile variables and risk seeking behavior <strong>of</strong> the investor are<br />

shown in the above table. Since p-value >.05 accept null hypothesis and vice-versa.<br />

Inference:<br />

From the above result <strong>of</strong> One Way ANOVA, it can be inferred that there is significant difference<br />

between stock market experience and reaction to bearish market, as the p-values for this variable is<br />

less than 0.05. In other words it can be said that reaction to bearish market differs with experience.<br />

Other pr<strong>of</strong>ile variables don’t make much difference to investors’ risk seeking behavior.<br />

TO FIND ASSOCIATION BETWEEN CONSENT OF OTHERS IN BUYING THE STOCK<br />

AND PROCURING SAME STOCK AS OTHERS.<br />

Null Hypothesis, H0: Difference = 0, i.e. there is no significant difference between consent <strong>of</strong> others<br />

in buying the stock and procuring same stock as others.<br />

Alternate Hypothesis, H1: Difference ≠ 0, i.e. there is significant difference between consent <strong>of</strong><br />

others in buying the stock and procuring same stock as others.<br />

Table No.9: Association between Consent <strong>of</strong> Others in Buying the Stock and Procuring Same<br />

Stock as Others.<br />

Sum <strong>of</strong> Squares Df Mean Square F Sig.<br />

Between Groups 14.893 4 3.723 1.856 .125<br />

Within Groups 190.547 95 2.006<br />

Total 205.440 99<br />

Association between the consent <strong>of</strong> others in buying the stock and procuring same stock as others are<br />

shown in the above table. Since p-value >.05 accept null hypothesis and vice-versa.<br />

Inference:<br />

From the above result <strong>of</strong> One Way ANOVA, it can be inferred that there is no association between<br />

consent <strong>of</strong> others in buying the stock and procuring same stock as others.<br />

www.theinternationaljournal.org > <strong>RJEBS</strong>: Volume: 02, Number: 09, July-2013 Page 18