Creative HEAD UK April 2018

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

#BusinessEdit<br />

Employee wage<br />

deductions catching<br />

out employers<br />

UNIFORMS AND DEDUCTIONS are catching<br />

out big employers such as Wagamama and TGI<br />

Fridays, named on the latest government ‘name<br />

and shame’ list featuring businesses failing to pay<br />

the correct National Minimum Wage or National<br />

Living Wage.<br />

Several of the high-profile cases were<br />

due to the rules being incorrectly applied on<br />

uniforms and deductions and, Hilary Hall, chief<br />

executive of the NHF, warned salons to take<br />

care. “Deductions from pay, for any reason, is<br />

a tricky area and you should take legal advice<br />

before doing so, even if your employees agree<br />

to deductions being made,” she warned. “If<br />

such deductions take a team member below<br />

the minimum wage, then you’re breaking the<br />

law. HMRC will still consider the cost of items<br />

which employees have to supply as a deduction<br />

from wages for the purposes of calculating the<br />

National Minimum Wage.”<br />

FIT FOR WORK SCHEME<br />

SET TO CLOSE<br />

THE GOVERNMENT’s Fit for Work health,<br />

work and employee absence service has<br />

closed for referrals in England, and will<br />

cease in Scotland at the end of May.<br />

The service was designed to help<br />

small businesses in particular to get<br />

employees back on their feet and into<br />

work after sickness or injury. GPs were<br />

able to refer employees into it for specialist<br />

rehabilitation help and support. However,<br />

since its launch in 2015, the service had<br />

struggled to be accepted by businesses or<br />

GPs, and the government said it was closing<br />

because of “low referral rates”.<br />

The service’s website fitforwork.org will<br />

continue to offer free return-to-work advice.<br />

NO ANSWER ON SELF-<br />

EMPLOYMENT QUESTION<br />

THE NHF HAS expressed disappointment that the government failed to<br />

provide much-needed clarity on the future status and tax treatment of selfemployed<br />

workers in its long-awaited response to the Taylor Review of Modern<br />

Working Practices.<br />

The review had been tasked with looking at whether changing employment<br />

models, including the ‘gig’ economy and rising rates of self-employment, were<br />

benefiting or exploiting workers. It had recommended a number of potentially<br />

significant changes, including the creation of a new category of worker, a<br />

‘dependent contractor’, as a halfway house between being directly employed<br />

and self-employed.<br />

Were this to happen, it could have important implications for hair and<br />

beauty. Chair renters, for example, could gain rights to benefits such as<br />

sickness and holiday pay. In its response, the government announced plans<br />

to crack down on employers who fail to pay fines imposed by employment<br />

tribunals, including ‘naming and shaming’ and much larger penalties.<br />

But on the all-important issue of self-employment status it decided to<br />

put the question out to further consultation. The government also rejected<br />

Taylor’s proposals to reduce the difference between the National Insurance<br />

Contributions (NICs) of employees and the self-employed.<br />

“Although it’s great news for people who are self-employed, we are obviously<br />

disappointed that changes to NICs have been ruled out,” said NHF chief<br />

executive Hilary Hall. “But the burning questions on employment status<br />

have not yet been answered, yet there could be far-reaching consequences<br />

for the hairdressing, barbering and beauty industries. We will be building<br />

on the campaigning work we have already done and actively participating in<br />

the consultations.”<br />

PAY AND TAX CHANGES ARRIVE<br />

APRIL HERALDS THE start of the new financial year and will bring an<br />

array of pay and tax changes. Hourly rates for the National Living Wage and<br />

National Minimum Wage will all be going up, as will the Apprentice wage, see<br />

table below.<br />

With tax, owners who pay themselves an income from dividends rather than<br />

a salary will see their tax-free dividend allowance fall from £5,000 to £2,000.<br />

Income from dividends above this will be taxed at 7.5 per cent for basic-rate<br />

taxpayers, 32.5 per cent for higher-rate payers and 38.1 per cent for top-rate<br />

payers. In Scotland, the basic rate of income tax will be frozen at 20p, while a<br />

new intermediate rate of 21p will kick in on earnings above £24,000. The rate<br />

for higher-rate taxpayers will also increase, by 1p to 41p. A new ‘starter’ rate,<br />

set at 19p, will also be introduced, and will apply to the first £2,000 of taxable<br />

income between £11,850 and £13,850.<br />

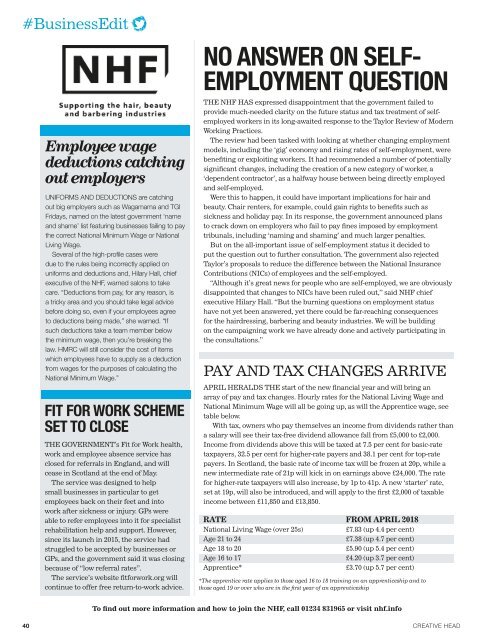

RATE FROM APRIL <strong>2018</strong><br />

National Living Wage (over 25s)<br />

£7.83 (up 4.4 per cent)<br />

Age 21 to 24<br />

£7.38 (up 4.7 per cent)<br />

Age 18 to 20<br />

£5.90 (up 5.4 per cent)<br />

Age 16 to 17<br />

£4.20 (up 3.7 per cent)<br />

Apprentice*<br />

£3.70 (up 5.7 per cent)<br />

*The apprentice rate applies to those aged 16 to 18 training on an apprenticeship and to<br />

those aged 19 or over who are in the first year of an apprenticeship<br />

To find out more information and how to join the NHF, call 01234 831965 or visit nhf.info<br />

40<br />

CREATIVE <strong>HEAD</strong>