International construction market survey 2016

ebP5dMy

ebP5dMy

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Global cost<br />

performance analysis<br />

Our <strong>survey</strong> has found that while average global <strong>construction</strong> prices are increasing, the rate of<br />

price inflation is generally slowing. The classic economic theory of demand and supply driving<br />

cost inflation also requires careful consideration. In over-reliant <strong>market</strong>s, wider macro-economic<br />

and political drivers will make costs volatile in the year ahead.<br />

2.9%<br />

<strong>construction</strong> cost price inflation recorded<br />

in this <strong>survey</strong>, 0.7% lower than last year<br />

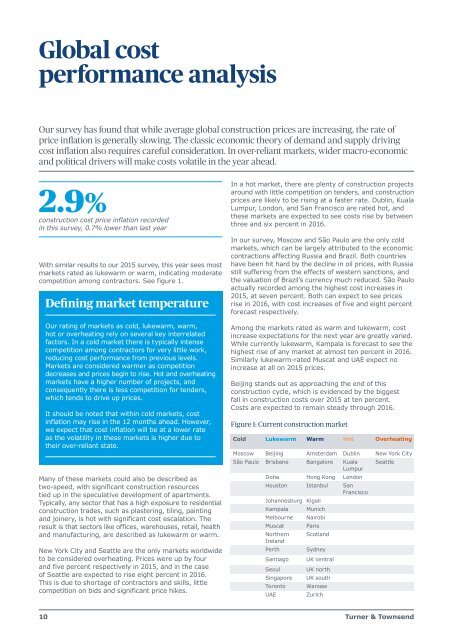

With similar results to our 2015 <strong>survey</strong>, this year sees most<br />

<strong>market</strong>s rated as lukewarm or warm, indicating moderate<br />

competition among contractors. See figure 1.<br />

Defining <strong>market</strong> temperature<br />

Our rating of <strong>market</strong>s as cold, lukewarm, warm,<br />

hot or overheating rely on several key interrelated<br />

factors. In a cold <strong>market</strong> there is typically intense<br />

competition among contractors for very little work,<br />

reducing cost performance from previous levels.<br />

Markets are considered warmer as competition<br />

decreases and prices begin to rise. Hot and overheating<br />

<strong>market</strong>s have a higher number of projects, and<br />

consequently there is less competition for tenders,<br />

which tends to drive up prices.<br />

It should be noted that within cold <strong>market</strong>s, cost<br />

inflation may rise in the 12 months ahead. However,<br />

we expect that cost inflation will be at a lower rate<br />

as the volatility in these <strong>market</strong>s is higher due to<br />

their over-reliant state.<br />

Many of these <strong>market</strong>s could also be described as<br />

two-speed, with significant <strong>construction</strong> resources<br />

tied up in the speculative development of apartments.<br />

Typically, any sector that has a high exposure to residential<br />

<strong>construction</strong> trades, such as plastering, tiling, painting<br />

and joinery, is hot with significant cost escalation. The<br />

result is that sectors like offices, warehouses, retail, health<br />

and manufacturing, are described as lukewarm or warm.<br />

New York City and Seattle are the only <strong>market</strong>s worldwide<br />

to be considered overheating. Prices were up by four<br />

and five percent respectively in 2015, and in the case<br />

of Seattle are expected to rise eight percent in <strong>2016</strong>.<br />

This is due to shortage of contractors and skills, little<br />

competition on bids and significant price hikes.<br />

In a hot <strong>market</strong>, there are plenty of <strong>construction</strong> projects<br />

around with little competition on tenders, and <strong>construction</strong><br />

prices are likely to be rising at a faster rate. Dublin, Kuala<br />

Lumpur, London, and San Francisco are rated hot, and<br />

these <strong>market</strong>s are expected to see costs rise by between<br />

three and six percent in <strong>2016</strong>.<br />

In our <strong>survey</strong>, Moscow and São Paulo are the only cold<br />

<strong>market</strong>s, which can be largely attributed to the economic<br />

contractions affecting Russia and Brazil. Both countries<br />

have been hit hard by the decline in oil prices, with Russia<br />

still suffering from the effects of western sanctions, and<br />

the valuation of Brazil’s currency much reduced. São Paulo<br />

actually recorded among the highest cost increases in<br />

2015, at seven percent. Both can expect to see prices<br />

rise in <strong>2016</strong>, with cost increases of five and eight percent<br />

forecast respectively.<br />

Among the <strong>market</strong>s rated as warm and lukewarm, cost<br />

increase expectations for the next year are greatly varied.<br />

While currently lukewarm, Kampala is forecast to see the<br />

highest rise of any <strong>market</strong> at almost ten percent in <strong>2016</strong>.<br />

Similarly lukewarm-rated Muscat and UAE expect no<br />

increase at all on 2015 prices.<br />

Beijing stands out as approaching the end of this<br />

<strong>construction</strong> cycle, which is evidenced by the biggest<br />

fall in <strong>construction</strong> costs over 2015 at ten percent.<br />

Costs are expected to remain steady through <strong>2016</strong>.<br />

Figure 1: Current <strong>construction</strong> <strong>market</strong><br />

Cold Lukewarm Warm Hot Overheating<br />

Moscow Beijing Amsterdam Dublin New York City<br />

São Paulo Brisbane Bangalore Kuala Seattle<br />

Lumpur<br />

Doha Hong Kong London<br />

Houston Istanbul San<br />

Francisco<br />

Johannesburg Kigali<br />

Kampala Munich<br />

Melbourne Nairobi<br />

Muscat Paris<br />

Northern Scotland<br />

Ireland<br />

Perth<br />

Sydney<br />

Santiago<br />

Seoul<br />

Singapore<br />

Toronto<br />

UAE<br />

UK central<br />

UK north<br />

UK south<br />

Warsaw<br />

Zurich<br />

10<br />

Turner & Townsend