Research Journal of Economics & Business Studies - RJEBS - The ...

Research Journal of Economics & Business Studies - RJEBS - The ...

Research Journal of Economics & Business Studies - RJEBS - The ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

and medium companies. Mazharul H. Kazi (2008) in his study “Stock Market Price Movements and<br />

Macroeconomic Variables”, concluded that the future direction about the suitability <strong>of</strong> contemporary<br />

empirical technique that is more efficient over the traditional methods for analyzing asset pricing and<br />

its return generating process in any securities market Daferighe. Emmanuel E, Aje. Samuel O(2009) in<br />

their study “An Impact Analysis <strong>of</strong> Real Gross Domestic Product Inflation and Interest Rates on Stock<br />

Prices <strong>of</strong> Quoted Companies in Nigeria”, concluded that while a reduction in interest and inflation rate<br />

resulted in increased stock prices, increased RDGP has a positive impact. Government should<br />

therefore implement policies that will reduce inflation rate and improve the standard <strong>of</strong> living <strong>of</strong> its<br />

citizens. Interest rate should be made moderate so as to encourage investment and transactions in<br />

stock. Sulaiman D. Mohammad, Adnan Hussain (2009) in their study “Impact <strong>of</strong> Macroeconomics<br />

Variables on Stock Prices: Emperical Evidance in Case <strong>of</strong> Kse”, concluded that the influence <strong>of</strong><br />

foreign exchange rate and foreign exchange reserve significantly affect the stock prices, while other<br />

variables like IPI and GFCF are insignificantly affect stock prices..<br />

3. SIGNIFICANCE OF THE STUDY<br />

<strong>The</strong> study will enable the investors to understand the price fluctuations <strong>of</strong> equity stocks when<br />

influenced by the macro-economic factors. It will help them to make investment decisions. <strong>The</strong> study<br />

can be extended to reveal the investment pattern <strong>of</strong> investors relating to the price changes. It can also<br />

be implemented to analyze the impact <strong>of</strong> the variations <strong>of</strong> the factors on the other company stocks <strong>of</strong><br />

different sectors.<br />

4. OBJECTIVE OF THE STUDY<br />

<br />

<br />

<br />

<br />

To determine the risk return relationship <strong>of</strong> the stock.<br />

To study the relationship between the macro economic factors and the share price movements<br />

To analyze the impact <strong>of</strong> the factors on the performance <strong>of</strong> the companies stocks.<br />

To determine the performance <strong>of</strong> the sectors based on their returns.<br />

5. METHODOLOGY<br />

5.1 Type <strong>of</strong> research: <strong>The</strong> type <strong>of</strong> research used in this study is descriptive in nature<br />

5.2 Sampling method: Stratified random sampling method is used for selecting companies from six<br />

sectors.<br />

5.3 Sample size: <strong>The</strong> analysis is done with 30 companies taken from 6 sectors (5 companies from each<br />

sector).<br />

5.4 Data collection method: Secondary data is used in this study and was collected from national<br />

stock exchange website and various journals, reports, publications and historical documents.<br />

5.5 Data Collection: <strong>The</strong> samples are selected from the following 6 industrial sectors 1)Automobiles,<br />

2) Banking, 3) Information Technology, 4) Telecommunication, 5) Fact Moving Consumer Goods, 6)<br />

Oil and petroleum<br />

5.6 Statistical tools: <strong>The</strong> statistical tools used for the study are 1) Mean, 2) Standard deviation,<br />

3)Regression, 4)Correlation, 5) Trend analysis<br />

6. DATA ANALYSIS AND INTERPRETATION<br />

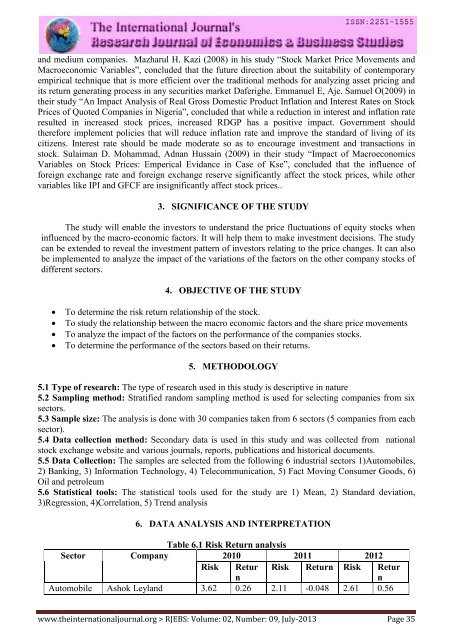

Table 6.1 Risk Return analysis<br />

Sector Company 2010 2011 2012<br />

Risk Retur<br />

n<br />

Risk Return Risk Retur<br />

n<br />

Automobile Ashok Leyland 3.62 0.26 2.11 -0.048 2.61 0.56<br />

www.theinternationaljournal.org > <strong>RJEBS</strong>: Volume: 02, Number: 09, July-2013 Page 35