Research Journal of Economics & Business Studies - RJEBS - The ...

Research Journal of Economics & Business Studies - RJEBS - The ...

Research Journal of Economics & Business Studies - RJEBS - The ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

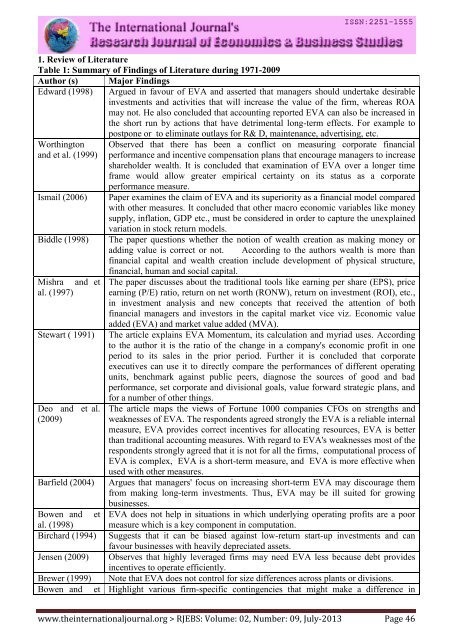

1. Review <strong>of</strong> Literature<br />

Table 1: Summary <strong>of</strong> Findings <strong>of</strong> Literature during 1971-2009<br />

Author (s) Major Findings<br />

Edward (1998) Argued in favour <strong>of</strong> EVA and asserted that managers should undertake desirable<br />

investments and activities that will increase the value <strong>of</strong> the firm, whereas ROA<br />

may not. He also concluded that accounting reported EVA can also be increased in<br />

the short run by actions that have detrimental long-term effects. For example to<br />

postpone or to eliminate outlays for R& D, maintenance, advertising, etc.<br />

Worthington Observed that there has been a conflict on measuring corporate financial<br />

and et al. (1999) performance and incentive compensation plans that encourage managers to increase<br />

shareholder wealth. It is concluded that examination <strong>of</strong> EVA over a longer time<br />

frame would allow greater empirical certainty on its status as a corporate<br />

performance measure.<br />

Ismail (2006) Paper examines the claim <strong>of</strong> EVA and its superiority as a financial model compared<br />

with other measures. It concluded that other macro economic variables like money<br />

supply, inflation, GDP etc., must be considered in order to capture the unexplained<br />

variation in stock return models.<br />

Biddle (1998) <strong>The</strong> paper questions whether the notion <strong>of</strong> wealth creation as making money or<br />

adding value is correct or not. According to the authors wealth is more than<br />

financial capital and wealth creation include development <strong>of</strong> physical structure,<br />

Mishra and et<br />

al. (1997)<br />

Stewart ( 1991)<br />

Deo and et al.<br />

(2009)<br />

Barfield (2004)<br />

financial, human and social capital.<br />

<strong>The</strong> paper discusses about the traditional tools like earning per share (EPS), price<br />

earning (P/E) ratio, return on net worth (RONW), return on investment (ROI), etc.,<br />

in investment analysis and new concepts that received the attention <strong>of</strong> both<br />

financial managers and investors in the capital market vice viz. Economic value<br />

added (EVA) and market value added (MVA).<br />

<strong>The</strong> article explains EVA Momentum, its calculation and myriad uses. According<br />

to the author it is the ratio <strong>of</strong> the change in a company's economic pr<strong>of</strong>it in one<br />

period to its sales in the prior period. Further it is concluded that corporate<br />

executives can use it to directly compare the performances <strong>of</strong> different operating<br />

units, benchmark against public peers, diagnose the sources <strong>of</strong> good and bad<br />

performance, set corporate and divisional goals, value forward strategic plans, and<br />

for a number <strong>of</strong> other things.<br />

<strong>The</strong> article maps the views <strong>of</strong> Fortune 1000 companies CFOs on strengths and<br />

weaknesses <strong>of</strong> EVA. <strong>The</strong> respondents agreed strongly the EVA is a reliable internal<br />

measure, EVA provides correct incentives for allocating resources, EVA is better<br />

than traditional accounting measures. With regard to EVA's weaknesses most <strong>of</strong> the<br />

respondents strongly agreed that it is not for all the firms, computational process <strong>of</strong><br />

EVA is complex, EVA is a short-term measure, and EVA is more effective when<br />

used with other measures.<br />

Argues that managers' focus on increasing short-term EVA may discourage them<br />

from making long-term investments. Thus, EVA may be ill suited for growing<br />

businesses.<br />

Bowen and et EVA does not help in situations in which underlying operating pr<strong>of</strong>its are a poor<br />

al. (1998) measure which is a key component in computation.<br />

Birchard (1994) Suggests that it can be biased against low-return start-up investments and can<br />

favour businesses with heavily depreciated assets.<br />

Jensen (2009) Observes that highly leveraged firms may need EVA less because debt provides<br />

incentives to operate efficiently.<br />

Brewer (1999) Note that EVA does not control for size differences across plants or divisions.<br />

Bowen and et Highlight various firm-specific contingencies that might make a difference in<br />

www.theinternationaljournal.org > <strong>RJEBS</strong>: Volume: 02, Number: 09, July-2013 Page 46