Research Journal of Economics & Business Studies - RJEBS - The ...

Research Journal of Economics & Business Studies - RJEBS - The ...

Research Journal of Economics & Business Studies - RJEBS - The ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

coverage without relying on the sale <strong>of</strong> existing inventory. <strong>The</strong> reliability <strong>of</strong> the quick ratio as an<br />

indicator <strong>of</strong> short-term liquidity depends on the quality <strong>of</strong> receivables and the market value <strong>of</strong> the<br />

securities.<br />

Long term solvency: This may be defined as a company’s ability to meet interest and principal<br />

payments on long term debt and similar obligations as they become due. <strong>The</strong> best indicator <strong>of</strong> longterm<br />

solvency is the ability <strong>of</strong> a firm to generate cash pr<strong>of</strong>its over a period <strong>of</strong> years. Financial leverage<br />

provides another means <strong>of</strong> evaluating long-term solvency.<br />

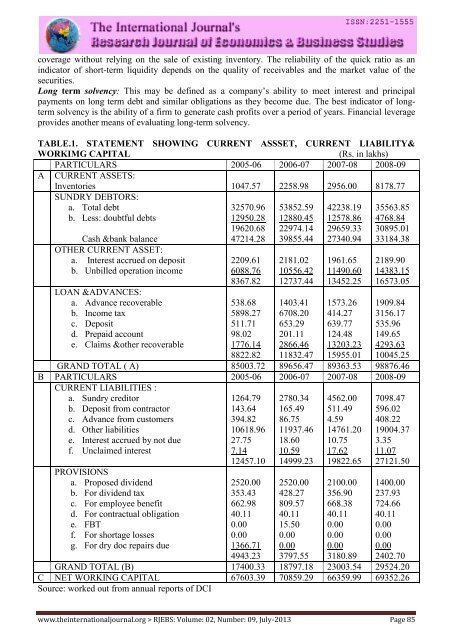

TABLE.1. STATEMENT SHOWING CURRENT ASSSET, CURRENT LIABILITY&<br />

WORKIMG CAPITAL<br />

(Rs. in lakhs)<br />

PARTICULARS 2005-06 2006-07 2007-08 2008-09<br />

A CURRENT ASSETS:<br />

Inventories 1047.57 2258.98 2956.00 8178.77<br />

SUNDRY DEBTORS:<br />

a. Total debt<br />

b. Less: doubtful debts<br />

Cash &bank balance<br />

OTHER CURRENT ASSET:<br />

a. Interest accrued on deposit<br />

b. Unbilled operation income<br />

LOAN &ADVANCES:<br />

a. Advance recoverable<br />

b. Income tax<br />

c. Deposit<br />

d. Prepaid account<br />

e. Claims &other recoverable<br />

32570.96<br />

12950.28<br />

19620.68<br />

47214.28<br />

2209.61<br />

6088.76<br />

8367.82<br />

538.68<br />

5898.27<br />

511.71<br />

98.02<br />

1776.14<br />

8822.82<br />

53852.59<br />

12880.45<br />

22974.14<br />

39855.44<br />

2181.02<br />

10556.42<br />

12737.44<br />

1403.41<br />

6708.20<br />

653.29<br />

201.11<br />

2866.46<br />

11832.47<br />

42238.19<br />

12578.86<br />

29659.33<br />

27340.94<br />

1961.65<br />

11490.60<br />

13452.25<br />

1573.26<br />

414.27<br />

639.77<br />

124.48<br />

13203.23<br />

15955.01<br />

35563.85<br />

4768.84<br />

30895.01<br />

33184.38<br />

2189.90<br />

14383.15<br />

16573.05<br />

1909.84<br />

3156.17<br />

535.96<br />

149.65<br />

4293.63<br />

10045.25<br />

GRAND TOTAL ( A) 85003.72 89656.47 89363.53 98876.46<br />

B PARTICULARS 2005-06 2006-07 2007-08 2008-09<br />

CURRENT LIABILITIES :<br />

a. Sundry creditor<br />

b. Deposit from contractor<br />

c. Advance from customers<br />

d. Other liabilities<br />

e. Interest accrued by not due<br />

f. Unclaimed interest<br />

PROVISIONS<br />

a. Proposed dividend<br />

b. For dividend tax<br />

c. For employee benefit<br />

d. For contractual obligation<br />

e. FBT<br />

f. For shortage losses<br />

g. For dry doc repairs due<br />

1264.79<br />

143.64<br />

394.82<br />

10618.96<br />

27.75<br />

7.14<br />

12457.10<br />

2520.00<br />

353.43<br />

662.98<br />

40.11<br />

0.00<br />

0.00<br />

1366.71<br />

4943.23<br />

2780.34<br />

165.49<br />

86.75<br />

11937.46<br />

18.60<br />

10.59<br />

14999.23<br />

2520.00<br />

428.27<br />

809.57<br />

40.11<br />

15.50<br />

0.00<br />

0.00<br />

3797.55<br />

4562.00<br />

511.49<br />

4.59<br />

14761.20<br />

10.75<br />

17.62<br />

19822.65<br />

2100.00<br />

356.90<br />

668.38<br />

40.11<br />

0.00<br />

0.00<br />

0.00<br />

3180.89<br />

7098.47<br />

596.02<br />

408.22<br />

19004.37<br />

3.35<br />

11.07<br />

27121.50<br />

1400.00<br />

237.93<br />

724.66<br />

40.11<br />

0.00<br />

0.00<br />

0.00<br />

2402.70<br />

GRAND TOTAL (B) 17400.33 18797.18 23003.54 29524.20<br />

C NET WORKING CAPITAL 67603.39 70859.29 66359.99 69352.26<br />

Source: worked out from annual reports <strong>of</strong> DCI<br />

www.theinternationaljournal.org > <strong>RJEBS</strong>: Volume: 02, Number: 09, July-2013 Page 85